Many casino fans are reluctant to disclose their banking details. In 2018, PayID was introduced to Australians as part of the New Payments Platform (NPP). The new service completely overhauled the online banking landscape across the country. The idea behind it is to provide Aussies with an easy-to-use payment solution that saves them the effort of remembering and disclosing their bank details.

PayID is a revolutionary payment service that allows users to rely on details they can easily recall to access their bank accounts. In fact, PayID is an identifier for your bank account. The money-transfer service is offered by Osko, and it is available to customers who have bank accounts at participating financial institutions. To process payments via PayID, you can use your phone number, email address, or ABN (Australian Business Number).

| PayID Summary | |

|---|---|

| Available in | Australia |

| Website | www.payid.com.au |

| Connecting bank account to PayID | Free |

| Withdrawal balance from PayID to your bank account | Free |

| Pay to online merchants | Free |

| Available for deposit | Yes |

| Available for withdrawal | Yes |

| Usual deposit time in online casino | Instant |

| Usual withdrawal time from online casino | Instant |

| Live chat | Depends on the bank |

| Telephone support | Bank-dependent |

| E-mail support | Depends on the individual financial institution |

PayID users can make online payments promptly and easily. Interestingly enough, the main idea behind this platform is to allow people to send money to others without the need to remember any bank details. Furthermore, PayID is the initiative of 13 of the most reputable banks in Australia and the Reserve Bank of Australia, meaning that it is safe to use. Before we continue, we would like to note that more than 100 banks offer the NPP and PayID to their clients.

PayID Registration Process

As established, PayID is a form of payment that allows you to use your phone number, email address, or ABN (Australian Business Number) to send money. This banking solution requires an account with an Australian financial institution, as PayID must be activated through your bank. Below you will find the steps you need to take to start using this payment solution:

- Go to the official PayID website

- Find a participating bank. PayID’s website lists all banking institutions that support the service. You can use the search bar to find a suitable bank or examine the list of participating banks on PayID’s home page.

