Electronic checks have seen a surge in popularity these last few years, particularly in the realm of online gambling. Online casinos have begun accepting deposits made via this electronic payment system, giving users yet another reliable option to transact sums of money in a secure manner.

| eCheck Summary | |

|---|---|

| Available in | Most countries |

| Website | N/A |

| Connecting bank card/account to eChecks | Fee depends on bank |

| Withdrawal balance from eChecks to your bank card/account | N/A |

| Pay to online merchants | Fee depends on bank |

| Available for deposit | Yes |

| Available for withdrawal | Yes |

| Usual deposit time in online casino | Instant |

| Usual withdrawal time from online casino | Up to several days, depending on the banking institution |

| Live chat | N/A |

| Telephone support | N/A |

| E-mail support | N/A |

An eCheck is just like a paper check only in virtual form. The process of making a payment via eCheck is exactly the same as it would be with a traditional one. You will be required to put down your name, your bank account number, the sum you would like to transact, and whatever information the bank requires from you. Unlike most others payment methods, eChecks are not a new technology. Since the process of writing a paper check and sending an electronic one are the same, this system has been employed by the banks for a good number of years. At the time of this writing, eChecks have been around for two decades.

If you are considering using this online payment procedure then please have a look below, where we go over every aspect of using eChecks for depositing to and withdrawing from online casinos.

ECheck Registration Process

As was already pointed out, eChecks have long outperformed their paper counterparts, with the latter slowly but surely turning into an obsolete fund transfer solution. That said, both solutions work in a fairly identical manner, so customers who have already used paper checks would have not a single issue in managing their financial operations through the electronic version.

In an attempt to implement as many convenient banking methods as possible, contemporary casino operators add eChecks to the lineup of processors in their cashier sections. Besides the various other advantages of electronic checks, casino players should bear in mind that they could be used both for deposits and withdrawals. In the current section of this publication, we plan to outline the processes of set-up and activation of an eCheck account.

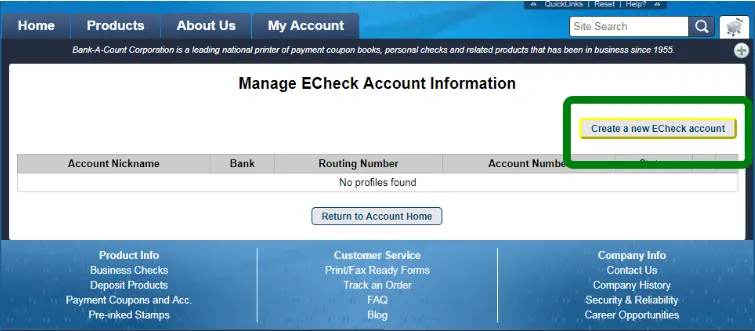

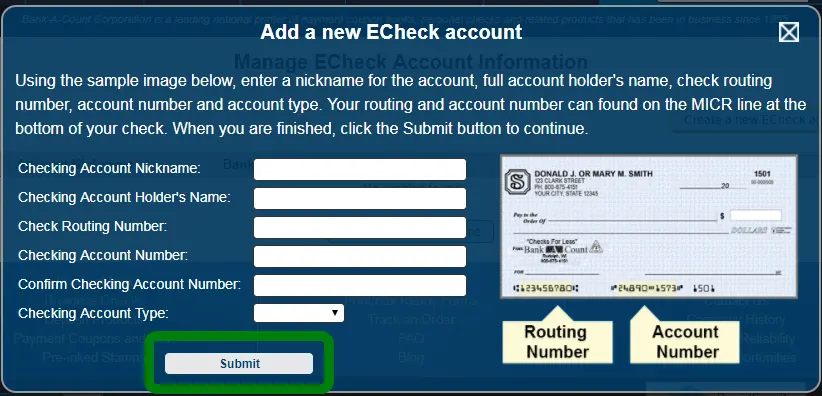

- Checking Account Set-up – before depositing and withdrawing from interactive casinos via eCkecks, casino players should be aware of how to set up a checking account. They must have opened one with а bank institution that supports this service. Essentially, a checking account is a type of deposit account enabling customers to initiate deposits and withdrawals.

