EcoPayz is an online payment solution that offers its users virtual Visa cards. The service is owned by PSI-Pay, a company registered with the Financial Conduct Authority of the United Kingdom. This is the government institution that is responsible for the oversight of any financial service operation in the jurisdiction of the United Kingdom. This regulatory body has an excellent track record for policing the companies under its watch and as a result, any entity licensed to operate under the terms of the FCA can be considered trustworthy and you can safely entrust your money to them.

| ecoPayz Summary | |

|---|---|

| Available In | Over 200 countries |

| Website | www.ecopayz.com |

| Connecting Bank Card/Account to ecoPayz | Fees apply |

| Withdrawal balance from ecoPayz to Your Bank card/Accoun | Fees apply |

| Pay to Online Merchants | Free |

| Available for Deposits | Yes |

| Available for Withdrawals | Yes |

| Usual Deposit Time in Online Casinos | Instant |

| Usual Withdrawal Time from Online Casinos | Instant |

| Live Chat | Yes |

| Telephone Support | N/A |

| Email Support | Yes, customersupport@ecopayz.com |

EcoPayz has in recent years risen in popularity in the realm of online gambling due to the excellence of its service. It provides gamblers with an alternative to traditional payment solutions by offering them the opportunity make transactions in a quick and safe manner. For your convenience, we have provided you with an outline of the best and worst aspects of EcoPayz.

ecoPayz Registration Process

Digital wallets are a very popular payment method players can use to add and withdraw funds from their accounts. Providing players with the needed flexibility, security, and convenience, it is clear why digital wallets like ecoPayz are now such a common choice.

It comes as no surprise that the digital wallet continues to gain ground, especially among avid casino fans, as ecoPayz gives them the freedom to make online payments worldwide without worrying about their security and privacy. Trusted by millions of users worldwide, ecoPayz users can spend, receive, and send money using the same account.

While transferring funds to and from their gaming accounts, avid casino fans should not worry about their funds as ecoPayz relies on the latest security and fraud protection technology. Even when making payments directly on the website of their casino of choice, players’ financial information will never be shared with the operator, thus ensuring the security and integrity of your personal information.

Registering for an account is a hassle-free process and will cost players next to nothing. Gambling enthusiasts can fund their ecoPayz accounts in a number of ways, which is to say that they will be able to find the deposit method that suits them best. These are the steps gambling aficionados need to follow in order to start using ecoPayz.

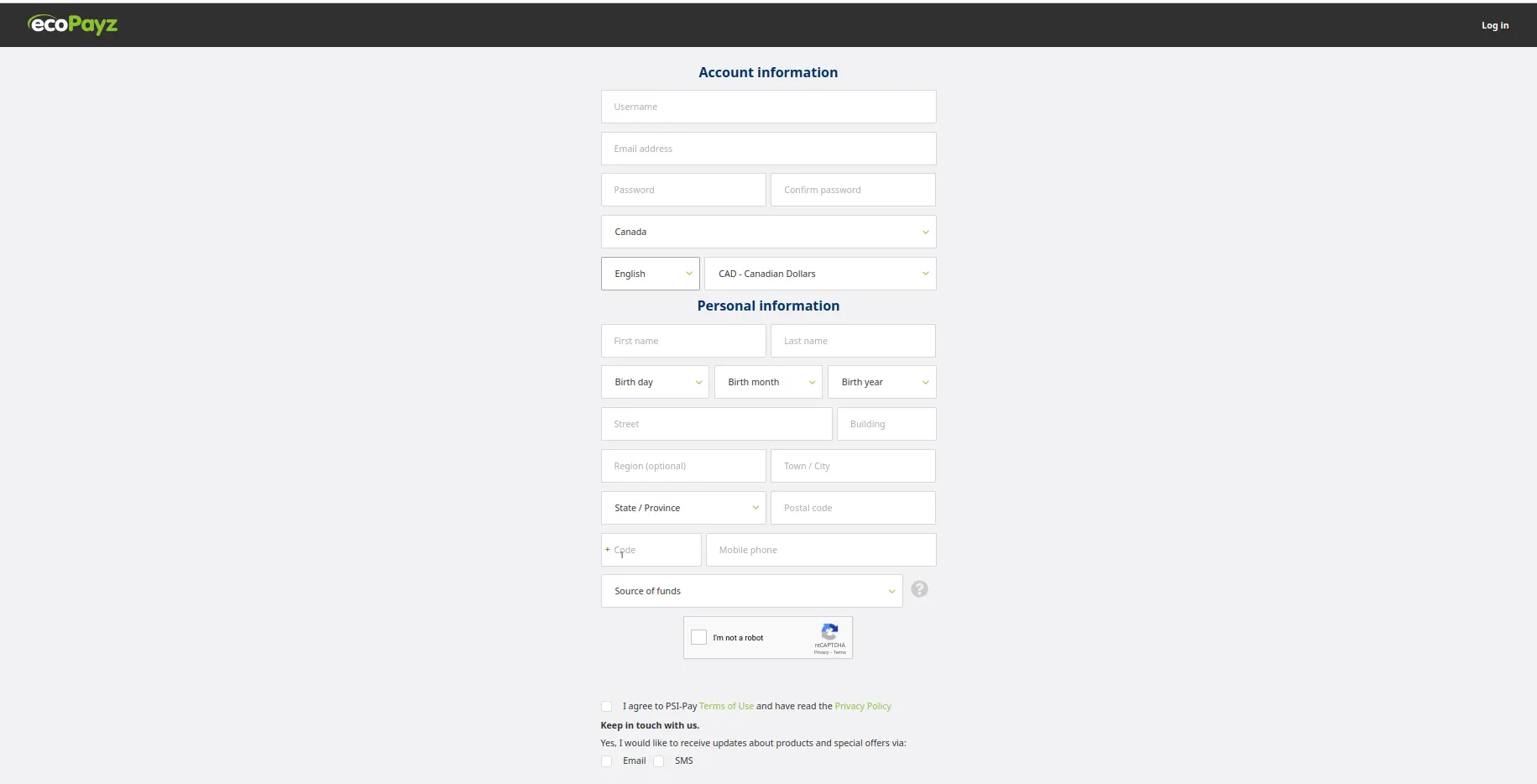

- Players should visit the official ecoPayz website and click or tap the Sign Up button. Then, players will be asked to fill in their account information, which includes their username, email address, and password. Then, they need to pick the country they live in, the language in which they will view all the information, and the currency in which they want to set up their account.

