Online gambling operators are constantly adopting new payment solutions to accommodate players and their banking needs. Venmo is among the latest additions to the cashiers of some casinos, although the method is hardly new.

Available exclusively to payees from the United States, Venmo emerged in 2009 as a mobile payment solution that enables users to seamlessly transfer money from their cards or bank accounts. Paying from one’s Venmo balance is also an alternative.

| Venmo Summary | |

|---|---|

| Available In | The United States |

| Website | www.venmo.com |

| Connecting Bank Card/Account to Venmo | Free for bank accounts; 3% for transfers from credit cards |

| Withdrawing Balance from Venmo to Bank Card/Account | Free for standard transfers to bank accounts; 1.5% fee for instant transfers to linked debit cards or bank accounts |

| Pay to Online Merchants | Free |

| Available for Deposit | Yes |

| Available for Withdrawal | Yes |

| Usual Deposit Time in Online Casinos | Instant |

| Usual Withdrawal Time from Online Casinos | Between 24 and 72 hours |

| Live Chat | Yes |

| Telephone Support | 855 812 4430 (Monday to Friday from 10 am to 6 pm EST) |

| Email Support | support@venmo.com; contact form |

A subsidiary of the global fin-tech company PayPal since 2013, Venmo started as a mobile bill-splitting service for friends and relatives. The method has now made its way to some US-facing online casinos where players can use it to manage their real-money balance. Users also have the option to apply for a Venmo debit card and use it across all US merchants that work with Mastercard.

Venmo stands out from other payment methods because it adds a social element to mobile banking. Users can attach animated stickers and emojis to their mobile payments and share the transactions to their Venmo feed. Commenting on money transfers is also possible with Venmo, which makes the method shockingly similar to social media platforms like Facebook.

Venmo Registration Process

Venmo is easily one of the most well-loved and frequently used payment processors in the US. It is safe to say that the most standout feature of the payment method is its speed, as this is one of the fastest-performing payment solutions available these days, which renders it a perfect fit for the needs of avid casino fans.

It is hardly a surprise that Venmo is so well-preferred by gambling enthusiasts, as creating an account comes at no cost. No monthly fees are charged, which is to say that the payment method shines particularly brightly in terms of cost-effectiveness.

Once players have found an online casino that meets their requirements and facilitates payments via Venmo, they should take some time to find their bearing when it comes to the registration process.

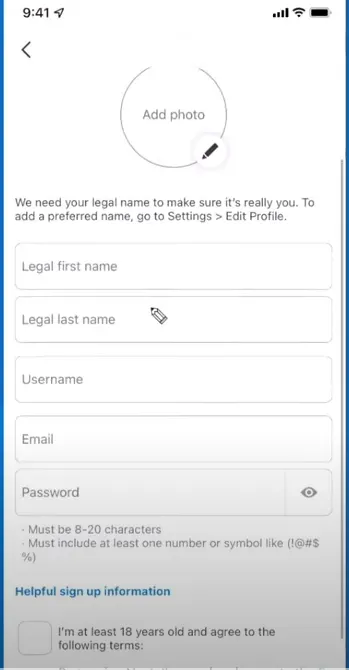

- Signing up for a Venmo account is exceptionally straightforward and the first thing avid casino fans need to do is download and install the app that is designed for iOS-based devices or the one that works for Android-run tablets and smartphones.