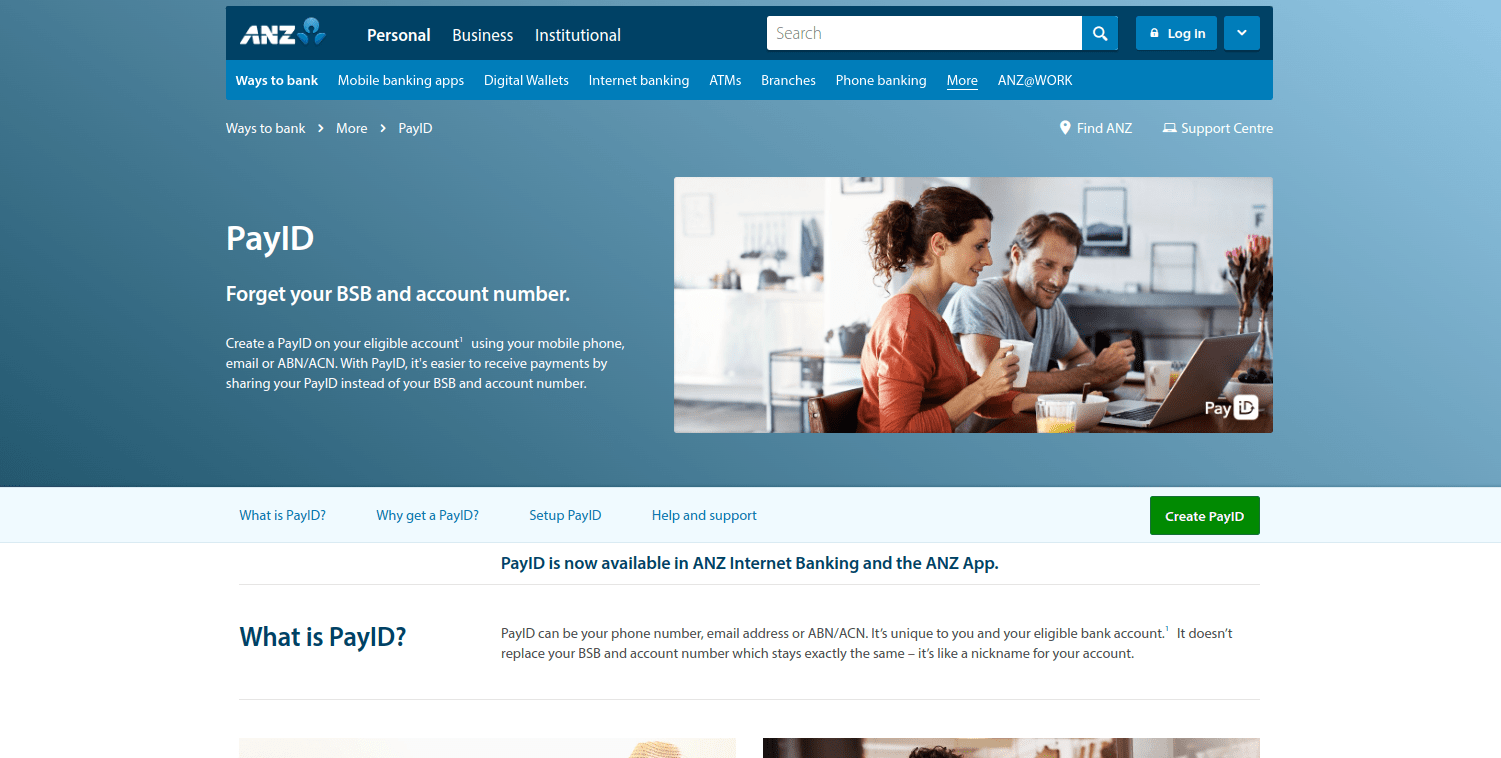

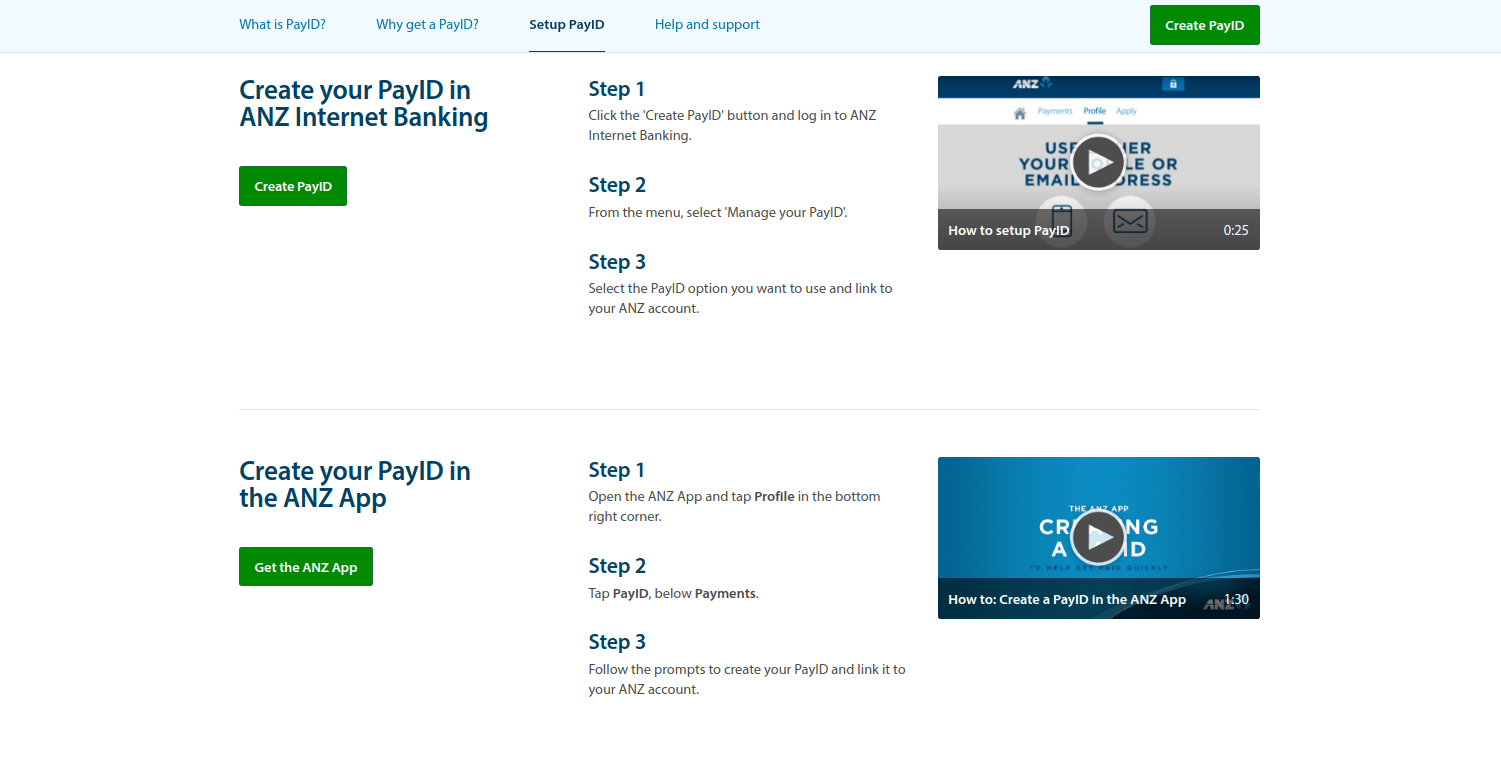

- Once you have found a bank you can utilize, click on its logo. This will take you to the PayID page of that bank’s website.