- Creating an ecoPayz account will not be possible without providing any personal information, and gambling enthusiasts need to enter their first and last names, their date of birth, address, and phone number.

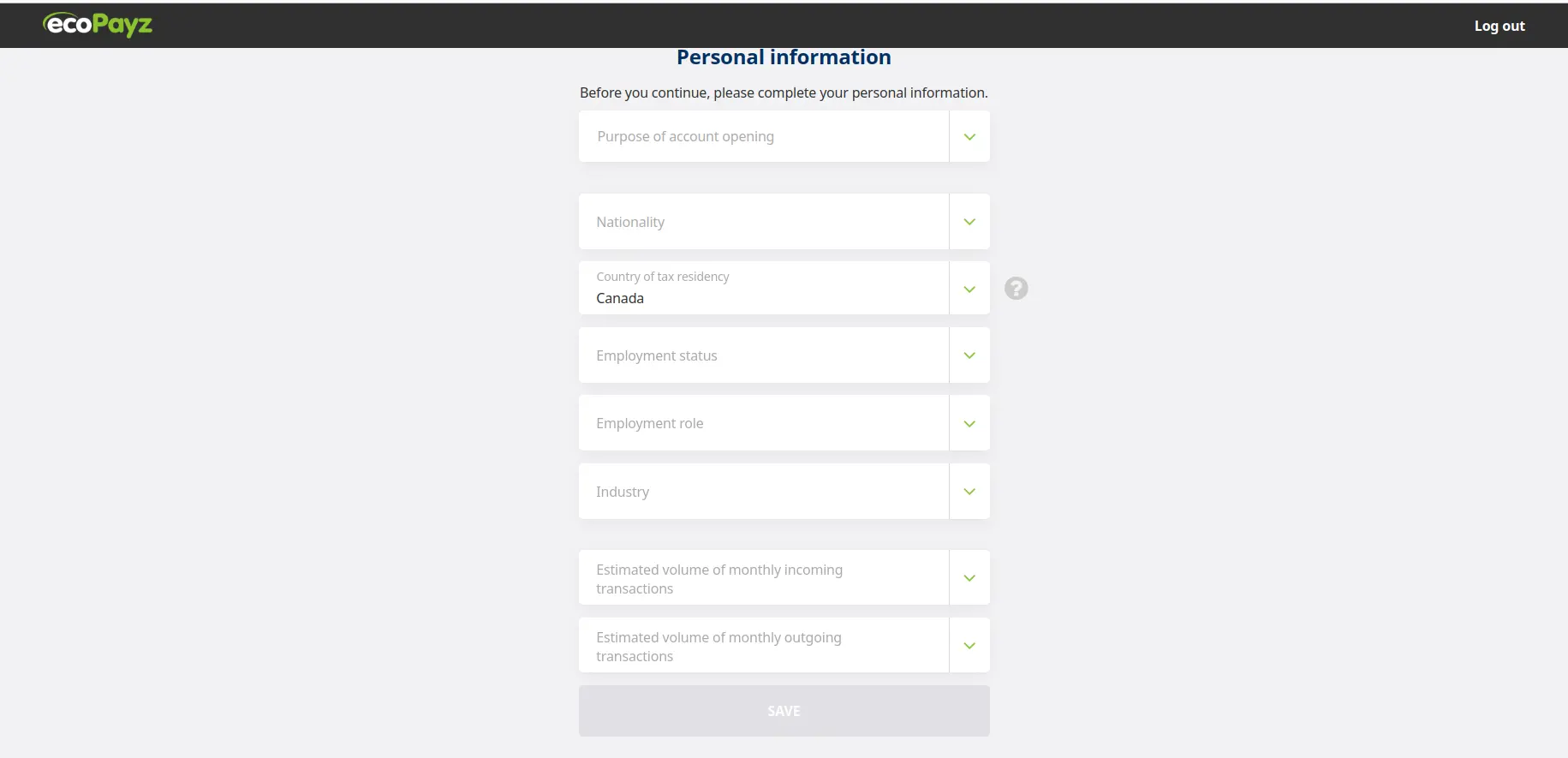

- Before they continue with their payments, players need to provide some more personal information.