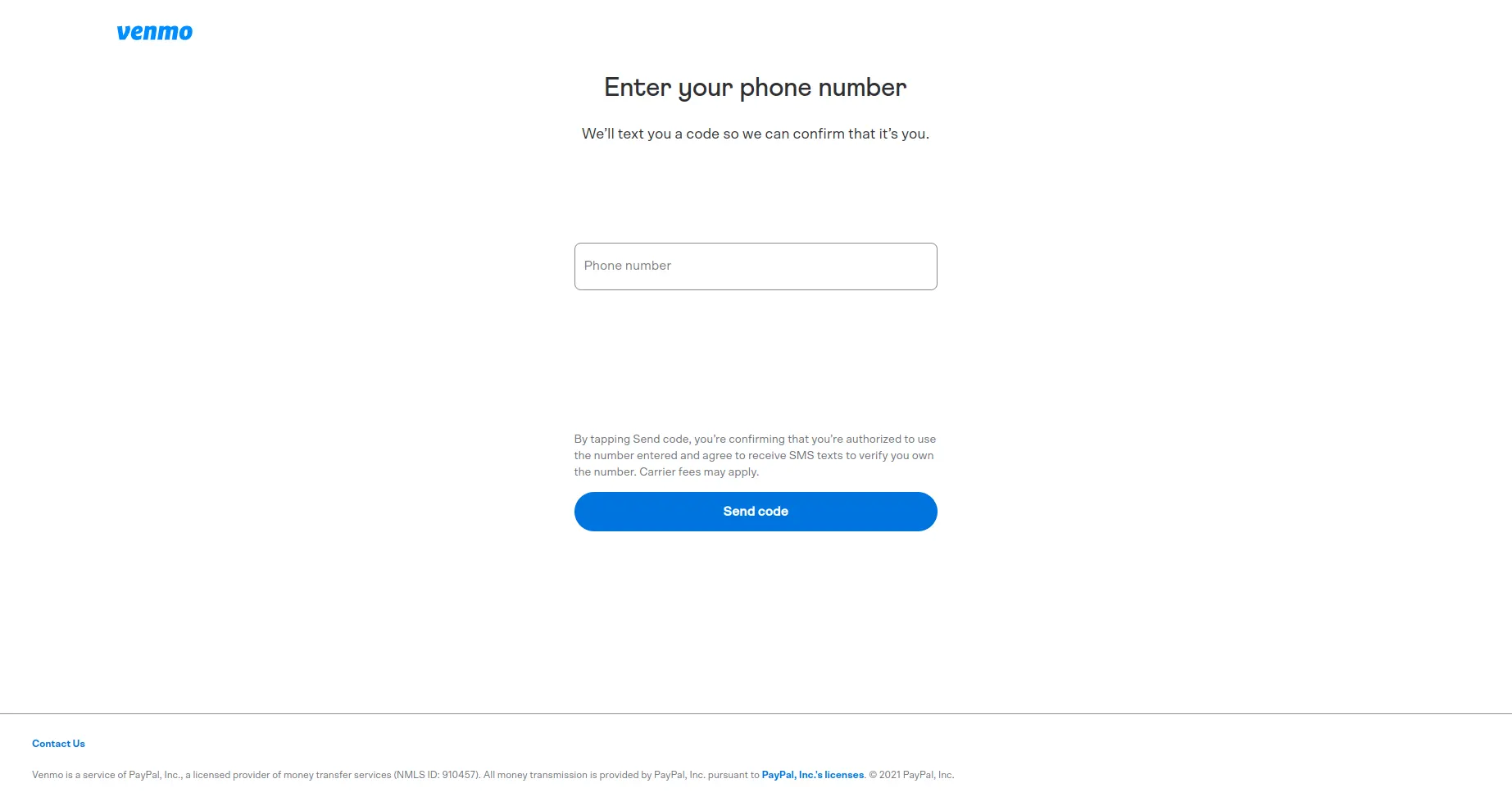

- Then, they will be asked to decide whether they prefer to register for a personal or business account. After they pick one of the two options, gambling enthusiasts will be required to provide their phone number. They should make sure that they have not mistyped it because they will receive a unique code they need to key in.

- Once players have provided the unique four-digit code, they will be prompted to set up their accounts. To do so, they need to provide their first and last name, a valid email address, create a username, and a password. Avid casino fans need to confirm that they are at least 18 years old as well. Then, gambling enthusiasts need to agree to the Terms and Conditions.

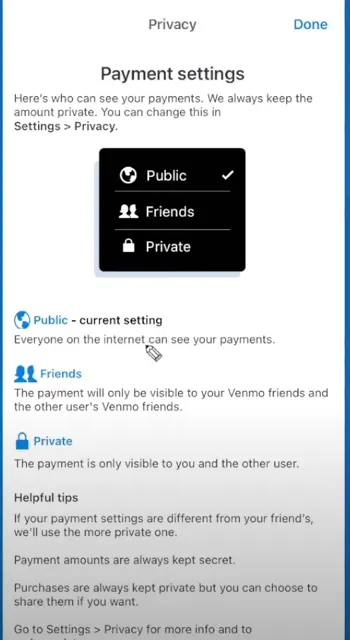

- Next, players should review the payment settings, and what they need to do is decide if they prefer to keep their transactions private, public, or visible to their friends.

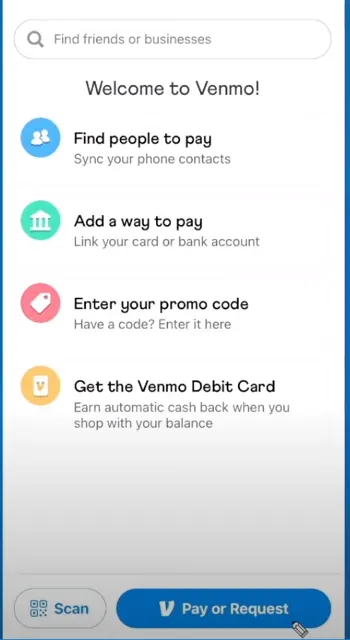

- Players need to review the payment methods they can use in order to fund their Venmo account and pick the one that meets their requirements. Adding funds to their accounts is possible via bank transfer, Direct Deposit, or by cashing a check. Receiving money in their Venmo accounts is also possible through merchant refunds and from other Venmo accounts.