- Next, log in to your bank account by entering the required information.

- Finally, follow the bank’s instructions and connect your account to your PayID.

Finalizing Bank PayID Registration

The process will not take long. PayID has ensured that future users can quickly find a banking institution that offers this service. Additionally, activating PayID after you reach your bank’s website is easy and fast, regardless of which institution you use for online banking.

At the time of writing, Australia has what is known as “the big four” banks: the Commonwealth Bank of Australia, Westpac (WBC), the Australian & New Zealand Banking Group (ANZ), and the National Australia Bank. All of these institutions enable their users to connect their accounts to PayID. Other popular banks that support PayID include Macquarie Bank and Bendigo Bank.

Using PayID for Gambling Transactions

A growing number of online casinos geared toward the Australian market have started to embrace PayID. One of the reasons for this trend is that the payment service supports both deposits and withdrawals. Casino enthusiasts who are interested in using this method to make casino payments should first create their unique PayID.

To do so, you must have a bank account at a financial institution that offers this service. To use PayID, log in to your online banking account, click on the Payment Settings button, select “PayID,” and follow the instructions. After that, you will receive a code to verify your mobile number or email address.

If you use the CommBank app, log in to your account, click on the “Profile” button, and select “Manage PayID.” Then choose the type of PayID you would like to use and select an account that will be linked to it. Currently, there are four types of PayID: phone number, email address, ABN, and organizational ID.

The last step is to confirm your details by entering the code you receive. Once you successfully activate the PayID service, you will receive an email. From that point, your PayID is connected to your bank account. A single bank account may have multiple PayIDs; however, each PayID can be linked to only one bank account.

PayID for Gambling Additional TipsTo upload funds to your gaming account via PayID, log in to your online banking account, click on the “Pay someone” button, and enter the amount you wish to deposit. You will be required to fill in a description field of up to 280 characters and confirm the payment. If you have already deposited at a given online casino via PayID, the deposit will be processed instantly. For security reasons, first-time deposits at a gambling site might take up to 24 hours.

Another important thing to mention is that deposits and withdrawals via PayID are carried out in real time. If you are unsure whether you are sending money to the right person, you will see the name of the recipient before confirming the payment.

Once you have accumulated the minimum amount required by the casino for a withdrawal, you can use your PayID. Web-based casinos often have a pending period of 24 to 72 hours. After the casino operator releases your winnings, you will see them in your PayID instantly. In rare cases, it might take several hours for the money to reach your PayID account. Players should note that they will have to disclose their PayID to the casino operator.

Casino enthusiasts should keep in mind that not all web-based casinos that accept Australian players support PayID. Hence, if you wish to use this payment solution, we advise you to first visit the banking page of the casino before setting up an account.

| PayID Gambling Transactions | |

|---|---|

| Supported transactions | Deposits and withdrawals |

| Deposit pending time | Instant |

| Withdrawal pending time | Varies between casinos |

| Additional security | PayID users have to first log into their online bank accounts |

Advantages and Disadvantages of PayID

Some casino fans are uncomfortable with sharing their bank details and personal financial information. That is why many Australian casino aficionados have started using PayID, as it comes with many advantages over traditional payment methods.

As we already explained above, PayID works as an identifier for your bank account. Hence, you do not have to remember or disclose your BSB or account numbers. In other words, PayID users can conveniently send and receive money. The fact that you do not need to share your bank details significantly increases safety and helps maintain your online anonymity.

Furthermore, the PayID platform meets all security standards employed by participating banks. This means that payments to and from online casinos are processed safely. As far as legitimacy goes, many well-established Australian banks have adopted PayID. In addition, the platform was launched by Osko as part of its New Payments Platform (NPP). Osko is a BPAY payment service that uses your bank’s security standards.

More Advantages and Disadvantages of PayIDMany casino fans choose their payment solution based on speed. After all, once you make a deposit to an online casino, you will most likely want to start playing right away. Using PayID means you can deposit at web-based casinos instantly.

Of course, receiving your winnings promptly is also important. Each virtual casino has its own rules and policies regarding payments. Some operators review payout requests within several hours, while others might take up to five business days. After the casino approves your request, the money will reach your PayID account almost instantly.

Probably one of the most notable advantages associated with PayID is the lack of fees. Linked to your bank account, the platform simply serves as an intermediary between consumers and merchants. PayID reduces the possibility of sending money to the wrong recipient, as you will see the name behind the email address or phone number before approving the payment.

Unfortunately, PayID can be used only for payments within Australia. Another drawback is that it is not available at every Australian-based casino. Therefore, fans who would like to use it for deposits and withdrawals have to do some research first.