- Once customers confirm their intention of setting up a checking account they should provide their personal and banking information including the account nickname, the full account holder’s name, the check routing number, and the checking account number. They might be prompted to confirm the checking account number. The routing and account numbers are not to be mistaken. While routing numbers are always made up of 9 digits, account numbers vary between 9 and 12 digits in length.

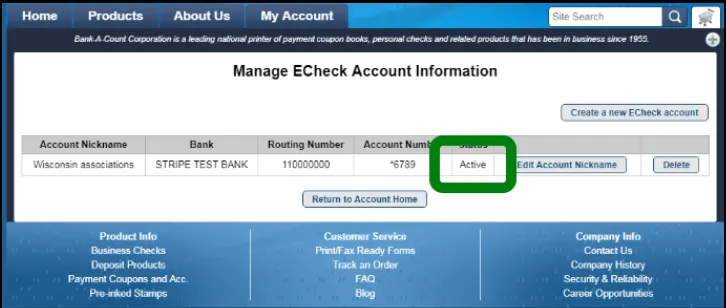

- Once submitted to the banking institution, the set-up process might take several days to be confirmed and completed. Once it is a fact, the checking account status should be changed to ‘active’.

How eCheck Works?

Advantages and Disadvantages

Just like any other payment solution eChecks have their own inherent advantages and disadvantages. For your convenience, we have listed below all major aspects of this service that you should be aware of.

To begin with, anyone who has previously dealt with paper checks will know exactly how this process works. In truth, it is exactly the same. eChecks are one of the easiest payment solutions to utilize from a practical point of view, the only requirement being a bank that supports this feature. Whereas other services would require a registration and identity verification, the use of eChecks demands none of that. As you have already completed that process before when opening a bank account, all you have to do is enter your banking information and confirm the payment. The process is completely straightforward and requires no prior knowledge or beforehand preparation on your part. No other service can offer a procedure that is this straightforward and easy to utilize.

While some online casinos have begun accepting eChecks as a valid payment method, eWallets and credit cards remain the dominant way to transact money. The number of casinos that support eChecks is not that large, despite the fact that the obvious advantages of this payment solution. If this is the only way you would like to deposit and withdraw money you would be limited to only a few choices.

More Advantages and DisadvantagesThe thing about eChecks is that in order to use them, you would have to sacrifice your anonymity to a certain extent. Since your name and bank account number would be present on the form when you issue the deposit payment. The same can be said about the withdrawal process, as you would be required to enter that very same information into the form. Other payment solutions provide a similar service but also keep your identity relatively obscure. Players that place a lot of value on remaining anonymous online may want to direct their attention to a different payment service.

Another factor that you have to take into account when you wish to use eChecks is their availability. Naturally, each bank picks and chooses what services to offer to its customers. As we have mentioned above, electronic checks are nothing new to the world of online banking and with the passage of time new, more convenient and technological superior ways to transact money have emerged and have come to replace the checking service. The truth of the matter is that checks are becoming an obsolete way to transact money. As a result, many banks have ceased offering and processing payments via way of check. European countries have started to abandon check payments going as far back as 1993 when Finnish banks abandoned the check for the more modern gyro system, which was entirely electronic even back then. In other European countries check use is declining in favor of bank-to-bank transfers. The United States is the only Western country that is still reliant on checks for every-day transfers. While this might sound excellent for US players, you have to take into account the state of online gambling in the country. Currently, the online casino industry is a shadow of what it once was due to the Unlawful Internet Gambling Enforcement Act of 2006. There are only a handful of online casinos that are allowed to operate in US jurisdiction and even those are limited to certain states. Overall, the use of checks is declining in popularity in favor of more modern methods. Some online casinos still support this payment solution though those are few and far between.