How Venmo Works

Using Venmo for Gambling Transactions

Players must set up Venmo accounts before they can use the method for online gambling transactions. Creating an account comes at no extra cost and requires only a couple of minutes. Entering some basic personal and banking information is necessary, starting with a valid ten-digit mobile phone number and email address. Note that the method works only with US mobile numbers.

Venmo will then send you a text message with a four-digit code you must enter in the designated field to verify your mobile phone and proceed further. Venmo users must confirm both their emails and phone numbers before they can transfer money from their accounts or request payments.

Under the regulations of the US Treasury Department, users may also have to provide their social security numbers in case they send $300 or a higher amount within a single week. SSN identity verification is again necessary whenever customers transfer amounts exceeding $1,000 to their bank accounts within seven days.

Once players complete the registration process and connect Venmo to their cards or bank accounts, they can start using the method for online casino deposits. Depositing from one’s Venmo balance is also possible. If the Venmo balance is insufficient for the transaction, the system will automatically pull out the necessary amount from the linked card or bank account.

After you find a US-friendly online casino that supports Venmo and register there, you simply must load the cashier and select the method from the available deposit options. Specify the sum you wish to transfer to your real-money balance and follow the casino’s instructions to complete the transaction. The funds should be available in your casino account shortly after.

Since Venmo is a subsidiary of PayPal, you might be able to use it at casinos that work with the e-wallet. Just tap the icon with the PayPal logo on your smartphone to initiate the PayPal checkout process. Venmo will then appear as a banking option on the next page if available. If so, the cashier system will prompt you to select one of two options – “Pay with PayPal” or “Pay with Venmo”.

The withdrawal procedure is quite similar, only the funds will require a bit more time to go through due to the casinos’ verification policies. Users receive money from others straight to their Venmo balance and can leave it there for future deposits. Alternatively, players have the option to transfer the withdrawn funds to a linked bank account, credit card, or debit card.

| Venmo Gambling Transactions | |

|---|---|

| Supported Transactions | Deposits, withdrawals |

| Deposit Pending Time | Instant |

| Withdrawal Pending Time | Up to 72 hours (varies across casinos) |

| Additional Security | Log-in required |

Advantages and Disadvantages of Venmo

Cost-effectiveness and convenience are among the biggest advantages of using Venmo for gambling-related transactions. Paying for online purchases via the Venmo mobile app does not involve any additional expenses. The same goes for sending and receiving money to and from friends, family, and online businesses from the Venmo balance, linked debit cards, and bank accounts. Topping up the Venmo balance from one’s bank account is also free of extra charges.

Another advantage of this payment method is that it facilitates cryptocurrency transactions. Users can purchase or sell decentralized currencies and store them in their Venmo balance. Venmo partners with the brokerage platform Paxos for this purpose and supports several major cryptocurrencies, including Bitcoin Cash, Bitcoin, Litecoin, and Ethereum.

The service is available to all Venmo customers from the US except those based in the state of Hawaii. Limits on crypto transactions are in place – you can purchase no more than $20,000 per week and up to $50,000 per year.

Venmo is convenient and easy to use for online gambling transactions. We are confident players who have previous experience with the PayPal platform will have no issues when banking with Venmo. There is no learning curve whatsoever. All you have to do is download the app, sign up, verify your account, and link it to your personal bank account or card.

Venmo users can acquire Venmo debit cards at no extra cost. The Mastercard-branded debit cards are linked to customers’ available Venmo balance, allowing them to initiate transactions at merchants based in the United States and US territories. You can apply for one via the cards tab of your Venmo account and will receive it within fifteen days of approval.

Additional Advantages and Disadvantages of Venmo Venmo Visa-branded credit cards are also available to registered customers with verified accounts. These offer various perks, including contactless transactions, personalized QR codes, and cashback rewards when making online purchases. On the downside, only select customers are eligible for credit cards.

Last but not least, Venmo involves a social-network element as it enables you to interact with your friends. During the registration process, the app will prompt you to give it access to your contacts so that you can add acquaintances who also use Venmo to your friends list. You can attach comments, custom emojis, and animated stickers to your payments for your friends to see in their feed.

