MiFinity is an electronic wallet that has started to gain traction among online casino players in recent years. The method enables customers from 170 supported countries to swiftly send and receive secure payments to online merchants, or in this case, online casinos.

The payment processor has received accreditation from the UK Financial Conduct Authority (FCA) and is within the regulatory scope of the 2011 Electronic Money Regulations legislation. The Malta Financial Services Authority regulates it for European customers under the provisions of the 1994 Financial Institutions Act.

The company has over 18 years of experience in the field of online payments. However, the method was not all that popular among online gamblers until recently. MiFinity is much more than your average virtual wallet. It offers a broad range of cost-effective services and products to businesses and consumers alike, including virtual debit cards.

| MiFinity Summary | |

|---|---|

| Available In | Over 170 countries |

| Website | www.mifinity.com |

| Connecting Bank Card/Account to MiFinity | Fees apply |

| Withdrawing Balance from MiFinity to Your Bank Card/Account | Fees apply |

| Pay to Online Merchants | Free |

| Available for Deposits | Yes |

| Available for Withdrawals | Yes |

| Usual Deposit Time in Online Casinos | Instant |

| Usual Withdrawal Time in Online Casinos | Several hours to 48 hours processing; processing timeframes vary between casinos |

| Live Chat | Yes |

| Telephone Support | Yes |

| Email Support | Yes |

MiFinity is gaining popularity in the online gambling space due to the numerous advantages it offers. To begin with, players can use it both for withdrawals and deposits, an option that adds flexibility to their bankroll management.

MiFinity is convenient, reliable, and effortless to use. Also, language is never a barrier with MiFinity. Players worldwide can set up their virtual wallets in over 15 languages, including English, Italian, Chinese, Spanish, Swedish, Russian, French, and German.