While eChecks might sound excellent on paper, the reality of the situation is that not every bank supports the feature. Some banks have chosen to abandon this technology in favor of new and more advanced ones and since players are more likely to make a payment via credit or debit card online casinos, as well, have slowly supporting this transaction method.

| eCheck Pros | eCheck Cons |

|---|---|

| Practical and easy to use payment solution | eChecks are not widely accepted by online casinos |

| No registration required | Players are required to provide banking details during payments |

| Available for both deposits and withdrawals | many banks do not offer eCheck services |

Using eChecks for Gambling Purposes

At several online casinos, you have the option to deposit and withdraw via eCheck. At any online casino that supports this payment method, you will find the eCheck option on the Cashier page. There you will have to click on the eCheck option which will open a new window. There you will have to type in the name of your bank, enter your bank routing number and your bank account number, as well as the type of your account.

Following that, you will enter the sum that you wish to deposit or withdraw and confirm the transaction. Electronic checks are not as popular as other transaction methods so you might be hard pressed to find a website that still supports them. Arguably, the most popular online casinos accept a large number of deposit and withdrawal services, which will most likely include eChecks as well. The more obscure gambling websites are prone to stick to the ‘traditional’ methods of transacting money, e.g. eWallets, credit cards, wire transfers, and prepaid vouchers.

| eCheck Gambling Transactions | |

|---|---|

| Supported transactions | Deposits and withdrawals |

| Deposit pending time | Instant |

| Withdrawal pending time | Several days |

| Additional security | Bank’s authentication systems |

| eCheck Mobile Payments | |

|---|---|

| Apple pay | No |

| Google pay | No |

Fees for Gambling Purposes

Generally speaking, eChecks are one of the cheapest deposit methods that you can use. A typical eCheck payment will cost anywhere between $0.50 and $1.50. This is a relatively low cost when compared to other payment services, but still higher than those that have no cost at all. Still, the price you pay for each transaction is offset by the added security, as well as the simplicity and ease with which the payment is carried out. At some casinos you might be charged a commission fee of a few percent of the total sum, but that is not all that common nowadays.

| eCheck Fees | |

|---|---|

| Gambling deposit fee | $0.50 – $1.50 |

| Gambling withdrawal fee | Depends on the bank |

| Bank account deposit fee | N/A |

| Bank account withdrawal fee | N/A |

| Credit/debit card deposit fee | N/A |

| Credit/debit card withdrawal fee | N/A |

| Maintenancce fee | N/A |

Processing Times for Gambling Transactions

When you initiate a deposit via eCheck you are probably wondering how long it would take for the money to arrive and for you to start wagering it. Since the payment is done virtually it would take no time at all to receive the funds into your casino balance. As soon as you confirm the transaction the money should appear in your casino account and you can begin playing your favorite games. When it comes to depositing this is an excellent way to do it, since you have immediate access to your money. However, where withdrawals are concerned, it is an entirely different matter.

When you request to cash in your winnings the casino staff would have to first review your plays. This normally takes no more than 48 hours at worst and only after this process is complete will they send the payment. The transaction can take up to several days to clear as a normal check would. This is not a fault of the casino, but one of the banking systems. In case you were wondering, the casino does not also receive your deposits instantly.

However, it allows you to play on credit since it is certain that it will receive its payment. This one of the worst aspects of using eChecks – the days-long withdrawal times. Other services, such as eWallets, have been known to execute withdrawals within hours. Where processing times are concerned, eChecks rank along the same lines as wire transfers. If you are looking for a service that will process your funds quickly you might want to look at other online payment solutions.

| eCheck Processing times | |

|---|---|

| Gambling deposit time | Instant |

| Gambling withdrawal time | Up to several days |

| Bank account deposit time | N/A |

| Bank account withdrawal time | N/A |

| Credit/debit card deposit time | N/A |

| Credit/debit card withdrawal time | N/A |

Security at Online Casinos

When it comes to online payment solutions eChecks are perhaps the safest method. This method of payment goes directly through your bank’s network in order to be processed. This means that users get to enjoy the highest security level possible. Banks are not known for the futility of their security systems, rather the opposite, and they are presently the most secure financial institutions that you can count on.