And now for the downsides. The biggest drawback here is that Venmo is available only to players who reside in the United States. Another major disadvantage is that the method does not support purchases to international merchants. It follows you can only use it at a select few casinos hailing from the US.

Venmo is a mobile-first payment service so you need a compatible smartphone or tablet to make online purchases. The company started to phase out the support for its web platform in 2018, so paying and charging money are currently unavailable to desktop users. The combined weekly ceiling on transactions is low at $6,999, which renders Venmo unsuitable for online casino high-rollers.

The biggest disadvantage of Venmo undoubtedly stems from the fact other Venmo users can see your purchase history. We suggest you tackle your account’s privacy settings where you can select to share your purchases with friends only. You can also make it private, in which case the information will appear only under the Your Stories tab of your feed.

Venmo Fees for Gambling Transactions

As we previously told you, Venmo is a very cost-efficient way to manage your online gambling funds. When fees are in place, they are nominal and clearly stated to prevent any unpleasant surprises. There are no fees for monthly maintenance or setting up an account. Paying for online purchases or transferring funds to people via your Venmo balance, debit card, or bank account also comes at no cost. However, there is a 3% fee when you send funds via a Venmo-connected credit card.

Receiving money from fellow Venmo users is not associated with extra expenses, either. Standard electronic transfers from the Venmo balance to a linked bank account are also free. You will incur a 1.5% fee if you use instant electronic transfers to withdraw funds to your bank account or debit card. Said fees start at $0.25 and cannot exceed $15 per instant electronic withdrawal.

The fees for purchasing or selling cryptocurrencies via Venmo start at $0.49 but the exact charges are amount-specific. In other words, the more cryptos you transact with, the higher the fees you have to pay. Venmo Mastercard withdrawals from non-MoneyPass automated teller machines are charged at a rate of $2.50, while signature withdrawals at a bank desk will cost you $3.

| Venmo Fees | |

|---|---|

| Gambling Deposit Fee | Free |

| Gambling Withdrawal Fee | Free |

| Bank Account Deposit Fee | Free |

| Bank Account Withdrawal Fee | Free for standard bank transfers |

| Credit/Debit Card Deposit Fee | 3% for sending funds directly from a credit card |

| Credit/Debit Card Withdrawal Fee | 1.50% for instant transfers to linked debit cards |

| Maintenance Fee | None |

Processing Times with Venmo

Apart from being cost-effective, Venmo also poses as a time-efficient way to manage your online gambling transactions. Deposits with this mobile solution are typically instant at Venmo casinos. As far as withdrawals go, you will have to wait a little longer due to the verification policies implemented by gambling operators.

The casino will have to first approve your withdrawal request before it releases the funds from your balance. The timeframes necessary for verification are operator-specific, ranging from several hours to three business days. The waiting times are normally available on the payments page but you can always ask a support representative if you fail to find them.

Adding money to the Venmo balance via a linked bank account might require between three to five working days. Users who have acquired Venmo debit cards can top up their balance immediately but are restricted by a weekly limit of $500.

Moving funds in the opposite direction is also possible and requires one to three business days. Players who are in a hurry to withdraw from their Venmo balance have the option to use the so-called instant transfers.

In this case, the funds will hit their bank accounts within half an hour or so. Speed comes at a cost, though, as instant transfers are associated with a 1.5% transaction fee. The Venmo debit cards connect directly to your available Venmo balance, so no extra steps are necessary to move the funds.

| Venmo Processing Times | |

|---|---|

| Gambling Deposit Time | Instant |

| Gambling Withdrawal Time | Varies across casinos |

| Bank Account Deposit Time | 3 to 5 working days |

| Bank Account Withdrawal Time | 1 to 3 working days, 30 minutes with instant transfers |

| Credit/Debit Card Deposit Time | Instant for holders of Venmo debit cards |

| Credit/Debit Card Withdrawal Time | Instant for holders of Venmo debit cards |

Mobile Payments with Venmo

Venmo is the ideal solution for smartphone and tablet casino players since it is intended primarily for use on portable devices. Furthermore, sending and charging money is possible on mobile only. The company started to phase out its web services back in 2018. When it comes to compatibility, Venmo will work on any smart device that runs on Android 5.0 and iOS 12 or higher.

Regardless of the operating system you are using, your phone should be able to accept short-code messages. Those who use iPhones and iPads should head over to the App Store to download the iOS app for free. The Venmo iOS app is the third most popular finance-related application in the App Store, boasting a 4.9-star rating out of 5 possible stars.

Android users can obtain their applications from the Google Play Store. English is the only supported language, but this makes sense considering Venmo is available within the United States only.