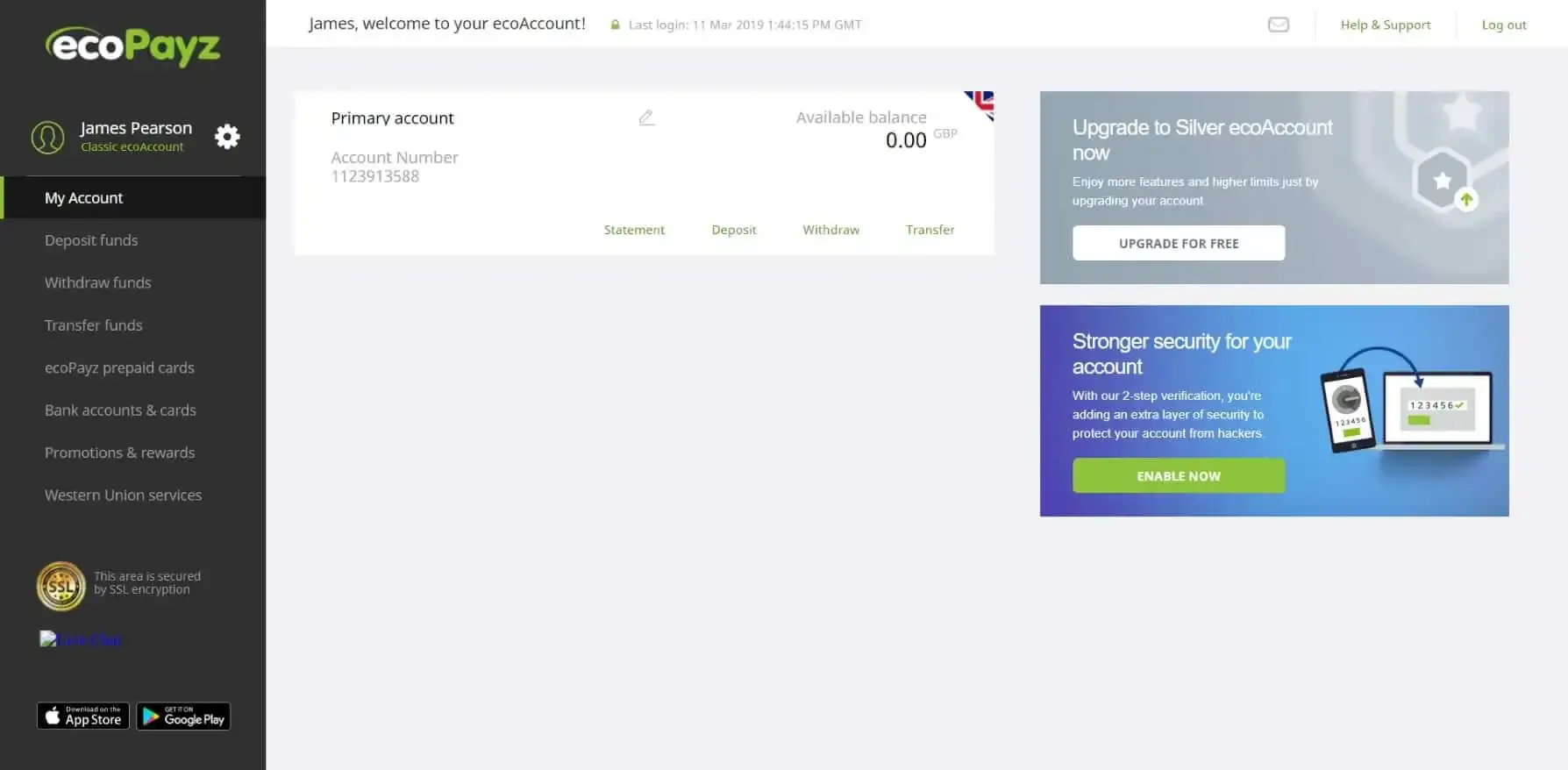

- Once players save the required information, they will be able to access their accounts. What they should keep in mind, however, is that the company will need some time to verify the information they have provided, and until this happens, they will not be able to access the full range of account features.