When you send an electronic check there are several security layers that the transaction must pass through. The banks have excellent authentication systems that will prevent any unauthorized transactions, as well as encryption technology used to encode every piece of information sent via the Internet. Furthermore, since the eCheck service is provided by your bank and connected to your bank account you get to enjoy assurances that nothing will happen with your personal funds. In the event that someone does manage to gain access to your money, the bank is obligated by law to compensate you for your losses.

Furthermore, the online casinos also have security systems of their own, meant to protect any sensitive information that goes through their network. The most often implemented security system are the SSL – Secure Socket Layer – protocols, that encrypt all personal and banking information sent to the casino servers using 128- or 256-bit encryptions. This is state-of-the-art technology and has an excellent track record of keeping users’ information safe and away from the hands of any potential wrongdoers. The encryption these protocols use is incredibly strong and breaking it is practically impossible.

Security Additional TipsNaturally, you should not rely entirely on the security systems of the other parties to keep your information safe. After all, no security measure can protect you, if you yourself are not careful. The steps you can take to safeguard your data are relatively simple but highly effective. For starters, never share any of your banking information online with anyone. This way no one but you can access your bank accounts and use your funds.

Furthermore, always be mindful of using public networks. While it might be tempting to connect to a public router for free Wi-Fi, these networks are the primary target of hackers and other unauthorized people. It is best to use your own personal network, or if you simply must use a public one do so with a VPN active. The safety of your personal and banking information is of paramount importance and no amount of security is too much.

| eCheck Security | |

|---|---|

| Passcode | No |

| Fingerprint | No |

| FaceID | No |

| Two-factor authentication | Depends on bank |

| Trusted devices | No |

| IP Restrictions | No |

ECheck Alternatives

Although digital checks are not too dissimilar from paper checks, the electronic processing of transactions makes them more budget-friendly, less time-consuming, and much more secure. However, in case interactive casinos have failed to implement eChecks, gaming fans might want to investigate some of the viable alternatives for eChecks, and below we offer five convenient options.

-

Wire Transfers

Wire transfers are especially preferred by gaming fans due to their broad availability and convenience when handling deposits and withdrawals from online casinos. To execute transactions via bank transfers, players will need the banking details of their preferred gambling operator. This includes their IBAN and SWIFT code.

Wire transfers are especially preferred by gaming fans due to their broad availability and convenience when handling deposits and withdrawals from online casinos. To execute transactions via bank transfers, players will need the banking details of their preferred gambling operator. This includes their IBAN and SWIFT code.Players should not be worried about the safety of their online transactions as banking institutions use advanced encryptions to protect their customers’ personal and banking information. Furthermore, when initiating online payments through bank transfers, the relevant information is shared by the two banking institutions, that of the player and the online casino, i.e. no third parties are involved.

Deposits to online casinos via bank transfers are typically processed within 3 business days, while withdrawals may take up to 5 business days. Bank transfers are not very time-efficient because processing times can be significantly increased by bank holidays and weekends.

Bank transfers are especially appealing to high rollers, as deposit and withdrawal limits tend to vary between $20 and a maximum of $100.000.

-

Debit/credit cards

Credit and debit cards have turned into the most popular payment methods over the globe. They are used for online and offline purchases, and when it comes to interactive casino sites, they are very widely used. In spite of the various other payment solutions that have emerged over the years, credit and debit card payments have remained a top choice among casino fans.

Credit and debit cards have turned into the most popular payment methods over the globe. They are used for online and offline purchases, and when it comes to interactive casino sites, they are very widely used. In spite of the various other payment solutions that have emerged over the years, credit and debit card payments have remained a top choice among casino fans.Among the major advantages of card payments are the instant payments they facilitate. A few clicks and gambling fans are seconds away from replenishing their casino balance. Security is yet another important factor to consider and contemporary casinos utilize SSL protocols to protect users’ personal and financial information.

