Electronic checks have surged in popularity in recent years, particularly in the realm of online gambling. Online casinos now accept deposits made via this electronic payment system, giving users another reliable option to transfer funds securely.

| eCheck Summary | |

|---|---|

| Available in | Most countries |

| Website | N/A |

| Connecting bank card/account to eChecks | Fee depends on bank |

| Withdrawal balance from eChecks to your bank card/account | N/A |

| Pay to online merchants | Fee depends on bank |

| Available for deposit | Yes |

| Available for withdrawal | Yes |

| Usual deposit time in online casino | Instant |

| Usual withdrawal time from online casino | Up to several days, depending on the banking institution |

| Live chat | N/A |

| Telephone support | N/A |

| E-mail support | N/A |

An eCheck is essentially a paper check in virtual form. The process of making a payment via eCheck is exactly the same as with a traditional check. You must provide your name, bank account number, the amount you want to transfer, and any other information required by the bank. Unlike most other payment methods, eChecks are not new technology. Because the processes of writing a paper check and sending an electronic one are identical, banks have employed this system for many years. At the time of this writing, eChecks have been around for two decades.

If you are considering using this online payment method, please review the information below, where we cover every aspect of using eChecks to deposit to and withdraw from online casinos.

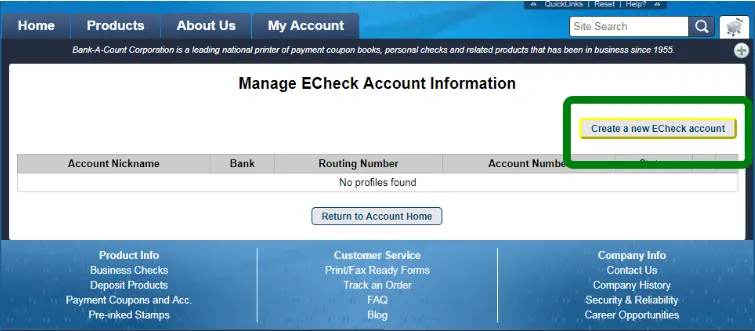

ECheck Registration Process

As was already pointed out, eChecks have long outperformed their paper counterparts, with the latter slowly but surely turning into an obsolete funds-transfer solution. That said, both options work in a fairly identical manner, so customers who have already used paper checks should have no issues managing their financial operations through the electronic version.

In an attempt to implement as many convenient banking methods as possible, contemporary casino operators add eChecks to the lineup of processors in their cashier sections. Besides their various advantages, casino players should bear in mind that they can be used both for deposits and withdrawals. In this section, we outline the processes of setting up and activating an eCheck account.

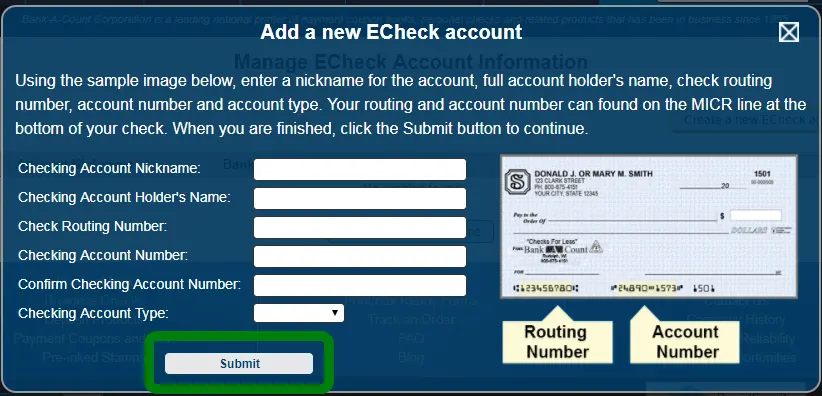

- Checking Account Set-up – before depositing to and withdrawing from interactive casinos via eChecks, players must know how to set up a checking account. They need to open one with a bank that supports this service. Essentially, a checking account is a type of deposit account that enables customers to initiate deposits and withdrawals.