The developers behind Venmo are constantly fine-tuning the app to deliver a seamless experience to all smartphone users. It is highly recommended to install updates regularly if you wish your Venmo app to run as smoothly as possible. Connecting the app to your Google Pay or Apple Pay is possible as well.

| Venmo Mobile Payments | |

|---|---|

| Apple Pay | Yes |

| Google Pay | Yes |

Security at Venmo Online Casinos

Venmo implements elaborate encryption to safeguard users’ financial and personal data. Various other measures are also in place to protect you and your payments. For starters, there is a multi-factor authentication process when you log in, which adds an extra level of security. The platform might send you a special six-digit code to the mobile number you have registered your Venmo account with.

Users who have connected bank accounts or cards to their Venmo accounts can authenticate themselves by verifying their banking information. Alternatively, you can give the app permission to remember your smartphone as a trusted device. Doing this enables you to skip the code confirmation on future log-ins.

Another great thing about Venmo is that it enables you to add a PIN to your account for additional safety. The app will then prompt you to enter this unique passcode each time you attempt to sign into your Venmo profile. Just navigate to the settings and tap on security where you can activate this feature.

Venmo also supports biometrics for authentication purposes such as fingerprint and Face ID. In fact, the app first uses the Face ID and only sends prompts for the passcode if the biometric fails. As part of the PayPal family, Venmo is heavily regulated by several federal agencies in the US, including the Consumer Financial Protection Bureau and the Financial Crimes Enforcement Network (FinCEN).

The mobile payment platform recently attracted scathing criticism for its global public feed which practically enabled everyone on the internet to view users’ transaction history. The good news is the company ditched this practice when it came under regulatory pressure. Of course, the fact that Buzzfeed reporters managed to find the Venmo accounts of President Biden and his wife within ten minutes of searching also played an important role in the company’s decision to step up its privacy game.

| Venmo Security | |

|---|---|

| Passcode | Yes |

| Fingerprint | Yes |

| FaceID | Yes |

| Two-Factor Authentication | Yes |

| Trusted Devices | Yes |

| IP Restrictions | N/A |

Venmo Alternatives

Venmo is a payment method that has exploded in popularity among players, and it is easy to see why as it provinces them with the required speed of the transactions and user-friendliness. The payment method is exceptionally easy-to-use, and even total novices will execute their casino deposits without much of a hiccup. Venmo is a great choice for casino-related transactions because payments will not cost players a dime.

Using Venmo for gambling-related transactions is a simple process, and although it is so commonly available at online casinos, it might still happen not to see it at the betting platform that suits your taste. This is not to say that avid casino fans will be left without any options as there are plenty of other payment processors they can pick instead.

These are some of the most commonly offered payment methods players can make use of in case the payment list of their online casino of choice does not feature Venmo.

-

Credit Cards

Without a doubt, the most commonly used and widely offered methods for casino deposits are credit and debit cards. Typically, transactions can be done via Mastercard, Visa, and American Express. The deposit and cashout limits are indeed one of the most important things players should consider when looking for a payment method that suits them best, and when card payments are concerned, the transaction limits are normally at the higher end of the spectrum.

Without a doubt, the most commonly used and widely offered methods for casino deposits are credit and debit cards. Typically, transactions can be done via Mastercard, Visa, and American Express. The deposit and cashout limits are indeed one of the most important things players should consider when looking for a payment method that suits them best, and when card payments are concerned, the transaction limits are normally at the higher end of the spectrum.Credit cards stand out as flexible and reliable casino deposit methods, which makes them a great option for avid casino fans. These well-renowned payment solutions are also celebrated for their lightning-fast processing times, as once deposits are authorized, the preferred amount will reach players’ gaming accounts within a few minutes.

Even though most casino operators prefer not to charge extra fees on card payments, there are still some exceptions to the rule. Even if card payments incur additional costs, gambling enthusiasts can be sure that they will be fair.

In spite of the fact that credit cards are such a great online casino deposit method, players should keep in mind that they might not double as cashout options. The alternatives they might be given a choice from will vary from one online casino to another, but bank transfers, cryptocurrencies, and checks are the recurring options.

-

Cryptocurrencies

Cryptocurrencies are now at an all-time high in terms of popularity, and today, more and more online casinos integrate them into their cashiers. Wirth speed, convenience, and security on their side, cryptocurrencies undoubtedly pose as a good Venmo alternative.