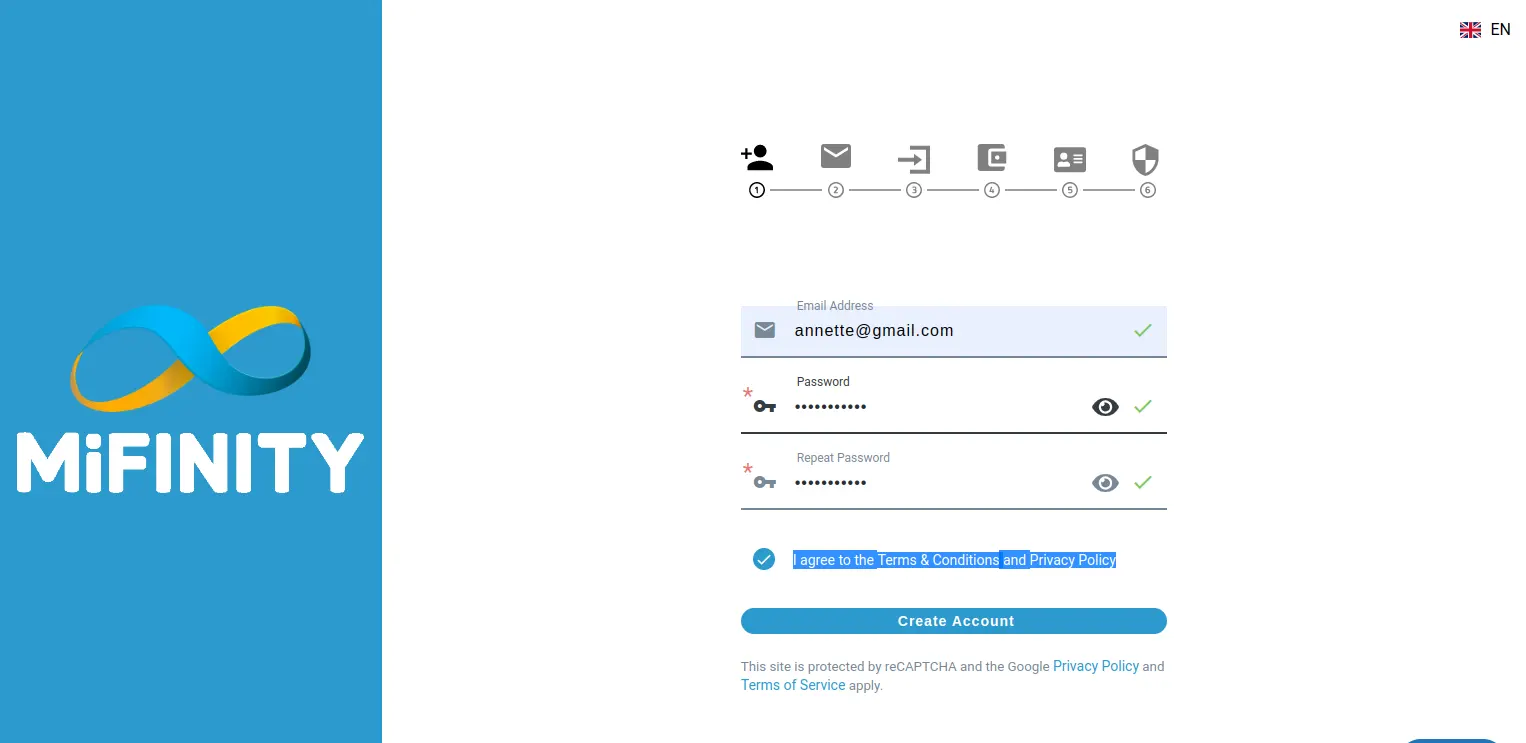

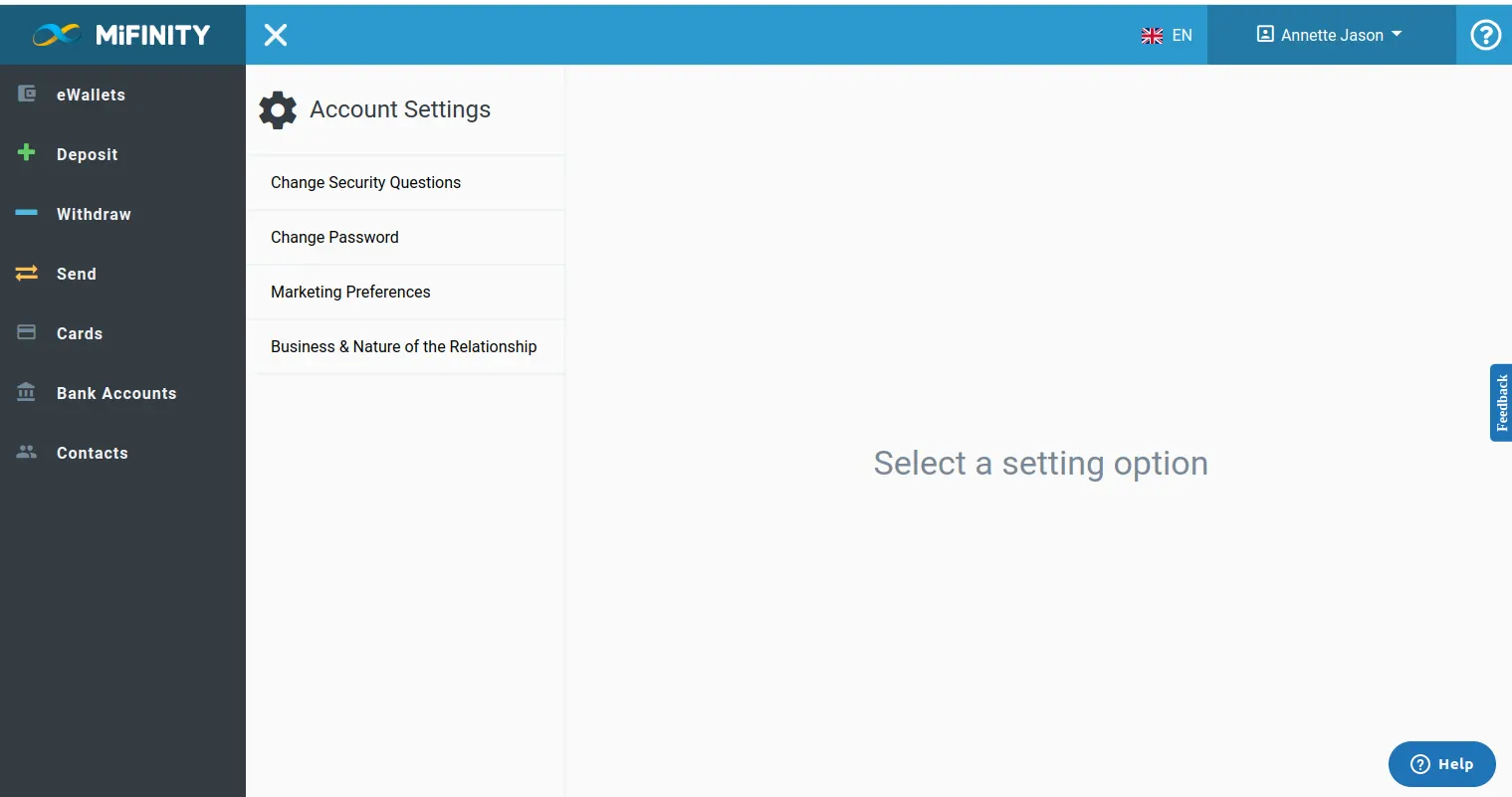

MiFinity Registration Process

MiFinity is a secure digital wallet that provides users with the opportunity to make online payments or receive funds safely and promptly. MiFinity is available in over 170 countries. It works in a way similar to all other eWallets. Users are required to register with MiFinity and fund their digital wallets via credit/debit card by Visa/Mastercard or bank account. Some people, however, may be reluctant to disclose their banking credentials. That is why MiFinity allows its registrants to fund their balances via MiFinity Voucher, CashtoCode, Sofort, Trustly, Interac, and Union Pay. In the lines below, we will provide our readers with a step-by-step explanation of creating a MiFinity account.

- Visit the official website of MiFinity and click the Sign-Up button in the upper right corner.

- You will be required to enter your email address and create a reliable password. Confirm the password and tick the I agree to the Terms & Conditions and Privacy Policy box.

- Upon completing the registration, you will receive an activation email. You must follow the link provided in the email to finalize the registration process.

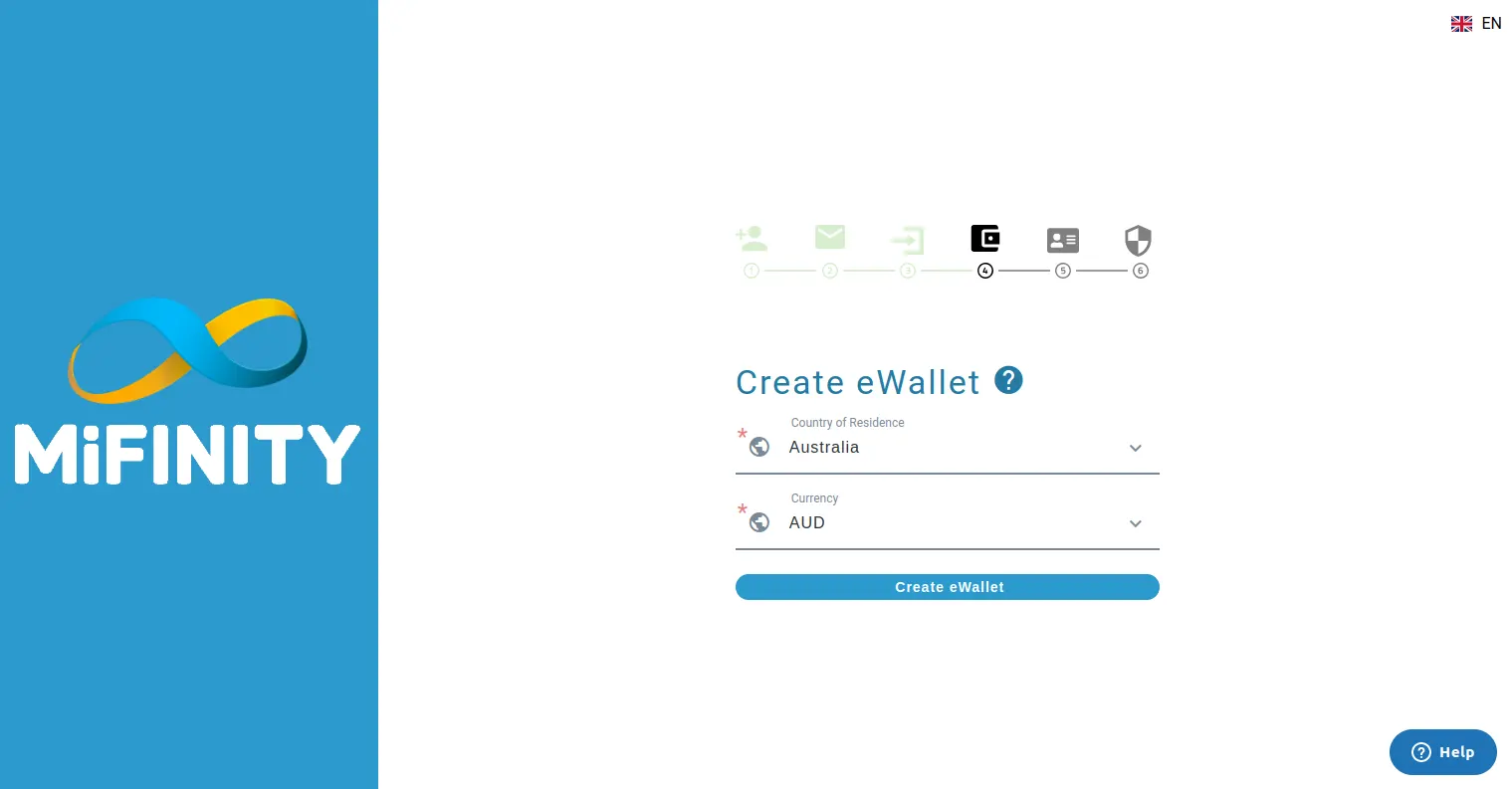

- After that, you will be prompted to log in to your MiFinity account and create your eWallet depending on your needs. You will have to select your country of residence and preferred currency.