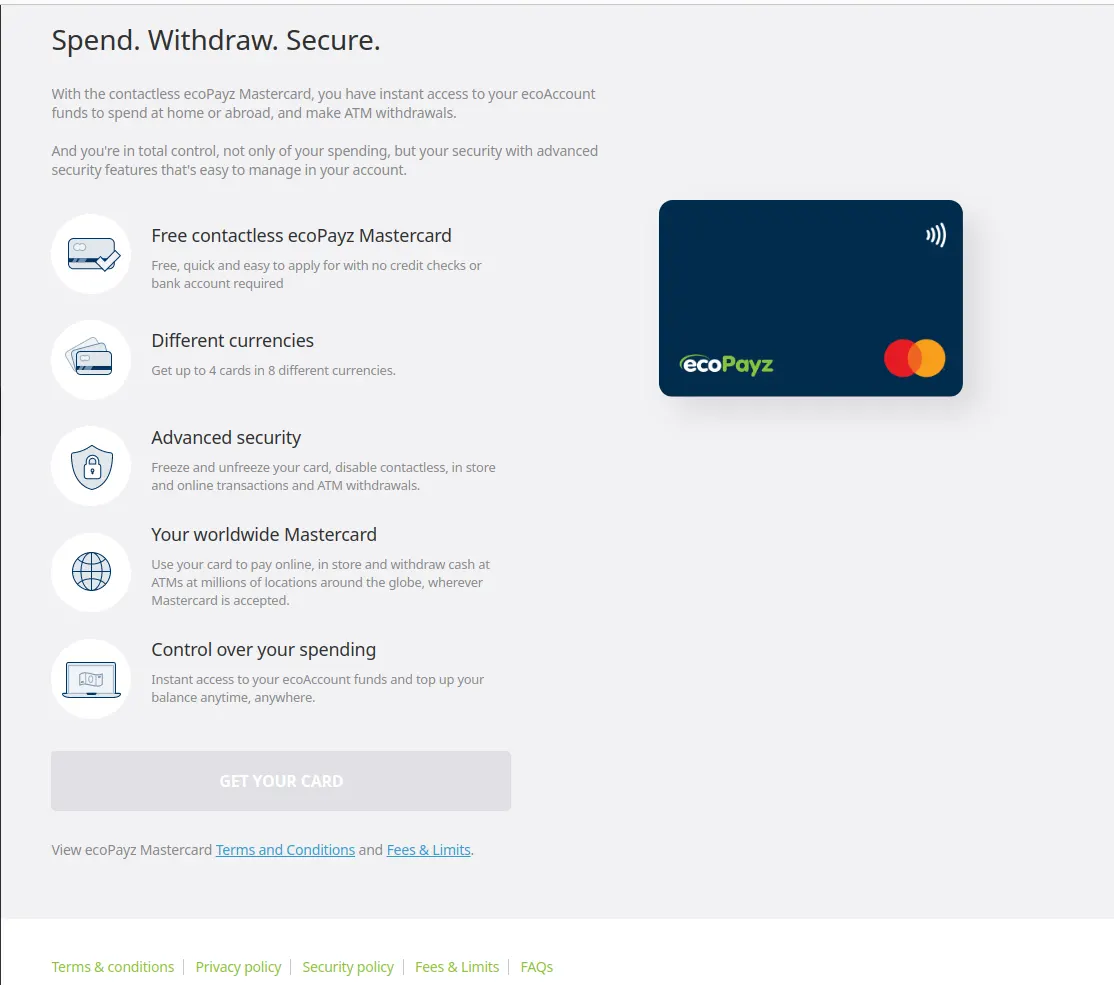

- As soon as players go through the verification process, they get a contactless ecoPayz Mastercard.

- After they verify their account, players will be able to see the full range of deposit methods they can use in order to add funds to their ecoPayz accounts. Keeping up with their payments will also be exceptionally easy, and gambling enthusiasts will view all transactions they have made depending on their date or within a specific date range.

How ecoPayz Works

Advantages and Disadvantages

EcoPayz provides you with an alternative to traditional bank cards, in the sense that you get to keep all of their advantages while also discarding some of the negative aspects. Every user is issued a virtual Visa card that they can use to make payments online in the same manner that they would when using a physical debit card. While this may sound like the exact same thing, it should be noted that the virtual card gives you a significant advantage over the physical.

For starters, the virtual cards that EcoPayz issues are in no way connected to your bank account. This means that the only funds that are available are those that you decided to load on the card. That makes it impossible for third parties to gain access to the money stored in your bank account. This is an excellent way of protecting your funds since the virtual card can function as a proxy between your bank account and third parties, e.g. online casinos or merchants.

Furthermore, the virtual cards offered by EcoPayz are Visa cards in every sense of the word. They simply do not exist in physical form. What this means is that you can use you EcoPayz card to pay at any online store or casino that accepts Visa. Visa is a commonly known and accepted brand and there is hardly a store out there that does not accept payments by it. Additionally, any EcoPayz virtual card can be loaded by various different means including traditional credit and debit cards, wire transfers and even other online services such as eWallets.

More Advantages and DisadvantagesSince EcoPayz offers you a virtual Visa, the service behaves much like a normal debit card would. You have a card number, expiration date, your name and a CVV code. If you are already familiar with how bank cards are used, you will have no trouble with using this service. It is just like a card issued by your bank but without the extra risk. The virtual cards support over 40 different currencies, including three of most used currencies in the world – the United States Dollar, the Great Britain Pound, and the Euro. This allows you to use the card at almost every online marketplace and casino without incurring extra exchange charges. The service supports over 40 other currencies in addition to the main ones.

In addition to the virtual cards, EcoPayz can also provide you with a physical EcoCard that you can use at retail stores everywhere. Much like the virtual cards, this one is tied directly to your EcoPayz account and can only be used to spend the available balance. This card supports three main currencies and a plethora of secondary ones, so it is an excellent way to pay when travelling abroad. Anyone can apply for one of these cards and it would only cost you nothing to receive one. The ecoCard gives you a convenient and safe way to make payments both at retail and online stores.

Despite its many advantages, EcoPayz falls short in several aspects. Since it is a prepaid service is suffers from the same flaws as other similar ones. Since EcoPayz offers virtual payment cards, some users might confuse them with credit cards. In reality, this could not be further from the truth. EcoPayz allows you to make payments using your own money, it does not extend credit in any form to any user. As such you will be confined to your own personal means. This can be problematic for some people, for instance, in the event that they do not have enough funds in their account to cover the minimum required deposit at an online casino. This would require the user to put more money into the EcoPayz account before they can send out a transaction.

Unlike other online payment solutions, the EcoPayz service is riddled with fees for nearly every interaction with it. Depositing with a credit card to your EcoPayz balance will have a charge between 1.69% and 2.99%. To withdraw your funds to a bank account you would have to pay a service fee, depending on your account standing. For every currency conversion, you would have to pay 1.49% or 2.99%, depending on your account type. In order for the company to issue you a virtual card, you will have to pay them $2.30 or your region’s equivalent. Additionally, when you request financial services from EcoPayz, you will have to pay 4% in commission, with a minimum charge of $0.80. This includes forex, money orders, traveller’s cheques, security brokers and dealers, etc.

These fees vary depending on the region and country of the user and as a result, some people will have to pay more than others. Additionally, if your country’s currency is not supported by EcoPayz you would have to pay the exchange fee in order to top up your balance. While it is reasonable to pay a company for their service, there are many other similar payment solutions that are either free or feature much lower charges.

| ecoPayz Pros | ecoPayz Cons |

|---|---|

| Available in most countries | Requires registration |

| Quick and simple transactions | Charges fees for topping up the wallet |

| Highly secure | Prepaid cards are unavailable in some countries |

| Supports over 40 currencies | Verification takes time |

Using EcoPayz for Gambling Purposes

EcoPayz is a commonly accepted method of payment at many online casinos. As mentioned above, it is a very appealing service to many gamblers. It can be used to as a traditional Visa card meaning that you get the benefits of that brand. Since every online casino out there accepts Visa cards you should experience no trouble in making a deposit straight. Alternatively, you may also find an EcoPayz option on the Cashier page. Clicking on it will open another window where you would need to enter your payment information. As soon as that is done, your deposit will clear and you can start gambling away your hard-earned money.