Using card payments to handle casino transactions is a straightforward process. Once they sign up for an online casino, gaming fans should navigate to the cashier section of the site and choose among the accepted bank cards. Afterward, they are supposed to fill in the relevant information including the name of the card, its number, date of expiry, and CVV code.

Card payments’ fees vary between 0.20% and 5%. As far as processing times are concerned, deposits to online casinos are instantly processed, while withdrawals may take anywhere between 1 and 5 business days.

-

E-wallets

Over the last two decades, the popularity of digital wallets has also increased considerably, ranking them among the most widely preferred banking methods among casino players. They have a real potential to seriously challenge card payments and there is barely a good online casino that has failed to implement at least several e-wallet solutions.

Over the last two decades, the popularity of digital wallets has also increased considerably, ranking them among the most widely preferred banking methods among casino players. They have a real potential to seriously challenge card payments and there is barely a good online casino that has failed to implement at least several e-wallet solutions.PayPal, Skrill, and Neteller are the most popular brands in the category of digital wallets. There are various other similar solutions, both local and international. Depending on their destination, online gaming enthusiasts can use different e-wallet alternatives to the most popular brands.

E-wallets serve as an intermediary. Customers can transfer funds by using their debit/credit cards and then utilize them to replenish their casino accounts. Digital wallets can also be linked to bank accounts.

One of the main advantages of e-wallets is the fact that they can be used both for deposits and withdrawals. Deposits are processed instantly, while withdrawals usually take no more than 24 hours. E-wallets also ensure a high level of online security, as customers’ personal and banking information remains anonymous.

-

Prepaid cards

Prepaid cards, also known as voucher cards are a commonly preferred method of banking primarily because of the anonymity they ensure. Paysafecard is possibly the most popular brand among providers of voucher solutions available on online gambling sites. It is part of the famous Paysafe Group, the parent organization to which the popular e-wallets Neteller and Skrill belong.

Prepaid cards, also known as voucher cards are a commonly preferred method of banking primarily because of the anonymity they ensure. Paysafecard is possibly the most popular brand among providers of voucher solutions available on online gambling sites. It is part of the famous Paysafe Group, the parent organization to which the popular e-wallets Neteller and Skrill belong.Since its establishment in 2000, Paysafecard has grown at a very rapid pace, and customers can purchase voucher cards from thousands of retailers across the globe. Besides the security of one’s personal and banking information, the ease of use is yet another advantage of prepaid cards. To use a prepaid voucher, casino gaming fans should fill in the 16-digit code as a unique identifier. They can choose cards of various denominations and using several cards to replenish one’s casino balance is also an option.

Although Paysafecard has introduced a service enabling customers to withdraw funds to a Paysafe account, most online casinos do not support it among their withdrawable solutions. Therefore, gaming fans use bank transfers to withdraw their accumulated winnings.

-

Cryptocurrency

Bitcoin and other altcoins have revolutionized the way people transact online and have introduced an unrivaled level of security and anonymity. Over the last decade, a growing number of gambling operators have been adding different cryptocurrencies to their cashiers, recognizing their immense popularity and undeniable benefits.

Bitcoin and other altcoins have revolutionized the way people transact online and have introduced an unrivaled level of security and anonymity. Over the last decade, a growing number of gambling operators have been adding different cryptocurrencies to their cashiers, recognizing their immense popularity and undeniable benefits.Cryptocurrencies are decentralized digital assets that do not exist in the physical world. Since its launch in 2008, Bitcoin’s value has skyrocketed and delivered some lucrative investment opportunities.

To use Bitcoin or some other cryptocurrency, casino fans should go to the cashier section of the online casino, and select Bitcoin from the list of supported payment methods. The next thing they are supposed to fill in is the cryptocurrency wallet address and the amount they wish to transfer. Once the transaction is confirmed the casino balance will be replenished.