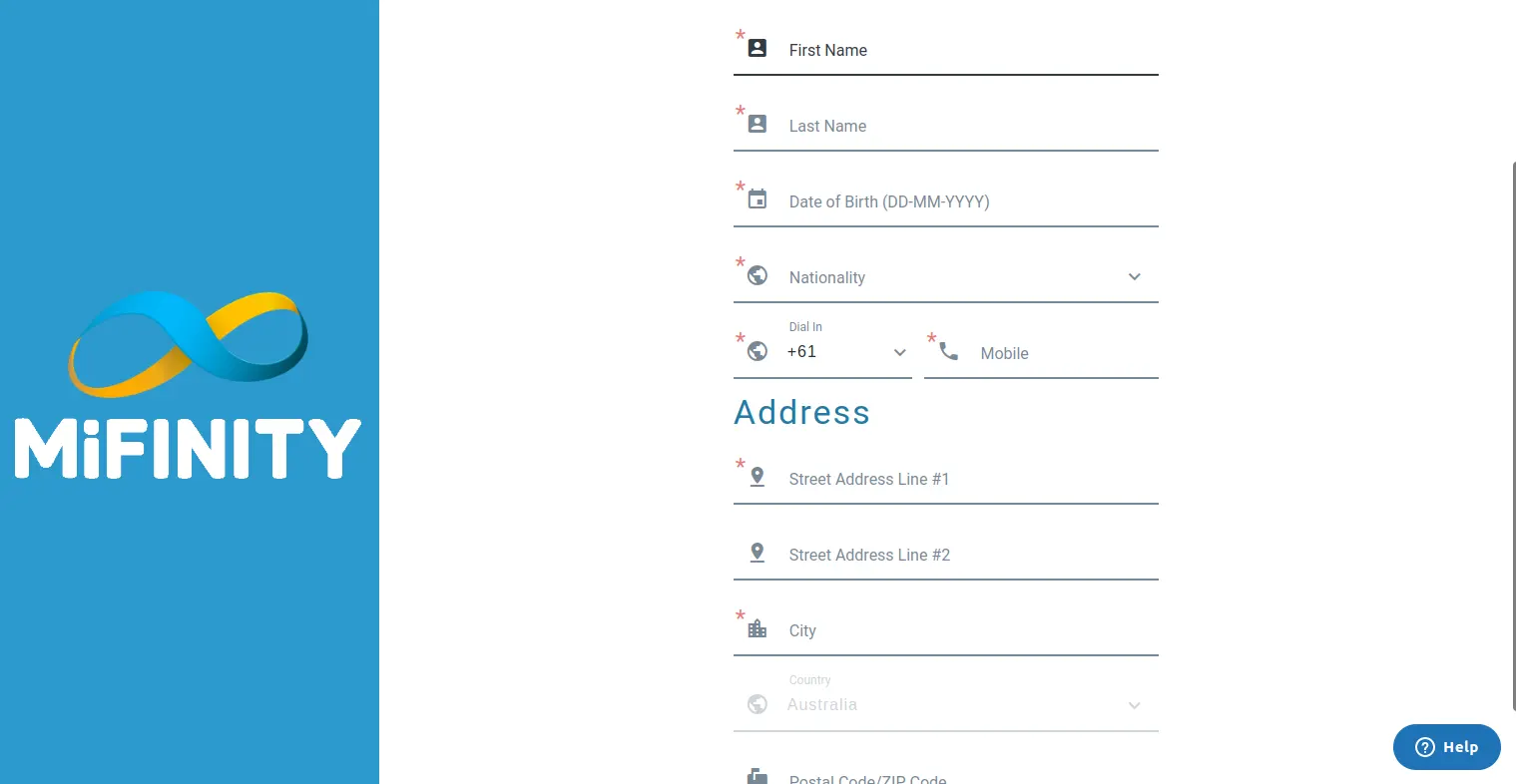

- The next step is to provide personal details, including name, date of birth, nationality, phone number, address, and postal code.