EcoPayz is a commonly used transaction service at online casinos and poker rooms, meaning that you should have no trouble in finding a gambling website that supports it. In fact, whereas other payment services might try to distance themselves from the online gambling industry, EcoPayz embraces its involvement. On their website, EcoPayz showcases some of the online casinos, sportsbook, bingo and forex websites where you can use this payment service to its full benefit. These are some of the most reputable websites in their respective industries and you can safely play there with no issue.

| ecoPayz Gambling Transactions | |

|---|---|

| Supported Transactions | Deposits and withdrawals |

| Deposit Pending Time | Instant |

| Withdrawal Pending Time | Varies across casinos |

| Additional Security | Requires log-in |

| ecoPayz Mobile Payments | |

|---|---|

| Apple Pay | Yes |

| Google Pay | Yes |

Fees for Gambling Transactions

Using EcoPayz can incur some charges in certain situations. When you make a deposit into a foreign currency the service provider has to exchange it. This will cost you 2.99% of the transaction. This can happen when you deposit to a casino that does not support your main currency. Other than that there are no other fees associated with the service.

When a transaction is made to an online casino a service charge is incurred by the payment company. Normally, the online casinos bear the cost of the transaction in the hope of gaining some consumer good will. But, every now and then, an online casino might refuse to pay the cost for the deposit and the user is left to pick up the bill. This is the reason why websites charge a commission when the user makes a deposit or requests a withdrawal. This charge does not go to the casino for profit, but to pay the service provider.

| ecoPayz Fees | |

|---|---|

| Gambling Deposit Fee | Free |

| Gambling Withdrawal Fee | Free |

| Bank Account Deposit Fee | 0.00% – 10.00% |

| Bank Account Withdrawal Fee | Depends on ecoPayz account type |

| Credit/Debit Card Deposit Fee | 1.69% – 6.00% (plus $0.30) |

| Credit/Debit Card Withdrawal Fee | Depends on ecoPayz account type |

| Maintenance Fee | $1.82 per month (after 12 months of inactivity) |

Processing Times for Gambling Transactions

The processing times at online casinos vary based on the kind of transaction that you initiate. For deposits the payment clears instantly, allowing you to immediately begin playing with your money. The time required to receive a withdrawal, however, will vary between the different online casinos. Since the virtual cards are essentially Visa cards they also feature the same processing times. Whenever you wish to cash in your winnings and request a withdrawal, the casino will have to first review your play history and other details. This process can last from 24 to 72 hours, or it might not even take place, depending on the casino in question. Only after it is completed will your payment actually be sent and then it could take between 1 and 5 business days to clear.

Now it reasonable to ask yourself why the deposits clear instantly, while withdrawals can take up to a working week to appear in your account. In reality, the truth is that deposits do not clear instantly. Payments that just as long for the casino to clear, as they do for the players. But rather than have its users wait, the casino allows them to play on credit since it knows that it will receive the money eventually. It does this, in order to appease it users and allow them instant access to the games, as well as to generate some consumer good will.

| ecoPayz Processing Times | |

|---|---|

| Gambling Deposit Time | Instant |

| Gambling Withdrawal Time | Instant when approved by the gambling operator |

| Bank Account Deposit Time | 1 to 4 business days |

| Bank Account Withdrawal Time | Up to 5 business days |

| Credit/Debit Card Deposit Time | Instant |

| Credit/Debit Card Withdrawal Time | Up to 3 business days |

Security at Online Casinos

Identity fraud has increased exponentially with the rise of the Internet. This has been a cause for concern for many years, especially so when you have to submit a significant amount of personal information to third parties. For this reason, almost every online service has some security system in place to safeguard your data. Online casinos most often implement very strong SSL – Secure Sockets Layer – encryption protocols which encode all of your data making it completely unreadable to unauthorized parties. This is one of the most popular security systems on the Internet and it has a very good track record of keeping users’ personal information safe. This is due to the fact that every piece of data sent between you and the casino is encrypted using this state-of-the-art protocol, which makes it nigh impossible for anyone but you and the casino to read. Modern day encryption systems are so developed that it would take any potential wrongdoers hundreds of years to break the encryption with the technology at our disposal. In practice, it serves as a foolproof method of protecting data.

On the EcoPayz’ side of things, you will also find the service to be equally, if not more, secure than the online casinos. Since EcoPayz is regulated by the Financial Conduct Authority of the United Kingdom it is required to possess only the best online security available. As a result, EcoPayz uses the same SSL encryption found at online casinos, as well as its successor Transport Layer Security. Depending on your browser, you can benefit from one or the other. Furthermore, any servers that store personal information are separated from any other hardware in highly secured, restricted locations. Only authorized personnel have access to these servers and so your information is protected with extreme care. Additionally, all transactions are made in compliance with the Payment Card Industry and Data Security Standards, which is the norm for all online payment services. You can also enable 2-Step Verification to your EcoPayz account. This is a security measure provided by Google that allows companies to send a verification code to your smartphone which you can then enter to access your account. This method ensures that as long as you have your phone on you, no one else can login to your account.