As far as transaction fees are concerned, there are no such at online casinos. However, using the Bitcoin network to conduct transactions is not free of charge. Cryptocurrency transactions are usually instantaneously processed. Users with unverified accounts might have to wait for some extra time to receive their withdrawals, but they are usually finalized for no more than 48 hours.

Casino Games with eCheck

Online gaming aficionados who prefer eChecks to replenish their accounts and receive withdrawals enjoy a wide assortment of casino games. Below we have compiled a list of some of the most popular casino games they can indulge in including slots, live dealer games, blackjack, and roulette.

Slots with eCheck

Slots make up the largest portion of casinos’ gaming portfolios, which is not surprising at all, taking into consideration the broad selection of themes, the limitless winning possibilities, and simple rules. From traditional three-reel variations to advanced five-reel options, featuring various scatters, wilds, and multipliers, players have a myriad of options in front of them.

Wild Donuts

Wild Donuts is an eye-catching, colorful 6-reel, 5-row slot developed by Max Win Gaming. With an RTP of 96.3%, it is a high variance game, and maximum wins are as high as x10,000. Minimum bets start from $0.2 and the maximum ones equal $100. Candy lovers will certainly be fascinated with the deliciously alternating sweets coming in all colors, shapes, and sizes. Cascading symbols and a free spins round add to the thrill and excitement of players. Other similarly themed slots that would appeal to fans of Wild Donuts include Yummy Wilds, Jammin Jars 2, and Tasty Treats.

Gold Hit: O’Reilly’s Riches

A freshly released title by Ash Gaming, O’Reilly’s Riches is an Irish-themed game, with a mythical mischievous leprechaun in the center of the action. Wearing a cocked hat and a green button-down shirt, the supernatural creature will lead players in a fairy world of green hills and rainbows. Besides the enthralling design of the game, the developers have come up with an innovative reel set comprising 5 reels, each one having from 4 to 8 rows, giving it a stair-like appearance. With an RTP of 95.21% and betting limits ranging from $0.1 to $350 per spin, this game is equally suitable for all player types.

Dawn of Egypt

Dawn of Egypt is a marvelous creation of Play’n Go, with an RTP of 96.23%, minimum bets of $0.10, and maximums of $100 per spin. There are ten paylines altogether. Released in 2020, this game has had quite a success, as it explores the widely popular theme of the ancient Egyptian civilization. Lotus symbols, ankhs, snakes, and scorpions populate the 5-reel grid. The characters of Ra and Bastet also come into play against a backdrop of a masterfully rendered tomb. Other slots from the same developer exploring similar themes include Sisters of the Sun, Doom of Egypt, and Legacy of Egypt, to mention a few.

Live Dealer Games with eCheck

Whether it is blackjack, baccarat, poker, or roulette that stirs their interest, ECheck casino depositors have the chance to explore a wide assortment of live dealer games. Available across smartphones, tablets, and PCs, live dealer variations are possibly the most thrilling option at contemporary casinos. Live-dealer lotteries and bingo are also among the possible variants.

Blaze Live Roulette

Blaze Live Roulette by Authentic Gaming delivers eCheck casino depositors with the opportunity to place their chips and try out their luck at this dynamic variation of the classic game. Unlike other games by Authentic Gaming, this one is streamed from an attractively decorated studio with cameras alternating between the presenter, the table, and the wheel. The game’s RTP stands at 97.30%, with minimum bets of $0.20 and maximums capped at $100. Blaze Live Roulette is a typical European Roulette game, as the only difference with the classic variation is the attractive game-show presentation of the game.

Blackjack Lobby

Blackjack Lobby launched by Evolution Gaming is one fine example of a live dealer game for casino fans to engage in. Wagers are in the range of $0.10 and $5,000. In line with the classic rules of the game, players are supposed to beat the dealer without going over 21. The game utilizes 8 standard 52-card decks, as cards from 2 to 10 are worth their face value, face cards are worth 10, and Aces are either 1 or 11.