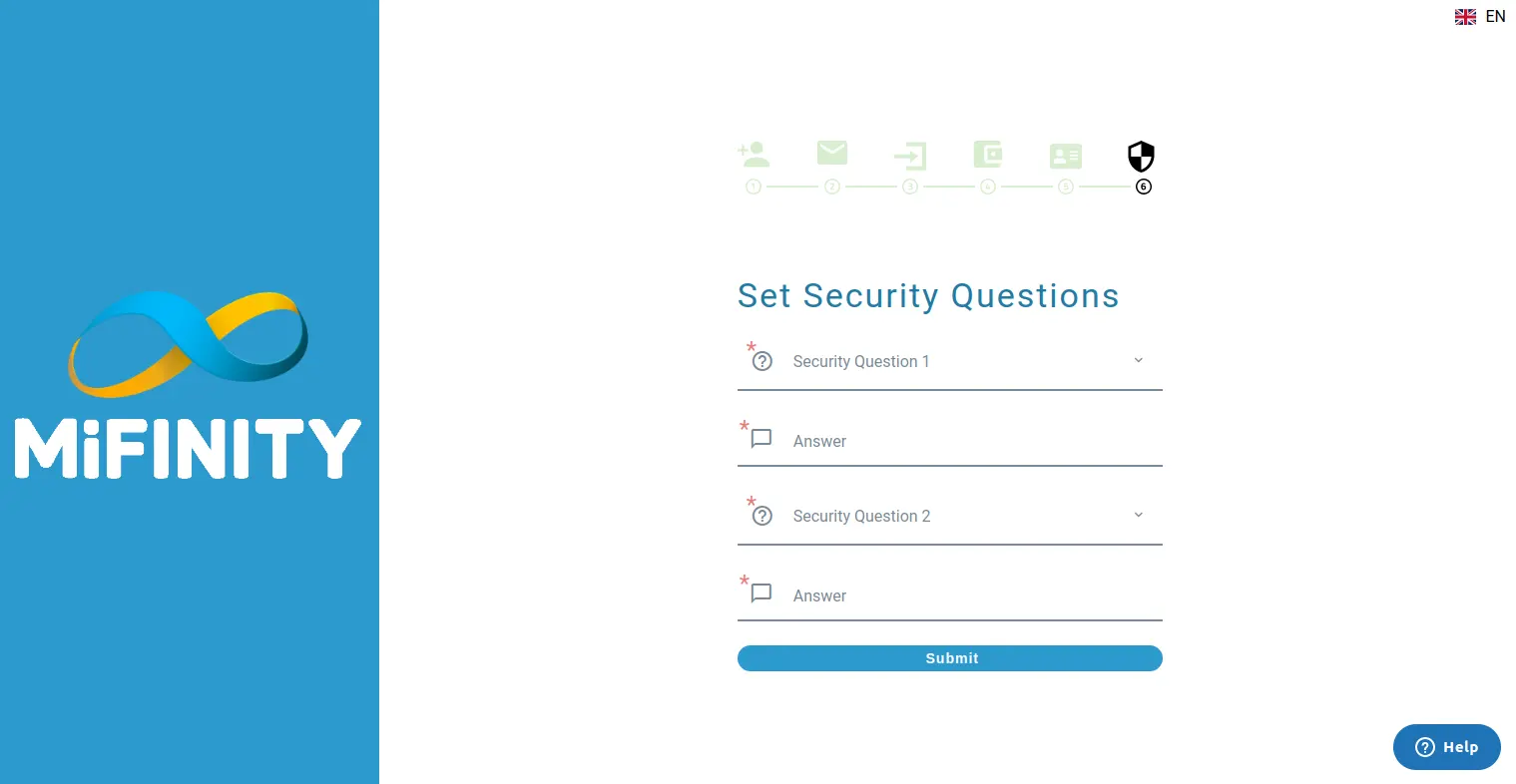

- Set your security question and answer. After that, you will receive a verification code via SMS.

- Once your MiFinity eWallet is ready, you must add funds to it via any of the supported payment methods. Now, you can use MiFinity to make online payments, send, and receive money.

Other Products Offered by MiFinity

MiFinity is more than just a digital wallet. In 2020, the company announced its partnership with UnionPay International, allowing users residing in Europe to make cross-border remittances on the MiFinity platform by entering the recipient’s UnionPay card number. This makes sending money from anywhere in Europe and the United Kingdom to China easier than ever.

In January 2022, MiFinity launched another product called Virtual IBAN. The Virtual IBAN is linked to the MiFinity eWallet and allows users to fund their MiFinity accounts directly from any GB or EEA IBAN-enabled bank account without incurring fees. Another advantage of the MiFinity Virtual IBAN is that it facilitates same-day SEPA transactions. At the moment, MiFinity’s Virtual IBAN is available only to customers from the EEA region and the United Kingdom and supports two currencies – EUR and GBP.

If you want to top up your MiFinity eWallet without disclosing your banking credentials, the MiFinity eVoucher is the right solution. It is a prepaid voucher that MiFinity users can buy from partner resellers, including Dundle, ReloadHero, OffGamers, and Kinguin. To add funds to your MiFinity eWallet via eVoucher, select MiFinity eVoucher as a preferred deposit method and enter the 20-digit PIN.

Customers can also redeem the MiFinity eVoucher directly on the merchant’s website through the MiFinity iFrame platform. At the time of writing, the MiFinity eVoucher is available in the following currencies – AUD, CAD, CHF, CNY, CZK, DKK, EUR, GBP, INR, JPY, NOK, PLN, RUB, SEK, USD, and ZAR.

Using MiFinity for Gambling Transactions

Using MiFinity for gambling-related transactions is beyond simple. You start by signing up for the virtual-wallet service, whereby you must enter a valid email address and choose a strong password for your account. They will send you an email to activate your new MiFinity account with. Just click the link featured in the email to proceed with the registration process.

You select your country of residence and specify what purpose you intend to use your wallet for. The dropdown menu gives you a choice from several options, including e-commerce, gaming, and travel. We recommend you choose your local currency, if available, to save on conversion fees.

MiFinity gives you a choice from 11 currencies – USD, EUR, GBP, AUD, CAD, CZK, RON, SEK, PLN, NZD, and CHF. The system will prompt you to boost your account’s security by selecting two security questions. Then they will send a verification code to the mobile number you have provided to complete your registration.

Make sure you act quickly because the verification code expires after five minutes. Of course, you can always request them to send you a new one if you fail to verify your number within the designated time. Then you sign in and upload the requested documents to verify your identity and address. You can use copies of your ID, passport, utility bill, credit/debit card (Mastercard, Visa, or UnionPay), or driving license. So far, so good.

MiFinity for Gambling Transactions Additional TipsNow that you have registered and validated your MiFinity wallet, you have to top it up so you can start depositing to your favorite online casinos. One thing we particularly dig about MiFinity is that you can add several wallets to the same account. You can choose different categories and currencies for each wallet integrated into your account.

Registrants can fund their wallets’ balance with a variety of methods. Feel free to use your credit/debit card, bank transfers, and cryptocurrencies like Bitcoin and Bitcoin Cash. Players can also fund their MiFinity accounts with locally available payment processors like Klarna, iDeal, Giropay, and Trustly. The method you use must be in your name.

When you are all set, just log into your existing casino account or create a new one at a new gambling site you want to try. Open the casino’s cashier and select MiFinity from the list of accepted payment solutions. Specify the sum you wish to transfer to your casino balance and select Deposit.

The system will transfer you to the MiFinity login page, where you have to enter the email and password you registered with. The next step involves selecting a deposit option, with a choice from your MiFinity wallet’s balance, bank card, online banking, or cryptocurrency. Click on Make Payment, and you are good to go.

Deposits with MiFinity are typically instant, allowing users to start gambling at their favorite online casinos in the blink of an eye. Another great thing about MiFinity is that it enables you to withdraw your casino winnings just as conveniently. The withdrawal process is nearly the same as depositing, the only difference being it requires a bit more time.

Accredited and trusted gambling operators normally process withdrawal requests within 24 to 48 hours. Of course, the exact processing timeframe depends on the individual casino’s policies. After the funds reach your wallet, you can withdraw them from your balance to a card or via a bank transfer.

| MiFinity Gambling Transactions | |

|---|---|

| Supported Transactions | Deposits and withdrawals |

| Deposit Pending Time | Instant, no pending time |

| Withdrawal Pending Time | Up to 48 hours depending on the respective casino’s policies |

| Additional Security | Login required; Two Factor Authentication |

Advantages and Disadvantages of MiFinity as a Casino Deposit Method

There are many reasons why more and more players are transitioning to MiFinity as their preferred banking solution. For starters, the service is widely available to users from over 170 countries around the globe. The list of non-service countries is rather short, spanning only twenty or so restricted regions.