Security Additional TipsOverall, EcoPayz offers one of the safest payment services that you could ever use. It is in complete compliance with all government security regulations and the company will take every measure necessary to safeguard your personal information. When using this service you can put your mind at ease, knowing that any sensitive data will never fall into the wrong hands. Of course, no security measure will help you if you do not help yourself. You must always be careful when giving up your information online. What you should never do is send any of your banking or card information over the Internet in the form of email or other types of message. Always be mindful of unsecured public networks as those make you vulnerable to attacks. Create a strong password for your EcoPayz account and never share it with anyone. This is not too much to ask of anyone, and while these steps might seem trivial, they can help you out quite a lot in the long run.

| ecoPayz Security | |

|---|---|

| Passcode | Yes |

| Fingerprint | Yes |

| FaceID | Yes |

| Two-Factor Authentication | Yes |

| Trusted Devices | Yes |

| IP Restrictions | Yes |

ecoPayz Alternatives

It is only natural that gambling enthusiasts want to make sure that they will be able to top up their accounts and cash out their winnings securely, quickly, and without paying exorbitant fees. These are only some of the factors they might pay attention to when they are looking for a convenient and stress-free way to move their funds around their online casino of choice.

The range of options is indeed wide, as avid casino fans can opt for prepaid vouchers, card payments, direct bank transfers, mobile payments, and a whole lot more. Even though ecoPayz has stood the test of time and is a common choice for many gambling enthusiasts, there might still be players who do not think that the digital wallet is effective and suits their preferences. In such cases, it is good to know what other payment solutions you might come across while playing your favorite games online.

-

Other Digital Wallets

If players do not feel like using ecoPayz but enjoy the convenience digital wallets offer, they still have several other processors to decide between. E-wallets like Neteller, Jeton, WebMoney, MuchBetter, Skrill, and PayPal are frequently among the featured deposit and cashout methods, so gambling aficionados are unlikely to struggle to find an online casino that has added these methods to its cashier.

If players do not feel like using ecoPayz but enjoy the convenience digital wallets offer, they still have several other processors to decide between. E-wallets like Neteller, Jeton, WebMoney, MuchBetter, Skrill, and PayPal are frequently among the featured deposit and cashout methods, so gambling aficionados are unlikely to struggle to find an online casino that has added these methods to its cashier.Digital wallets give players instant, secure, and unlimited access to their funds, which is exactly what they might be looking for while betting online. What adds to the appeal of such payment methods is that they are available when players want to collect their winnings. Time efficiency is of high priority for gambling enthusiasts, and while top-ins are reflected in a matter of a few moments, withdrawals might take from a couple of hours to three days to go through.

One of the top reasons why so many gambling enthusiasts use digital wallets as their preferred deposit and cashout method is that they offer enhanced security. As is the case with ecoPayz, while executing payments through the other digital wallets, players will not be asked to enter any of their credit card or bank account information on the banking page of the casino. Not to mention the up-to-the-minute encryption systems such companies make use of.

Digital wallets are unlikely to break players’ bankrolls, and what is even better is that they support a number of currencies.

-

Instadebit

When players enter the world of online gambling, they want to make sure that they will be able to wrap up their payments in a quick and hassle-free manner, and this is exactly what Instadebit offers. It is a bank-based payment solution that offers high-security levels and is among the most chosen ways for players to move their funds to and from web-based casinos.

When players enter the world of online gambling, they want to make sure that they will be able to wrap up their payments in a quick and hassle-free manner, and this is exactly what Instadebit offers. It is a bank-based payment solution that offers high-security levels and is among the most chosen ways for players to move their funds to and from web-based casinos.The payment method is featured on thousands of websites, which is to say that the choice of Instadebit-friendly online casinos is far from being limited. Gambling enthusiasts can start making payments directly from the balance of their bank account as soon as they register for an account, which is a speedy process.

Instadebit makes it possible for players to execute their payments with the utmost safety, as when initiating a deposit, they will never be asked to share their banking details with the casino. If players have enjoyed a lucrative betting session, they do not need to look for another payment processor to use, as Instadebit allows them to conveniently withdraw their winnings to their bank account.

The best thing about Instadebit is that it is suitable for mobile players because they can access the mobile-friendly pages of the payment processor with ease anytime and anywhere.

-

Debit and Credit Cards

Credit and debit cards are among the primary payment solutions for casino deposits and cashouts, and it is easy to see why, as players are already well used to using them on a daily basis. Card payments are such an obvious choice for avid casino fans because of their high acceptance rate, as they are featured on the banking pages of nearly all online casinos.

Credit and debit cards are among the primary payment solutions for casino deposits and cashouts, and it is easy to see why, as players are already well used to using them on a daily basis. Card payments are such an obvious choice for avid casino fans because of their high acceptance rate, as they are featured on the banking pages of nearly all online casinos.Avid casino fans can expect instant deposits, which is to say that they should be prepared to start playing the games they are taken with right away. In spite of the fact that card payments are so widely available, gambling enthusiasts should know that finding an online casino that processes cashouts through them might not be as easy as they might think. Even though debit cards facilitate payments in both directions, players are advised to look into their availability for cashouts in advance, as not all casino operators offer that opportunity.

Contrary to what some players might think, card payments provide high levels of security and protection of their funds, which is to say that security-conscious gambling enthusiasts should not shy away from using this payment method.

How much money payments will set players back is one more thing to consider, and while making casino deposits and withdrawals via their debit card, there are no additional costs. Still, there are casino operators that choose not to offer fee-free card payments, so it is best to check this in advance.

-

iDebit

One more payment processor that allows gambling enthusiasts to make payments from and to their bank account is iDebit. Transactions executed through iDebit are completed in real time, and avid casino fans can get their betting session underway without any ado. The payment solution is many players’ favorite deposit and withdrawal method also because they do not need to have a credit or debit card in order to use it.

One more payment processor that allows gambling enthusiasts to make payments from and to their bank account is iDebit. Transactions executed through iDebit are completed in real time, and avid casino fans can get their betting session underway without any ado. The payment solution is many players’ favorite deposit and withdrawal method also because they do not need to have a credit or debit card in order to use it.Its user-friendliness makes iDebit a top ecoPayz alternative, and all players need to do to complete payments through it is log into their account or check out as a guest, find the bank where they have an account on the list that will pop up, and log into their online banking using their credentials. As soon as players authorize the payment, the casino will receive a confirmation of the transaction on the spot.