Cryptocurrencies are now at an all-time high in terms of popularity, and today, more and more online casinos integrate them into their cashiers. Wirth speed, convenience, and security on their side, cryptocurrencies undoubtedly pose as a good Venmo alternative.Since no personal information is required in order to complete payments via cryptocurrencies, they are one of the safest deposit and cashout methods avid casino fans can rely on. Additionally, they are exceptionally easy to use, and what further adds to their allure is that players can use them for transactions in both directions.

Aside from being safe and efficient, cryptocurrencies are equally appealing to high-stakes players and avid casino fans who prefer placing smaller bets as typically, the transaction limits are rather wide.

Payments are fast, which is of crucial importance for gambling enthusiasts, especially if they cannot wait to go ahead with their real-money bets. They will benefit from the same time efficiency also when the time comes to withdraw their winnings, as in most cases, withdrawals take up to several hours to clear.

Cryptocurrencies hold high security and lightning-fast transaction speeds, but these are far from being the only reasons why they see such a great success, as more and more casino operators now introduce tailor-made bonus deals for these depositors.

-

Play+

Play+ is a convenient, safe, and cost-effective payment method, thanks to which players can fund their casino accounts in the blink of an eye. Registering for a Play+ account is a breeze, and players can do so at one of the participating land-based casinos or online. Considering that the payment solution is designed specifically with gambling transactions in mind, it makes sense that it works so well for players.

Play+ is a convenient, safe, and cost-effective payment method, thanks to which players can fund their casino accounts in the blink of an eye. Registering for a Play+ account is a breeze, and players can do so at one of the participating land-based casinos or online. Considering that the payment solution is designed specifically with gambling transactions in mind, it makes sense that it works so well for players.Players can easily add and remove funds from their Play+ accounts at any time. As for the spending and withdrawal limits of the Play+ cards, players should know that the amounts they will be allowed to add and withdraw will vary from one casino program to another. Yet, the standard limits for point-of-sale purchases per day are $5,000, but if players are enrolled in VIP programs, they will benefit from larger maximums.

While using Play+, gambling enthusiasts will benefit from fast cashout times, and withdrawals can be made using different devices or at various program-specific locations, thus adding to the convenience of the payment method.

Avid casino fans should not fear that the funds they will add to their Play+ accounts might fall in the wrong hands, as they are kept in a bank that is Federal Deposit Insurance Corporation-insured.

-

PayNearMe

PlayNearMe is a modern and reliable payment platform that makes it possible for avid casino fans to complete transactions anytime and anywhere they prefer. Speed and convenience undoubtedly matter while placing your bets over the Internet, and the payment method delivers in both departments.

PlayNearMe is a modern and reliable payment platform that makes it possible for avid casino fans to complete transactions anytime and anywhere they prefer. Speed and convenience undoubtedly matter while placing your bets over the Internet, and the payment method delivers in both departments.While using the payment platform, gambling enthusiasts are given the freedom to add funds to their gaming accounts in the blink of an eye using mobile-first payment methods, including Google Pay and Apple Pay, cash, ACH, or their debit cards.

The payment method tackles all challenges in payments as transactions are quick, easy to do, and reliable. Gambling enthusiasts can manage all their payments using a single flexible platform, as sending and receiving money is made exceptionally easy. The complexity of managing your payments using PayNearMe is reduced to a minimum, which is of crucial importance for many avid casino fans. The built-in reminders and the mobile wallet integration are also among the features that make PayNearMe a good alternative to Venmo.

Considering that PayNearMe is accepted by some of the leading operators that cater to the US market, finding an online casino that lives up to all players’ requirements will be a breeze.

-

VIP Preferred

Available at thousands of interactive gaming locations and online casinos, VIP Preferred is one more good Venmo Replacement. The payment method provides avid casino fans with quick and worry-free cash access, thus allowing them to effortlessly carry out their gambling-related transactions.

Available at thousands of interactive gaming locations and online casinos, VIP Preferred is one more good Venmo Replacement. The payment method provides avid casino fans with quick and worry-free cash access, thus allowing them to effortlessly carry out their gambling-related transactions.VIP Preferred depositors do not need to wait in order to go ahead with their betting session, as deposits are processed on the spot. What is even better is that gambling aficionados can resort to the payment system of VIP Preferred also when they want to cash out their winnings.

Naturally, while using VIP Preferred for payments from online casinos, gambling enthusiasts should not expect to get their winnings immediately as first, players’ requests should be approved by the representatives of the casino. Then, it will be a matter of a few days until their winnings are available in their VIP Preferred balance.

It is easy to see why players trust VIP Preferred, as all payments are executed in the utmost safety. Even though players will be asked to provide some of their banking details in order to start using the payment solution, VIP Preferred relies on up-to-the-minute encryption technology to protect the data of its users.