Most of these are jurisdictions where online gambling is either illegal or unregulated. The list includes countries like Afghanistan, Iran, Iraq, Syria, Sudan, Yemen, Turkey, Cuba, and North Korea. If you live outside these countries, you will experience no trouble setting up a MiFinity account.

The ease of use is another major plus of MiFinity. You can easily deposit and withdraw from your casino account in eleven currencies. There is no need to pay for conversion if you set up your MiFinity account in the same base currency as that of your online casino account.

The method is also very cost-effective, especially compared to widely used wallets like Skrill and Neteller. To put things into context, depositing with cards to your MiFinity account comes with a 1.8% fee, compared to Neteller and ecoPayz where fees reach 2.5% and 10%, respectively. If you deposit with locally available methods like iDeal, the fees with MiFinity are even lower at €0.50.

Additional Advantages and Disadvantages of MiFinityThe good news is withdrawals are equally inexpensive with MiFinity. You can pull out money from your balance at a flat fee of €1 per withdrawal, provided that you use local bank transfers or Visa cards issued in the European Economic Area (EEA). Maintenance fees on inactive accounts are also lower, compared to other similar methods.

Most online casinos that support MiFinity do not impose extra charges on payments with this wallet, which also saves you money. We should also not underestimate the high levels of security MiFinity offers. The method relies on up-to-date security technologies to process your payments.

You can have peace of mind, knowing all transactions to and from your wallet are well-protected. The way this method operates ensures an extra level of protection. There is no need to share any sensitive information when making or requesting a payment.

You can send and receive money anonymously by using only your email and MiFinity password. Once you select MiFinity in the casino cashier, the system will transfer you to the method’s login platform. The gambling operator has no access to your credentials and sensitive banking information.

Last but not least, MiFinity is a customer-oriented company that strives to ensure each user’s satisfaction. The platform supports several communication channels, including a quick and highly efficient chat service.

Compared to all these benefits, MiFinity has very few disadvantages. While registration is relatively simple, you still have to invest some time into setting up your account. Additionally, users must upload various documents to validate their MiFinity accounts. Otherwise, it would be impossible to transfer funds to the wallet’s balance.

The verification process takes 24 to 48 hours. This delay can be a major nuisance, especially when one is itching to start playing their favorite casino games for real money. Finally, there is the issue of availability. Albeit more cost-effective, MiFinity is not as widespread at online casinos as other wallets like Skrill, ecoPayz, and Neteller.

| MiFinity Pros | MiFinity Cons |

|---|---|

| Adequate chat assistance in real time | Fees on deposits and withdrawals to and from your MiFinity account |

| Availability in most countries worldwide with very few exceptions | Unavailable for online gambling transactions in the United States |

| Support of 11 currencies | Requires registering an account |

| Regulated by the FCA and the MFSA | Players must undergo verification before they can upload any funds to their wallets |

| No fees on casino deposits and withdrawals | Not as broadly available in casinos as Skrill, PayPal, and Neteller |

Fees for Gambling Transactions with MiFinity

MiFinity is very inexpensive to use, especially compared to similar virtual-wallet services. Opening an account is free, and so are deposits and withdrawals at most casinos that accept this method. Additional fees apply only when you top up your MiFinity balance or withdraw from it. Still, the charges are quite reasonable even if you are a small-scale gambler.

The most cost-efficient way to transfer funds to your wallet is to use Mastercard and Visa cards issued within the EEA. You will have to pay 1.8% in this case. The same applies to deposits with UnionPay, Klarna, and Bitcoin. The charge on transfers with iDeal is the lowest at €0.50 – this is the most inexpensive way to fund your MiFinity wallet.

The cost is higher for cards issued outside the EEA, reaching 2.5%. Argencard deposits come with a 7.7% fee, while those conducted with Aura reach 8.7%. The fees for Boleto, Bradesco, Itau, and PagoFácil are slightly lower at 6.7%. We suggest you look at MiFinity’s official website where you will find the fees applying to all accepted deposit methods.

Withdrawing from your wallet’s balance comes at a low price of €1 for SEPA bank transfers and EEA Visa cards. International Visa cards and EEA Mastercards incur a €1.75 fee on withdrawals, while interregional Mastercards cost €2 per request. Receiving money from casino operators and other online merchants comes at no extra cost.

The same goes for online casino deposits. We recommend you use your MiFinity account regularly to avoid the monthly maintenance fees of €1, which apply after one year of inactivity. As for currency conversion, MiFinity charges 2.99% to its wholesale exchange rates.

| MiFinity Fees | |

|---|---|

| Gambling Deposit Fee | Free |

| Gambling Withdrawal Fee | Typically free |

| Bank Account Deposit Fee | Country-specific (3.5% + €0.35 for Estonian banks, 7% + €0.35 for Latvian banks and Lithuanian banks, €0.50 for online bank transfers via iDeal) |

| Bank Account Withdrawal Fee | €1 within SEPA |

| Credit/Debit Card Deposit Fee | 1.8% for Visas and Mastercards issued within the EEA, 2.5% for non-EEA Mastercards and Visas, 1.8% for UnionPay cards |

| Credit/Debit Card Withdrawal Fee | €1.75 for interregional Visas and EEA Mastercards, €2 for interregional Mastercards, €1 for EEA Visas |

| Maintenance Fee | €1 administrative fee after 12 months of inactivity |

Processing Times for MiFinity

Like most e-wallets, MiFinity facilitates time-efficient payments to and from your online casino balance. Online casino deposits occur in real-time, meaning that the deposited funds hit your gambling balance instantly. The minimum deposit with this method is usually as low as €10 at most gambling sites.

Winning is easily the most exciting thing that can happen to you in an online casino. The good news is you can use MiFinity to swiftly cash out your loot. Note that processing timeframes would range across different sites.

Some casinos would approve your request within several hours. Others will require 24 to 48 hours to release the funds from your gambling account. It all comes down to the withdrawal policies of individual operators.

Processing Times for MiFinity Additional Tips

Keep in mind that further delays are possible in case you try to cash out a heftier amount. The casino might request you to send some documents for verification and their assessment will take some time. It is a standard procedure that seeks to prevent financial frauds such as money laundering.

MiFinity credits your wallet’s balance immediately when you use upload methods like credit or debit cards, online banking, and direct debit. However, the transaction is subject to reversal provided that MiFinity does not receive the money within a reasonable timeframe.