Another reason why gambling enthusiasts might pick iDebit over the other payment methods online casinos tend to offer is that they will benefit from bank-level security. While using the payment processor for their casino deposits or withdrawals, gambling enthusiasts can have full confidence that their credentials will stay securely between them and the bank where they have an account because they will not be shared or stored on the website of the casino.

Transactions are completed within the online banking environment of players’ trusted bank, so they can be assured that their banking information will not fall in the wrong hands.

-

Paysafecard

An overriding factor why players might or might not pick a payment processor is whether it provides the needed security. If the protection of their funds and banking details is the highest priority for gambling enthusiasts, prepaid vouchers, and Paysafcerad, in particular, might be the ultimate choice. The prepaid vouchers offer risk-free payments as the only information players need to provide is their 16-digit PIN and the amount they want to deposit. Not to mention that none of players’ personal information will be requested when purchasing the prepaid vouchers.

An overriding factor why players might or might not pick a payment processor is whether it provides the needed security. If the protection of their funds and banking details is the highest priority for gambling enthusiasts, prepaid vouchers, and Paysafcerad, in particular, might be the ultimate choice. The prepaid vouchers offer risk-free payments as the only information players need to provide is their 16-digit PIN and the amount they want to deposit. Not to mention that none of players’ personal information will be requested when purchasing the prepaid vouchers.By using the prepaid Paysafecard vouchers, gambling enthusiasts can pay securely and conveniently with or without registration. Creating a Paysafecard account might be a better alternative for players who want to stick to the payment processor in the long term. By using their Paysafecard account, avid casino fans will benefit from higher transaction limits, pay easily only using their login details, and even buy vouchers online.

Paysafecard is accepted worldwide, which gives players plenty of choices in terms of the online casinos where they can make use of it. If they want to enjoy an optimal Paysafecard experience, players can download and install the apps that are designed for iOS and Android-based devices. Thus, they will have full control over all their payments even when they are out and about.

Casino Games with ecoPayz

Today, avid casino fans who prefer to place their bets over the Internet can complain about anything but the lack of diversity of games. Most online casinos these days get players covered no matter their needs and preferences, as typically, their portfolios are comprehensive enough to keep players busy for hours upon hours.

To keep all their users satisfied and ensure that they will have a reason to keep on coming back for more, casino operators take special care to provide an adequate assortment of live games, slots, video poker varieties, jackpot games, and classics like roulette, poker, baccarat, and blackjack, among others. Some betting sites also offer casino-specific games to provide their users with a one-of-a-kind betting experience.

Slots with ecoPayz

By far the favorite among casino games, slots offer fun and excitement to the bucketload. Slots buffs can pick from countless themes and what is even better is that with some games, they can start hunting for massive payouts. In an attempt to cater to all kinds of tastes, casino operators take special care to offer a wide-enough variety of themes, reel set-ups, and in-game features, and to achieve this, work together with multiple software developers.

There are thousands and thousands of eye-pleasing and exciting slots ecoPayz depositors can enjoy, and these are only some of the titles they might find appealing.

Hotline

Offering some retro-themed spinning action, Hotline is a NetEnt-powered slot that takes players on a spinning adventure back to the 80s. It has five reels, three rows, and 30 non-adjustable win lines, and slot buffs can play it for as little as $0,15 and a maximum of $90 per game round.

The game is clearly themed around the fan-favorite TV series Miami Vice, and its sounds and visuals are created to remind players about the popular movie. In addition to the three characters that will emerge on the reels, players will also see necklaces, crowns, rings, sunsets, and a red sports car. The game has several exciting elements, and the bonus bet, re-spin, expanding wilds, and free spins features undoubtedly add to the excitement.

Money Train 2

Courtesy of Relax Gaming, Money Train 2 is played on a five-reel and three-row reel set-up, where 40 paylines are spread. Boasting excellent imagery and stirring sounds, this Wild West-inspired video slot offers a number of symbols that match the theme. The money train provides the background against which the reel engine is set, and there, slot buffs will see card suits, together with the Payer, Collector, Sniper, Necromancer, golden bonus symbol, and bonus symbols.

Money Train 2 offers some explosive extras, and in addition to the win multipliers, slot buffs might be in for handsome payouts also after they trigger the re-spin feature or Money Cart bonus rounds. Buy Feature is also on offer, and it gives players instant entry in the Money Cart bonus rounds. With 50,000 x bet max wins, it is easy to see why Money Train 2 is such a crowd-pleaser.

Rich Wilde and the Amulet of Dead

Play ‘n GO’s famed adventurer appears in a number of thrilling Egyptian-themed video slots, and one such is Rich Wilde and the Amulet of Dead. To attempt to unearth the hidden Thoth’s treasures, slot mavens need to stake between $0,10 and $100, which is to say that this video slot caters to all pockets.

The game’s reel matrix is made of five reels and three rows, and players can decide if they want to turn on all ten paylines or only some of them. Set in an ancient temple, this graphically superb video slot has a lot to offer in terms of bonus features. Fully-stacked symbols, win multipliers, and rounds of free spins might be the key to landing the maximum win of 250,000 credits.

Live Games with ecoPayz

If avid casino fans have already tried their hand at classics like roulette, poker, blackjack, baccarat, and craps, they are unlikely to have any trouble adapting to their live cousins. Such games are exactly what they sound like as they are led by professional dealers, thus bringing players an experience that is exceptionally close to the real thing.

Free Bet Blackjack

Free Bet Blackjack is part of Evolution Gaming’s Infinite range of games, which is to say that it offers an unlimited number of seats. As with the other live games that are courtesy of the provider, all bet requests are processed at a lightning-fast speed and the wide-ranging chip denominations render this blackjack variant a great option for all players, even those that do not have deep pockets.