Casino Games with Venmo

The number of online casinos that crop up these days keeps on increasing, and it is therefore not surprising that the competition between the casino operators is getting stiffer. With an eye to stay relevant and hold the attention of as many users as possible, operators do their utmost to provide as rich and varied game selection as possible.

Although there are nuances at each gambling site, Venmo users can usually take a pick from a great variety of games. Since players have different priorities and preferences for games, some might require a greater range of table and card classics, while others might be more into spinning the reels. As a result, casino operators strive to provide some of the most popular table games like roulette and blackjack, along with slots, live games, and jackpot games, among others.

Slots with Venmo

These days, players have made their voices loud and clear as to their favorite casino games, and as it turns out, slots are the most chosen games. Bright, flashy and fast, the diversity of slots is enormous, and players can pick from various themes, reel engine set-ups, and payline mechanics.

The in-game features are also worth considering as they are the key to the win potential of the games. These might come in the form of rounds of free spins, multipliers, and game-specific bonus games. Scatter and wild icons are also present at almost all slots available out there.

Doragon’s Gems

Doragon’s Gems is an RTG-powered video slot with a fantasy theme that offers riches of up to 250,000x the bet per line. Set in a mysterious cave, the game plays out on a 5×3 reel engine and is easily a sight to behold.

There are a slew of theme-related symbols, including gems, precious dragon eyes, and playing cards, while the premiums are green, blue, purple, and red dragons. The game is in no way void from bonus features as reel spinners will be in for handsome payouts after the multiplier trial, free games, bonus bet, or cascading wins features are triggered. There is also a bonus buy feature that can help players get into the preferred bonus feature.

Gem Strike

With a 5×3 reel layout and 25 paylines, Gem Strike is a simple video slot that is introduced by RealTime Gaming. Bets range from $0,25 and 25 credits per spin, thus rendering the game a perfect fit for low-stakes slot mavens. The symbols are exactly what slot buffs might expect, as they will be presented with gems of various colors and shapes. Scatter and wild icons are also not missing from the game paytable.

Players should not be fooled by the simple design of the game, as it is equipped with the multiplier trail feature and offers cascading wins. Rounds of free spins are also among the bonus features reel spinners can dive into if they give Gem Strike a go.

Khrysos Gold

Khrysos Gold is a slot with an Ancient Rome theme that is brought to players by RTG. The five-reel and three-row game engine is filled with theme-related symbols, along with wild, scatter, and bonus symbols.

The Slipper Wild, Morphing Wild, and Free Games features will undoubtedly make players’ journey to Ancient Rome exceptionally thrilling, but the jackpot game is what they will certainly look forward to. There are three jackpot prizes up for grabs, and the best thing is that the minor, mini, and major prizes keep on increasing by the minute.

Live Dealer Games with Venmo

If avid casino fans are looking to expand their horizons but at the same time want to enjoy card and table classics, then live games might be a perfect fit for them. Such games are favorites among avid casino fans because they take the classic casino experience to a whole new level by bringing the exciting and lively atmosphere of Las Vegas to their computers and portable devices. Typically, along with standard roulette and blackjack games, players will be presented with various game shows that have also caused a stir among avid casino fans.

Auto American Roulette

American roulette is among the most common variants of the table classic players will find in the live lobbies of online casinos. Auto American Roulette by Visionary iGaming is a live game that can bring players a betting experience that matches the one they are offered at land-based casinos. As with the other live games that are courtesy of the provider, Auto American Roulette works equally smoothly on desktop and portable devices.

The user interface might not be the most impressive, but players will certainly wrap their heads around it with ease. Roulette fans will be offered the chance to place inside and outside bets and benefit from rich game history. Results are offered for odd/even, hot/cold, and red/black numbers.

European Roulette

European Roulette offers the same rich HTML5 game interface features as American Roulette, but this time, players will benefit from a significantly lower house advantage. Optimized for mobile and desktop play, this double-zero roulette game offers the same digital video mixing, various camera angles, and HD video with picture-in-picture as its American counterpart.

In terms of the decisions they can make, players can pick from the standard range of outside and inside bets, but there is also a scalable racetrack, where call bets are featured. Players can pick from multiple chip denominations, while the wide-ranging bet limits make the tables suitable for players with different budgets.

Blackjack

Players who are adamant that they want to stick to the live games that are introduced by Visionary iGaming might also enjoy their take on blackjack. The blackjack tables tend to be quite packed at times, but fortunately for players, they can still join the action as there is no limit on the number of players who can bet at the same time.