When cashing out to your bank account, you must do your due diligence and make sure you have entered all your banking details correctly. These include your bank account’s number, your bank’s sort code, IBAN, or BIC/SWIFT.

MiFinity will charge you an administrative fee to a maximum of €25 in case you have requested a withdrawal to the wrong banking instrument. The company usually helps customers reclaim their funds in such instances.

| MiFinity Processing Times | |

|---|---|

| Gambling Deposit Time | Instant |

| Gambling Withdrawal Time | Processing times of up to 48 hours based on the operator’s withdrawal policies |

| Bank Account Deposit Time | Immediate |

| Bank Account Withdrawal Time | Might take several business days |

| Credit/Debit Card Deposit Time | Immediate |

| Credit/Debit Card Withdrawal Time | Immediate |

Mobile MiFinity

MiFinity provides players with the ultimate flexibility to deposit and withdraw from their favorite online casinos as they go via dedicated and web-based applications. You can access your MiFinity wallet from your mobile browser if you do not feel like downloading the native apps. The company itself recommends you use up-to-date versions of commonly available browsers like Safari, Chrome, and Mozilla Firefox.

The alternative is to install MiFinity’s dedicated app on your Apple or Android device. You can download it at no cost from the official Google Play and App Store platforms. Both apps are very user-friendly and highly effective, making it easy for mobile players to manage their payments on the go.

The interface is nice and crisp, allowing users to perform quick money transfers without experiencing any frustrating hassles. Both the browser version and the downloadable apps incorporate a chat feature. You can contact the support team in a flash if any issues arise.

The menu in the right upper corner gives you instant access to all vital functions of your account – deposits, withdrawals, transaction history, and the card or bank accounts linked to your wallet. Much like the desktop MiFinity, the mobile web-based version offers multi-language support, giving you a choice from over a dozen languages.

You can even install the Android app on older devices as the minimum compatibility requirement is Android 5.0. The iPhone app works on iOS 11.0 and above. The developers update both apps frequently to improve stability and performance for all users.

| MiFinity Mobile Payments | |

|---|---|

| Apple Pay | No |

| Google Pay | No |

Security at MiFinity Casinos

Casino players who choose MiFinity should feel safe knowing their transactions and sensitive information are secure and well-protected against cybercrimes. Several years ago, the company announced its partnership with FourStop GmbH, the global leader in the field of online fraud prevention.

The integration of this advanced anti-fraud technology further consolidated MiFinity’s security levels, decreasing the chances of having your sensitive information hacked or misused. Such breaches are unlikely to occur with MiFinity.

Due to regulatory requirements, the payment company added Strong Customer Authentication (SCA) to its lineup of authentication methods back in the fall of 2019. Customers from the EEA, Norway, Iceland, and Liechtenstein receive text messages with verification codes to enter along with their login credentials before they can pay from their wallet balance.

On top of that, MiFinity implements an advanced fraud-alert system to monitor all accounts for questionable activities. Customers themselves can report to clientservices@mifinity.com if they feel their accounts have been compromised in one way or another. The company has authorization to conduct payment services from the UK Financial Conduct Authority (FCA) and the Malta Financial Services Authority (MFSA).

| MiFinity Security | |

|---|---|

| Passcode | No |

| Fingerprint | Yes |

| FaceID | Yes |

| Two-Factor Authentication | Yes |

| Trusted Devices | No |

| IP Restrictions | No |

MiFinity Alternatives

MiFinity is a convenient and reliable payment method supported by over 300 websites. But if the web-based casino that appeals to your preferences does not employ MiFinity, you should know that there are other reputable digital wallets that offer the same advantages. Regardless of the eWallet you decide to use, you can fund your gaming balance without divulging your banking credentials. Moreover, digital wallets allow players to cash out their profits safely and promptly.

-

Skrill

Skrill, formerly known as Moneybookers, is a trustworthy digital wallet available in over 130 countries. This digital wallet is budget-friendly and supports over 40 currencies. Besides, it provides high levels of security and is accepted by many online merchants and gambling sites. Although Skrill mainly functions as an eWallet, it also offers prepaid cards and facilitates international money transfers.

Skrill, formerly known as Moneybookers, is a trustworthy digital wallet available in over 130 countries. This digital wallet is budget-friendly and supports over 40 currencies. Besides, it provides high levels of security and is accepted by many online merchants and gambling sites. Although Skrill mainly functions as an eWallet, it also offers prepaid cards and facilitates international money transfers.If you want to use Skrill to pay online, you must first open a Skrill account and fund it. You can use various payment methods to add funds to your Skrill account, including a debit/credit card by Visa and Mastercard, a prepaid voucher by Paysafecard, payment gateways such as iDeal and Trustly, and others. You can also use your bank account to deposit money into your Skrill wallet. Usually, it takes a few minutes to see the deposited amount in your Skrill account.

There is a broad range of Skrill-friendly casinos. Most operators do not impose extra fees on deposits and withdrawals via Skrill. A crucial thing to mention is that some online casinos restrict players who deposit via Skrill to claim the sign-up deal. Hence, check the fine print before joining a given web-based casino.

-

Neteller

Neteller is one of the most popular payment methods among casino enthusiasts. It is known as a digital wallet that allows users to store funds, pay online, and receive money. Neteller is the first choice of casino enthusiasts looking for a safe and swift payment method because it supports not only deposits but also withdrawals. Moreover, players who cash out via Neteller will get their winnings immediately after the casino approves the payment.

Neteller is one of the most popular payment methods among casino enthusiasts. It is known as a digital wallet that allows users to store funds, pay online, and receive money. Neteller is the first choice of casino enthusiasts looking for a safe and swift payment method because it supports not only deposits but also withdrawals. Moreover, players who cash out via Neteller will get their winnings immediately after the casino approves the payment.You do not have to provide your banking credentials when funding your casino account via Neteller. Instead, you only have to log in to your Neteller account and confirm the payment. Casino enthusiasts can pick from plenty of reputable gambling sites that support Neteller. Keep in mind that some web-based casinos exclude Neteller depositors from Welcome Bonuses and other promotions.

Given that you want to use Neteller for your gambling transactions, you must register with the payment method. The next step is to load funds into your eWallet. You can pick from various payment methods, including debit/credit card, bank account, Klarna, Trustly, Euteller, etc. After adding funds to your eWallet, you can deposit at any Neteller-friendly casino and enjoy a fun-filled gambling experience. Neteller supports various currencies, including but not limited to AUD, CAD, CNY, DKK, GBP, HUF, JPY, NOK, PLN, SEK, USD, etc.