- Once customers confirm their intention to set up a checking account, they should provide their personal and banking information, including the account nickname, full account-holder name, check routing number, and checking account number. They might be prompted to confirm the checking account number. The routing and account numbers should not be confused. While routing numbers are always 9 digits long, account numbers vary between 9 and 12 digits.

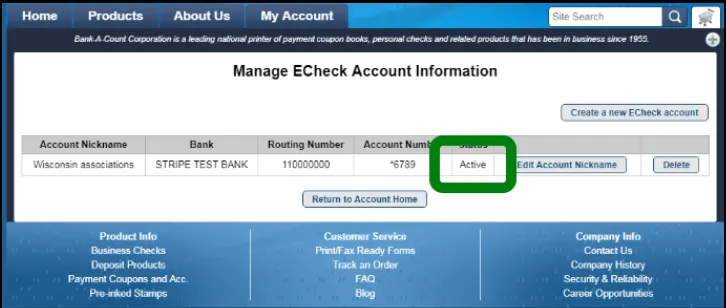

- After the information is submitted to the bank, the setup process might take several days to be confirmed and completed. Once this is done, the checking account status should change to “active.”

How Do eChecks Work?

Advantages and Disadvantages

Just like any other payment solution, eChecks have their own inherent advantages and disadvantages. For your convenience, we have listed below all major aspects of this service that you should be aware of.

To begin with, anyone who has previously dealt with paper checks will know exactly how this process works. In truth, it is exactly the same. eChecks are one of the easiest payment solutions to utilize from a practical point of view; the only requirement is a bank that supports this feature. Whereas other services require registration and identity verification, eChecks demand none of that. As you completed that process when opening a bank account, all you have to do is enter your banking information and confirm the payment. The procedure is completely straightforward and requires no prior knowledge or advance preparation. Few other services are this simple to use.

While some online casinos have begun accepting eChecks, e-wallets and credit cards remain the dominant ways to transact money. The number of casinos that support eChecks is not very large, despite the obvious advantages of this payment solution. If this is the only way you want to deposit and withdraw money, you will be limited to only a few choices.

More Advantages and DisadvantagesIn order to use eChecks, you must sacrifice some anonymity because your name and bank account number appear on the form when you issue the deposit. The same information is required when you initiate a withdrawal. Other payment solutions offer similar services while keeping your identity relatively obscure. Players who value remaining anonymous online may want to consider a different payment service.

Another factor is availability. Each bank chooses the services it offers. Although electronic checks are not new, more convenient and technologically superior methods have emerged and replaced them. Checks are becoming an obsolete way to transfer money, and many banks have stopped processing them. In Europe, the decline started as far back as 1993, when Finnish banks replaced checks with the fully electronic giro system. In most other European countries, check use continues to decline in favor of bank-to-bank transfers. The United States is the only Western nation still reliant on checks for everyday transfers. While this might sound positive for U.S. players, you must also consider the state of online gambling in the country. Owing to the Unlawful Internet Gambling Enforcement Act of 2006, only a handful of online casinos operate legally in certain states. Overall, the use of checks is declining, and only a few online casinos still support this payment method.

While eChecks might sound excellent on paper, not every bank supports them. Some institutions have abandoned the technology in favor of newer options, and because players are more likely to pay with credit or debit cards, online casinos have also slowly stopped supporting eChecks.

| eCheck Pros | eCheck Cons |

|---|---|

| Practical and easy to use payment solution | eChecks are not widely accepted by online casinos |

| No registration required | Players are required to provide banking details during payments |

| Available for both deposits and withdrawals | Many banks do not offer eCheck services |

Using eChecks for Gambling Purposes

At several online casinos, you have the option to deposit and withdraw via eCheck. At any site that supports this method, you will find eCheck listed on the Cashier page. Select it to open a new window, then type in your bank’s name, bank routing number, bank account number, and account type.