Aussie players who decide to use PayID should know that they cannot withdraw their winnings directly from PayID. Once the money appears in your PayID account, you must transfer it to your bank account before you can use it.

On a positive note, PayID features generous daily limits that reach up to $10,000. However, casino enthusiasts should not exceed the payment limits imposed by the online casino they are playing at. All in all, PayID is an innovative payment service that offers numerous advantages tailored to the needs of Aussie casino fans.

| PayID Pros | PayID Cons |

|---|---|

| Deposits and withdrawals are processed safely and promptly | Only Australian residents can make use of PayID |

| No need to disclose bank details | PayID cannot be used for withdrawing money from an account |

| Using PayID is absolutely free |

Fees for Gambling Transactions with PayID

At the moment of writing, there are no fees associated with the use of PayID. This means that casino enthusiasts will not be charged high fees for making deposits at online casinos or withdrawing funds. However, the payment platform is linked to the user’s bank account. Your bank might impose fees for transactions to and from your PayID account, but we cannot provide in-depth details, as these vary greatly between banks.

If you use PayID services via your CommBank account, you should know that the maintenance fee is $4 per month. However, if you make deposits totaling $2,000 monthly, you will not be required to pay a maintenance fee. Another important point is that the CommBank app imposes a daily withdrawal limit of up to $2,000. If you withdraw at non-CommBank ATMs, a fee might apply.

| PayID Fees | |

|---|---|

| Gambling deposit fee | Free |

| Gambling withdrawal fee | Free |

| Bank account deposit fee | Free |

| Bank account withdrawal fee | Free |

| Credit/debit card deposit fee | N/A |

| Credit/debit card withdrawal fee | N/A |

| Maintenance fee | Free |

Processing Times with PayID

All financial transactions via PayID are processed in “near real time.” You can send and receive money within a minute. If you are a casino fan who wants to make a deposit at an online casino, the money will appear in your gaming account instantly.

Every seasoned casino fan knows that withdrawal processing times vary between casinos and payment methods. While deposits are processed immediately, withdrawals require more patience. Once you have accumulated sufficient winnings, you can request a withdrawal by visiting the casino’s cashier page. Remember that most online casinos have minimum and maximum withdrawal limits.

The web-based casino will take some time to process your withdrawal request. This period, known as the pending period, varies between casinos. Usually, PayID casinos process withdrawal requests within three business days. After approval, you will receive your winnings instantly.

| PayID Processing times | |

|---|---|

| Gambling deposit time | Instant |

| Gambling withdrawal time | Instant after the payment is approved by the casino |

| Bank account deposit time | Instant |

| Bank account withdrawal time | Instant |

| Credit/debit card deposit time | N/A |

| Credit/debit card withdrawal time | N/A |

Mobile Payments via PayID

The PayID service is available to CommBank app users. Currently, over five million Australians use the app. Provided that your device runs on Android 4.4 or later, you can download the app from Google Play. The size of the app is 49 MB. If you own an iOS device, visit the Apple Store to find the CommBank app; it requires iOS 12.0 or later.

Both apps are available only in English, and you can download them for free. Installing them is a straightforward process that takes just a few minutes. Users can withdraw up to $500 from a CommBank ATM using Cardless Cash. To better control your finances, the apps come with useful features such as Goal Tracker and Spend Tracker. If you tend to forget bill due dates, you can opt to receive reminders and notifications.

Android users can also benefit from a feature called Tap & Pay, which allows on-the-go payments without cash or bank cards. For purchases under $100, no PIN is required. The CommBank app also allows users to use Google Pay and Apple Pay.

| PayID Mobile Payments | |

|---|---|

| Apple pay | Yes |

| Google pay | Yes |

Security at PayID Online Casinos

With PayID casinos, you can make deposits and withdraw your winnings simply by entering your email or phone number. Hence, your financial information remains private. What is more, PayID payments are subject to the bank’s fraud-screening procedures. PayID users can rest assured that the money they send will reach the right person, as they will see the name of the recipient before confirming the payment. CommBank provides a 100 percent security guarantee to its users.

You will be able to register a PayID by logging in to your online banking. If you use PayID via the CommBank app, you can enable two-factor authentication (2FA) to add an extra layer of protection. NetBank users can register for NetCode, a time-sensitive password.

PayID warns users that any emails asking them to disclose personal or banking information that appear to be from the payment platform are actually phishing emails. All financial transactions processed via Google Pay or Apple Pay are safe, as both contactless payment systems use encryption.

| PayID Security | |

|---|---|

| Passcode | No |

| Fingerprint | No |

| FaceID | No |

| Two-factor authentication | Yes |

| Trusted devices | No |

| IP Restrictions | No |