-

ecoPayz

ecoPayz is a global payment method accepted in over 200 countries. The digital wallet supports over 50 currencies, meaning users can easily avoid currency conversion fees. Using ecoPayz to pay online or fund your gaming account is child’s play. Like all other digital wallets, ecoPayz requires its users to set up an account. That is a hassle-free process and takes no more than a few minutes.

ecoPayz is a global payment method accepted in over 200 countries. The digital wallet supports over 50 currencies, meaning users can easily avoid currency conversion fees. Using ecoPayz to pay online or fund your gaming account is child’s play. Like all other digital wallets, ecoPayz requires its users to set up an account. That is a hassle-free process and takes no more than a few minutes.After setting up an ecoPayz account, you have to fund your eWallet. Even if you do not have a credit/debit card or a bank account, you should not worry too much as you can use other payment methods to add funds to your ecoPayz eWallet. Some include Neosurf, Interac, Western Union, etc. The ecoPayz account can be Classic, Silver, Gold, Platinum, or VIP. The higher your account level is, the higher your spending limit is and the lower the taxes are. ecoPayz also offers two other products, including ecoVouchers and ecoVirtualCards.

Finding a gambling site that supports ecoPayz is a walk in the park. In rare cases, operators impose fees on deposits and withdrawals via ecoPayz. However, most web-based casinos do not charge fees on payments via ecoPayz. Deposits are processed instantly. As for withdrawals, your gambling winnings will appear in your ecoPayz eWallet immediately after the casino approves the payment.

-

PayPal

Established in 1998, PayPal has stood the test of time, becoming one of the most reliable payment methods. It is available in over 200 countries and supports 25 different currencies. This payment method allows its users to shop online or in person without revealing their banking credentials to anyone. With PayPal, you can easily send money to other PayPal users. One of its most notable advantages is that it supports transactions both ways. In other words, if you are an avid casino fan, you can use PayPal to top up your gaming balance and cash out your profits.

Established in 1998, PayPal has stood the test of time, becoming one of the most reliable payment methods. It is available in over 200 countries and supports 25 different currencies. This payment method allows its users to shop online or in person without revealing their banking credentials to anyone. With PayPal, you can easily send money to other PayPal users. One of its most notable advantages is that it supports transactions both ways. In other words, if you are an avid casino fan, you can use PayPal to top up your gaming balance and cash out your profits.You must create an account and verify it to become a PayPal user. Setting up a PayPal account is free of charge. The next step is to add funds to your eWallet. You can use your debit/credit card or link your bank account to your PayPal wallet. Keep in mind that the payment method charges some nominal fees for depositing and withdrawing via credit/debit card. The fees vary between jurisdictions. On a more positive note, you will not incur extra charges for topping up your gaming balance via PayPal. Some operators may charge a small processing fee on withdrawals, but this depends on the withdrawal policy of the selected gambling site.

-

eZeeWallet

Launched in 2020, eZeeWallet is a relatively new payment method. It is available in over 180 countries but is mainly geared toward the needs of Aussies and Kiwis. eZeeWallet allows players to store funds, pay online, and receive money in a safe and prompt manner.

Launched in 2020, eZeeWallet is a relatively new payment method. It is available in over 180 countries but is mainly geared toward the needs of Aussies and Kiwis. eZeeWallet allows players to store funds, pay online, and receive money in a safe and prompt manner.Users are required to open an eZeeWallet account. Please note that you must be 18 years old or above to register with this payment method. You must verify your account to activate it. After that, you can add funds to your eZeeWallet account. You can use your debit/credit card, bank account, UPI, Trustly, and others to top up your eZeeWallet balance.

Many web-based casinos have added eZeeWallet to their lists of supported payment methods. This payment method is not only cost-effective but can be used for deposits and withdrawals. Besides, players who cash out via eZeeWallet will receive their profits immediately after the casino approves the payment.

Casino Games with MiFinity

MiFinity is a popular payment method supported by many reputable gambling sites. To correspond to the preferences of all casino fans, operators tend to join forces with a multitude of software companies and thus, offer bulky gaming portfolios. MiFinity casinos provide players with the opportunity to play premium-quality games and enjoy their gambling experience to the fullest.

No matter whether you are a fan of slots or table games, you can have a whale of a time at any MiFinity-friendly casino. Other game genres that you can enjoy include progressive jackpot games, video poker, specialty games, and live dealer games.

Slots with MiFinity

Slots dominate the game content of any MiFinity casino. That is because slots are the most popular casino games, and hundreds of thousands of casino enthusiasts enjoy spinning the reels. Slots offer various bonus features and revolve around different themes. Besides, some slot games can produce whopping payouts. Players do not have to learn some complex rules and strategies to play slots. Moreover, slots feature flexible bet limits and have a 100% contribution toward the wagering requirements associated with casino bonuses.

Roo Riches

Roo Riches is an Australian-themed slot powered by iSoftBet. The main character of the game is a kangaroo, and it is the highest-paying symbol. Other animals you will see while spinning the reels include falcons, crocodiles, and foxes. The slot comes with three bonus features. The Cash Chip feature triggers randomly during the base game to turn all Chip symbols in view into cash prizes.

Another interesting aspect of Roo Riches is the Lightning Bet feature, allowing casino enthusiasts to play with Cash Chips only. It is also possible to win some respins during the Lightning Bet feature. Players can also get up to 15 free spins if 3 or more scatter symbols land on the reels. The maximum you can win from a single spin is 2,000x the stake.

Fruit Shop

If you are looking for a classic fruit-themed slot that can produce some nice payouts, we advise you to try your luck on Fruit Shop. The game is created by NetEnt and features an RTP of 96.71%. The Fruit Shop logo acts as a wild and can land anywhere on the reels, substituting for all standard symbols. If you form a winning combination with the help of a wild, you will receive a 2x multiplier.

Given that you land a winning combination that includes a fruit symbol, you will trigger the free spins bonus round. Players who land a winning combination during the feature will have their payouts doubled. And if the winnings combination includes a wild, the payout will be multiplied by 4x. The game is played on a 5×3 grid and offers 15 paylines. Players can win a maximum of 8,000x the stake.

Big Bad Wolf

Big Bad Wolf is a slot based on the popular fairy tale The Three Little Pigs. It is powered by the tech-savvy software company Quickspin. The action takes place on a 5×3 grid, producing a total of 25 paylines. The beehive symbol is the wild, which performs its usual substitution duties. The highest-paying symbol is the pig with the straw in the mouth. Big Bad Wolf offers a Swooping Reels feature triggered after landing a winning combo.