This fast and feature-rich blackjack variant can live up to the expectations of all players, no matter their budget. What makes the live games introduced by Visionary iGaming so attention-grabbing is that the provider uses standard-size playing card games. Players should not worry about their bets even if they lose connectivity during the game as their bets will remain in play.

Blackjack with Venmo

Today, players can rest assured that, for the most part, online casinos tend to offer the most popular card and table classics, blackjack included. Blackjack is easily one of the most popular card games on a global scale, and if they decide to try their hand at it, players will notice that there are a host of variations available out there.

Due to the popularity of blackjack games, casino operators provide their users with different game variations that offer twists to the standard set of rules, thus making the gameplay all the more thrilling.

Suit ‘EM Up Blackjack

Suit ‘EM Up Blackjack is an intriguing variant of the century-old card classic, which comes from the portfolio of RealTime Gaming. The provider has chosen not to introduce any complex side rules to the gameplay, but this is not to say that it is void of any thrills. The game is played using six standard decks and a hole card, meaning that players will see only one of the deal’s cards.

To give the game a distinctive flavor, the software provider has added a side bet to it. Fans of the card classic can place that side bet before they get their first two cards, and as they might expect from the name, this bet wins if the two cards are of the same suit. Placing this side bet is optional, but the payout of 60 to 1 for suited Aces makes it a good option.

The lowest bet players can make per round is $1, while the largest amount they can stake is $250.

Blackjack + Perfect Pairs

Blackjack + Perfect Pairs is a single-hand blackjack variant, which is exceptionally easy to understand and play. The game is powered by RealTime Gaming and has a lot in common with the other blackjack variants that are courtesy of the provider.

That being said, the addition of the Perfect Pairs side bet is what makes this blackjack variant so appealing for players, and more specifically, the maximum payout of 25 to 1 they are offered. The dealer is required to hit on soft 17s, while players will be offered a standard payout for a blackjack.

The straightforwardness of the game, coupled with the bet limits that range from $1 to $250, render Blackjack + Perfect Pairs a great option for all fans of the card, including total novices to it.

Blackjack

If players want to enjoy a no-frills blackjack experience, RealTime Gaming’s Blackjack might live up to their requirements. It is a single-hand variant of the card classic in which a hole card is used and a payout of 3 to 2 is offered for a blackjack.

The game might not be the most visually appealing they will find out there, but blackjack fans will certainly relish the green-felt table that is an exact replica of the tables at land-based casinos. According to the rule set of this blackjack variant, the dealer is required to hit on soft 17s, while players are allowed to double on any two cards they are dealt. As usual, bets start at $1 and can go as high as $250.

Roulette with Venmo

Just like blackjack, roulette is also a staple game that makes it to the portfolios of most, if not all, online casinos. Such games are fast, easy to master, and exciting and are preferred by casino veterans and total novices. French, American, and European are the three most widely available variants of the game of chance, but roulette fans are undoubtedly in luck as these days, software providers tend to be much more imaginative and introduce new and exciting renditions of the table classic.

European Roulette

If players prefer to stick to all-time classics, then RealTime Gaming’s European Roulette might make them sit up. No matter whether players decide to make inside or outside bets, they will not be allowed to stake more than $250 and less than $1.

What might surprise players when they power up the game is that there is no roulette wheel. Yet, once they place their chips within the field they prefer and press the spin button, the wheel will instantly start spinning. The racetrack will also appear when players click or tap on the New Bet button.

Once the outcome of their current bet is determined, players will be asked whether they want to repeat it or want to go for another bet type or amount.

French Roulette

French Roulette is one more single-zero roulette game that is brought to players from the portfolio of RTG. It shares a lot of common traits with European Roulette, meaning that there are the usual numbers from 1 to 36 and a single-zero pocket. In this roulette variant, players can go for inside and outside bets, as well as for call bets. The payouts players will be offered are the usual ones that are offered in such variants of the table classic.

The game might not have the most advanced graphics and animations, but the provider has still paid attention to all details, as the wheel, betting field, and the chips are recreated to the tiniest details. Controlling the game is exceptionally easy, and players can place their chips and remove them from the table with a single click or tap.

American Roulette

American Roulette is one more classic that is part of RealTime Gaming’s portfolio of table games. As players might expect, a 38-pocket wheel is used in this game because of the addition of a double-zero pocket, which results in considerably higher house advantage. Because of this, gambling enthusiasts should carefully assess the pros and cons of the featured roulette variants before they start placing real-money bets.

As with the other roulette variants, American Roulette is also equipped with history, and players can remove their chips from the table using the Clear button. There is also a Reset button that allows them to repeat the bet they have placed in the previous round.