The main reason why this live blackjack variant might turn out to be particularly appealing for avid casino fans is that it comes with three optional side bets, including Bust It, 21+3, Any Pair, and Hot 3. The Six Card Charlie rule is also present here, together with free double down and split bets.

Speed Roulette

Playtech’s Speed Roulette is developed for players who prefer to enjoy the table classic at a faster pace. Producing more rounds per hour than regular games, this European-style roulette variant might not be suitable for the faint-hearted.

What players might like about this single-zero roulette variant is that they can make call bets, save bets they consistently make, and view the history of their previous bets. What players might notice about Speed Roulette is that there is no table, just a roulette wheel. In spite of this, placing a bet, clearing your chips, and placing the same bet again is made incredibly easy and only takes a few clicks or taps.

Boom City

Created to revolutionize the live casino space, Pragmatic Play’s Boom City is a game show in which an innovative mechanic is employed. It showcases a 6×6 grid, where 36 squares are featured. Whether players win or lose is determined by the outcome of two physical dice, one die determines the horizontal column, and the other one determines the vertical column.

What players need to do is select the square they think will be chosen by the two dice. There are power-up, bust, bonus round, and prize squares. The various features, bonuses, and outcomes make the game an appealing option for thrill-seeking players. Thanks to the 4k cameras, players will enjoy a truly immersive betting session, which helps make the game all the more appealing for avid casino fans.

Blackjack with ecoPayz

Blackjack is one of the games players tend to focus on when they are in the market for a classic casino experience. It is not a coincidence that the card classic enjoys such tremendous interest, as aside from being exceptionally entertaining, its rules are relatively easy to master. Today, new and enticing blackjack variants are introduced almost all the time, thus giving fans of the card classic plenty of choices.

Blackjack+

Courtesy of Felt Gaming, Blackjack+ is a game that allows players to enjoy the card classic at its best. It is a slick and modern yet authentic game that caters to all types of players, as bets can range between $0,10 and $500.

What further increases the excitement this blackjack game offers is that players are given a choice from six of the most preferred side bets, including Perfect Pairs, 21+3, Lucky Ladies, Suit ‘Em Up, and Buster.

The game is played using six decks of 52 cards, and players can bet on up to three hands at the same time. While playing Blackjack+, gambling enthusiasts can only split once per hand, double after a split, and on any first two cards. Hitting on split Aces is also among the allowed moves. Gambling enthusiasts are allowed to speed pay and start a new round quicker or use the rebet button if they want to make the same bet again.

Back Blackjack

Golden Rock Studios’ Back Blackjack is yet another intriguing variant of the card classic players might stumble upon in their online casino of choice. It is easily one of the best options high-stakes players have, as bets are capped at $5,000, while the least amount they can stake is $1.

The game does not fail to impress players with the betting opportunities it offers as there is an optional side bet they can make. If players have made the side bet and they or the dealer have a blackjack, three dice will be rolled. If all three dice show a different number, players will get a payout of 8 to 1, while getting the same number on the three dice will bring players a payout that are determined by the numbers they get (1s – 11/1, 2s – 22/1, 3s – 33/1, and so on). If the dealer and the player have a blackjack, a 4x win multiplier on the side bet winnings will be applied.

Blackjack Go

Blackjack Go by Green Jade Studios might completely suit the preferences of total novices to the blackjack tables. Players will be presented with a no-frills blackjack table where three bet positions are featured. Naturally, players should pay special attention to the decisions they can make, and doubling down is possible on any initial hand and after a split. Players can only draw a single card per split Aces and are not allowed to re-split split pairs.

Blackjack Go is played using six decks of 52 cards that are re-shuffled prior to each new round. As they play, gambling enthusiasts can select from several speeds at which the rounds are played, thus ensuring that they can place their bets as they prefer.

Roulette with ecoPayz

Roulette has been the game that springs to players’ minds when they think about casinos for as long as anyone can remember. Even though multiple other games have grown to prominence with the rise of technology, roulette is still one of the most beloved games and is part of the portfolios of nearly all online casinos. Today, there are a number of roulette variants that come with twisted rules and intriguing features.

European Roulette

Gamevy’s European Roulette is a simple yet intriguing variant of the table classic that will have players’ attention from the get-go. It is a simple-looking roulette game, the wheel of which contains 37 pockets, which is to say that players will benefit from a lower house edge.

Most players will be perfectly happy with the speed of the action and featured betting options. Yet, what some might not like about the game is that call bets are unavailable. If players choose to jump into the action asap, they can double all their bets, go for the auto bet option, and undo the wagers they have made with a single click of a button.

3D European Roulette

Provided by 1×2 Gaming, 3D European Roulette is exactly how it sounds, a visually appealing roulette game with cracking graphics and fluid animations. The single-zero roulette game allows players to pick from multiple chip denominations that are suitable for high-rollers and low-stakes roulette fans.

The realistic graphics are indeed the highlight of this roulette variant, but the available betting options are also worth mentioning. The game might be a real joy to play for gambling enthusiasts as, in addition to inside and outside bets, a racetrack is also available. Statistics and game history are also at hand, along with bet history.

Realistic Roulette

Created to provide roulette fans with an experience like no other, Realistic Roulette offers an immersive 3D environment. Players are allowed to switch between 3D and 2D modes, depending on how they want to view the betting layout and the wheel. The best thing about Realistic Roulette is that players can engage in the betting action on their tablet, smartphone, or computer and enjoy the same high-quality visuals at all times.

Stakes can run pretty high, especially if players want to make bets on Red/Black, as the upper limit on such bets is $1,000. To ensure the best experience for players, the provider has ensured that game history will always be close at hand.