During the Swooping Reels feature, you can also trigger the Pigs Turn Wild feature if you hit two swooping wins in a row. You can also win up to 10 free spins if 3 or more scatter symbols come into view anywhere on the reels. During the free spins feature, you can unlock the Blowing Down the House feature on condition 3 to 6 moon symbols land on the reels.

Live Dealer Games with MiFinity

Live dealer games are the perfect solution for those looking for an authentic gambling experience without leaving the comfort of their homes. When it comes to live dealer games, MiFinity casinos have a lot to offer. Some prominent software providers specialized in developing live dealer games include Evolution Gaming, Playtech, Pragmatic Play, and Ezugi. Live dealer games allow players to observe the action from different angles and communicate with fellow players and the dealer in real time. Live dealer games are suitable for players of all skill levels and bankroll sizes.

No Commission Baccarat

If you are a baccarat fan reluctant to pay the 5% commission on all your Banker bets, Evolution Gaming’s No Commission Baccarat is the game for you. It is played with 8 standard decks of cards, and wagers on the Player and Banker pay even money. However, if the Banker’s hand totals 6, you will be paid at the rate of 0.5:1. No Commission Baccarat is inspired by Asian culture, which explains why red is the dominating color. The game also offers a broad range of side bets, including Player and Banker Pair, Perfect Pair, Super 6, and Player/Banker Bonus.

Free Bet Blackjack

Free Bet Blackjack is an interesting blackjack variation courtesy of Evolution Gaming. The game is played with 8 decks of cards and follows the Vegas rules. It allows an unlimited number of players to join the action. The dealer peeks for blackjack and stands on all 17s. Players are allowed to split any pairs. Casino fans cannot double down after splitting. So far, the rules are standard.

What makes Free Bet Blackjack exceptional is that players are allowed to double down for free on condition the total value of the first two cards is 9, 10, or 11. Players will incur no extra costs for splitting a pair that does not include 10s. However, winning players will get their bets back if the dealer busts. Given that you enjoy placing side bets, you should know that Free Bet Blackjack offers Any Pair, 21+3, Hot 3, and Bust It.

Instant Roulette

Instant Roulette is a fast-paced roulette variation powered by the reputable software company Evolution Gaming. It uses 12 computer-controlled wheels, and all of them are spinning independently from each other. No dealer manages the table, meaning you can set the pace of the game as you like it. There is no betting timer, so you do not have to rush to place your wager.

Once you lay your bet, the wheel closest to finishing the spin will determine the winning outcome. At first glance, Instant Roulette can be quite confusing. However, the game is based on European Roulette, and the presence of 12 wheels allows for non-stop action. The house edge is just 2.70%, and payouts are the same as in European Roulette.

Blackjack with MiFinity

MiFinity users can select from a broad range of blackjack variations. Since it is one of the most well-liked table games, it is offered by every casino, be it land-based or online. While most blackjack variations have the same objective, there are some rule variations that players have to examine as they affect the house edge. In the lines below, we will briefly discuss some of the most sought-after variations offered at most MiFinity-friendly casinos.

American Blackjack

American Blackjack by Betsoft allows casino enthusiasts to wager on up to 3 hands at the same time. The software provider is known for developing games with high-quality graphics and swift animations, and American Blackjack is no exception in this regard. The game follows the basic “Las Vegas Strip” rules and is played with 6 decks of cards.

The dealer hits on soft 17s and peeks for blackjack when the face-up card is an Ace or has a value of 10. Players are provided with the opportunity to take insurance if the dealer’s up-card is an Ace. Players are allowed to split only once per hand. However, re-splitting is forbidden. A crucial thing to mention is that if you get 21 from a pair of split aces, the dealer wins if they get a natural blackjack.

Premier Blackjack with Side Bets

Premier Blackjack with Side Bets is a classy variation of the game that will correspond to the preferences of most blackjack enthusiasts. The game uses 8 standard decks, and the dealer peeks for blackjack when dealt an Ace or a card with a value of 10. The dealer stands on all 17s.

Players who hit a natural blackjack are paid at rates of 3:2, while the insurance bet pays 2:1. Blackjack fans can double down after splitting. Players can split only once per hand. Unlike cards with a value of 10 can be split. Bet limits range from $1 to $1,000. The RTP of the game is 99.59%, meaning you have to deal with a house edge of just 0.41%. The game offers two side bets – 21+3 and Perfect Pairs.

Rainbow Blackjack

Rainbow Blackjack, created by Realistic Games, follows the classic rules of the game. It is named after the side bet it offers – Rainbow Bet. This blackjack variation is played with 6 standard decks of cards within which 35 cards are painted in rainbow colors. If the first dealt card is colored, the player wins the side bet, and the payout is multiplied by the value shown on the card. Given that the second card dealt is also colored, the win is multiplied by the value of both cards. If the first two cards dealt are the same color, the side bet is multiplied by a set multiplier of up to 5,000x. Casino enthusiasts can take the Rainbow Bet, without playing the main game.

Roulette with MiFinity

It is no wonder that roulette is among the most popular casino games. It provides multiple betting options and has easy-to-understand rules. Additionally, everyone can walk away with a decent payout without having to learn some complicated strategies in advance. Roulette variations are available in abundance at MiFinity-friendly casinos. We can outline three basic roulette variations, including European, American, and French Roulette, and all other variations you will come across online are based on them.

Fair Roulette

Fair Roulette is a European-style roulette with a house edge of 2.70%. The wheel features a total of 37 numbered pockets. Casino fans can place various bet types, including inside, outside, and announced bets. The game allow players to enable/disable the music theme, edit their balance, or set wagering limits. The game runs well on desktop and handheld devices and features crisp graphics. Fair Roulette is powered by the innovative software company WorldMatch. The game’s betting limits are wide enough to fit different bankroll sizes.

Realistic Roulette

Realistic Roulette creates an authentic 3D environment that will appeal to the most demanding casino fan. The game uses a wheel with 37 numbered compartments. Thus, if you are familiar with the rules of European Roulette, you should not experience any difficulties playing Realistic Roulette. This roulette variation has a house edge of 2.70%, which can be reduced to 1.35% thanks to the La Partage rule. Chips are available in the following values – $0.20, $1, $5, $25, $100, and $500. Realistic Roulette can be played in 2D or 3D mode and is developed by Realistic Games in collaboration with Microgaming.

Golden Chip Roulette

Golden Chip Roulette is an elegant roulette variation created by the reputable software company Yggdrasil. Golden Chip Roulette uses a single-zero wheel and a racetrack, allowing players to place announced bets. The RTP of the game is 97.30%. During every round, the inner roulette wheel will show a Golden Chip Multiplier, ranging from 10x to 500x. If you place a straight-up bet (a bet on a single number) and you win, your payout will be multiplied by the amount shown on the Golden Chip Multiplier.