Next, enter the amount you wish to deposit or withdraw and confirm the transaction. Electronic checks are not as popular as other transaction methods, so you might be hard-pressed to find a website that still supports them. The largest and most reputable online casinos usually accept a wide range of deposit and withdrawal options, which often includes eChecks. More obscure gambling websites tend to stick to “traditional” methods such as e-wallets, credit cards, wire transfers, and prepaid vouchers.

| eCheck Gambling Transactions | |

|---|---|

| Supported transactions | Deposits and withdrawals |

| Deposit pending time | Instant |

| Withdrawal pending time | Several days |

| Additional security | Bank’s authentication systems |

| eCheck Mobile Payments | |

|---|---|

| Apple Pay | No |

| Google Pay | No |

Fees for Gambling Purposes

Generally speaking, eChecks are among the cheapest deposit methods you can use. A typical eCheck payment costs between $0.50 and $1.50. This is relatively low compared with other payment services, though higher than those with no fees at all. Still, the price is offset by added security and the simplicity of the process. At some casinos, you might be charged a commission of a few percent of the total sum, but this is no longer common.

| eCheck Fees | |

|---|---|

| Gambling deposit fee | $0.50 – $1.50 |

| Gambling withdrawal fee | Depends on the bank |

| Bank account deposit fee | N/A |

| Bank account withdrawal fee | N/A |

| Credit/debit card deposit fee | N/A |

| Credit/debit card withdrawal fee | N/A |

| Maintenance fee | N/A |

Processing Times for Gambling Transactions

When you initiate a deposit via eCheck, you may wonder how long it will take for the money to arrive. Because the payment is done virtually, the funds reach your casino balance almost immediately. As soon as you confirm the transaction, the money should appear in your casino account and you can begin playing your favorite games. For deposits, this is an excellent method because you have immediate access to your money. Withdrawals, however, are different.

When you request to cash in your winnings, the casino staff must first review your play. This normally takes no more than 48 hours, and only after this review is complete will they send the payment. The transaction itself can take several days to clear, just as a normal check would. This delay is caused by the banking system, not the casino.

The casino allows you to play on credit because it is confident it will receive the deposit. This is one of the worst aspects of using eChecks: the days-long withdrawal times. Other services, such as e-wallets, sometimes execute withdrawals within hours. In terms of processing times, eChecks are comparable to wire transfers. If you need faster payouts, consider a different online payment solution.

| eCheck Processing Times | |

|---|---|

| Gambling deposit time | Instant |

| Gambling withdrawal time | Up to several days |

| Bank account deposit time | N/A |

| Bank account withdrawal time | N/A |

| Credit/debit card deposit time | N/A |

| Credit/debit card withdrawal time | N/A |

Security at Online Casinos

When it comes to online payment solutions, eChecks are perhaps the safest method. This payment travels directly through your bank’s network to be processed. This means users enjoy the highest security level possible. Banks are renowned for robust security systems and are among the most secure financial institutions you can rely on.

When you send an electronic check, the transaction must pass through several security layers. Banks employ excellent authentication systems that prevent unauthorized activity and encryption technology that encodes every piece of information sent over the Internet. Furthermore, since the eCheck service is provided by your bank and connected to your account, you have assurance that nothing will happen to your personal funds. If someone gains access to your money, the bank is legally obligated to compensate you.

Online casinos also have security systems of their own to protect sensitive information that passes through their networks. The most commonly implemented system is SSL (Secure Socket Layer) protocols, which encrypt all personal and banking information sent to the casino servers with 128- or 256-bit encryption. This state-of-the-art technology has an excellent track record of keeping user data safe.

Security Additional TipsNaturally, you should not rely entirely on the security systems of other parties. After all, no security measure can protect you if you yourself are not careful. For starters, never share any of your banking information online with anyone.

Always be mindful when using public networks. While it might be tempting to connect to a public router for free Wi-Fi, these networks are primary targets for hackers. It is best to use your own secure network, or if you must use a public one, do so with an active VPN. The safety of your personal and banking information is paramount, and no amount of caution is too much.

| eCheck Security | |

|---|---|

| Passcode | No |

| Fingerprint | No |

| FaceID | No |

| Two-factor authentication | Depends on bank |

| Trusted devices | No |

| IP Restrictions | No |