PowerUp Roulette

PowerUp Roulette is an exciting new offering of Pragmatic Play in the form of a live dealer gameshow. It is a variation of a classic Roulette with the added benefit of bonus rounds that greatly improve players’ win potential. Should the roulette ball land on a bonus number, they have the chance to take part in the special mode. Multipliers range between 500x in the first round and 8,000x in the fifth. The RTP of PowerUp Roulette stands at 96.2%.

Blackjack with eCheck

Blackjack’s popularity is largely due to the combination of the elements of skill and luck. ECheck depositors to online casinos also prefer this casino game because of its traditionally higher RTP. Winning chances can be further boosted with the application of various strategies.

GameVy – Blackjack

Blackjack by GameVy is a fresh yet minimalistic interpretation of the classic table game. The title is mobile-friendly and the theoretical RTP stands at 99.42%. Essentially, the game follows the rules of American Blackjack and features a simplified design with no side bets. To improve the risk/reward ratio, players may choose to play with up to three hands against the dealer. The one notable difference from the standard rules of the game is the fact that the croupier will not check for Blackjack and offer insurance.

Perfect Pairs Blackjack

Perfect Pairs Blackjack, developed by Felt Gaming is among the world’s most popular blackjack side bet games. As per the game’s rules, if a player’s first two cards are of completely the same suit and value, they win a multiple of their Side bet stake. The base game features an RTP of 99.63%, whereas the Side Bet game has an RTP of 93.89%. Played in multiple interactive casinos across the globe, this variation is cross-compatible, delivering players with an excellent mobile gaming experience.

Multihand Blackjack

Play’n Go offers a genuinely professional and sophisticated Multihand Blackjack experience. The gentle soundtrack of the game enables players to enjoy a truly immersive experience, as are the crisp and clear visuals. Minimum bets start from $1 per hand and can reach $100 per hand. The Fast Play option in the menu can be enabled, increasing the pace at which cards are being dealt and taken off the table. Playing simultaneously up to three hands is among the special features of the game. If a player is dealt a Natural, the payout is 3:2. The chance to buy insurance is present if the dealer is dealt an Ace as the face card.

Roulette with eCheck

Whether eCheck depositors prefer some of the classic Roulette variations or games supplied with side bets and bonus features, they will be able to find a diverse assortment across interactive casinos.

European Roulette

European Roulette by Realistic Games is among the most popular versions of the game. It features simple rules and a total of 37 pockets for a single zero and the numbers from 1 to 36. The largest payout available is 35 to 1 for a straight-up wager. To qualify for this payout, casino players must correctly predict just one number that the ball will land on. The game features an intuitive interface, smooth animations, and a realistic wheel and ball. The RTP is in the range of 97.30% and 98.65%.

French Roulette

French Roulette is a superb addition to NetEnt’s unique collection of roulette variations. This is a single-zero variant, with numbers from 1 to 36. The minimum wagers to be placed stand at $1, while maximums are as high as $500, making the game suitable both for high-rollers and novice players. A winning Straight-up bet delivers a payout of 35:1. Split bets pay up at a ratio of 17:1, whereas Street Bets win potential equals 11:1. The game’s special features include Autoplay, Quick Spin, and Favorite bets. Yet another advantage of this variation of roulette is that it could be played on all mobile devices.

American Roulette

And last but not least, eCheck depositors might try out NetEnt’s take on American Roulette, featuring numbers from 1 to 36, a zero, and a double zero, thus lowering the RTP to 94.74%. The game features outstanding graphics and sound effects. Besides the standard bets, players can place bonus neighbor bets. Placing a winning Straight bet ensures payouts as high as $3,600. The game controls include a Re-bet button and an Autoplay feature. NetEnt’s American Roulette has a page dedicated to statistics, allowing players access to useful information.