The first regulated online casinos launched in Michigan in early 2021 following the passage of House Bill 4311. This momentous piece of legislation authorized commercial and tribal casinos in the state to legally provide remote sports betting, casino gaming, and poker to Michiganders. It marked the Wolverine State’s rapid emergence as one of the biggest regulated online gambling markets in the United States and the world, as a whole.

The iGaming sector in the country’s tenth most populous state has been consistently growing and shows no signs of slowing down. Michigan placed as the second highest-grossing regulated market in 2022 and was overshadowed only by New Jersey, and by a small margin at that. Last year, licensed operators raked in $1.58 billion in gross revenue from the online casino segment alone.

Michigan’s iGaming industry maintains its steady growth pace in 2023 despite the declining financial health of consumers and the rising inflation in the country. Commercial and tribal online gaming operations netted an impressive amount of $1.24 billion in the first eight months of 2023, which is $126.45 million more than their combined profits during their first full year of operation. Continue reading as we give you the full statistical rundown on Michigan’s iGaming industry and the financial results of all operators licensed in the state.

- Michigan is home to 3 commercial and 12 tribal casinos that collectively operate 15 licensed iGaming sites at the time of publication.

- Michigan is way out front its record-setting pace from last year as revenue grew by $225.89 million in the first eight months of 2023, representing a 22.3% rise compared to the same period a year earlier.

- The Wolverine State posted its largest annual revenue from iGaming to date in 2022, when earnings climbed by 42.1% to $1.58 billion compared to $1.11 billion recorded during the previous year.

- Profits from the interactive gaming segment accounted for approximately 48.5% of Michigan’s gambling industry revenue which raised a combined $3.26 billion in 2022.

- December 2022 was the highest-grossing month for the local online gambling industry as it saw $152.77 million in revenue, up 25.5% from the same month a year earlier.

- In 2022, internet gaming contributed $289.24 million in state taxes to the government’s coffers, a 43.4% increase from the previous year.

- Last year, Detroit-based casinos and their affiliated iGaming operations contributed $77.83 million in municipal service fees and city wagering taxes, a 40.8% increase from 2021.

- Tribal government taxes from tribe-operated online casinos saw a 46.6% surge, jumping from $22.39 million in 2021 to $32.83 million in 2022.

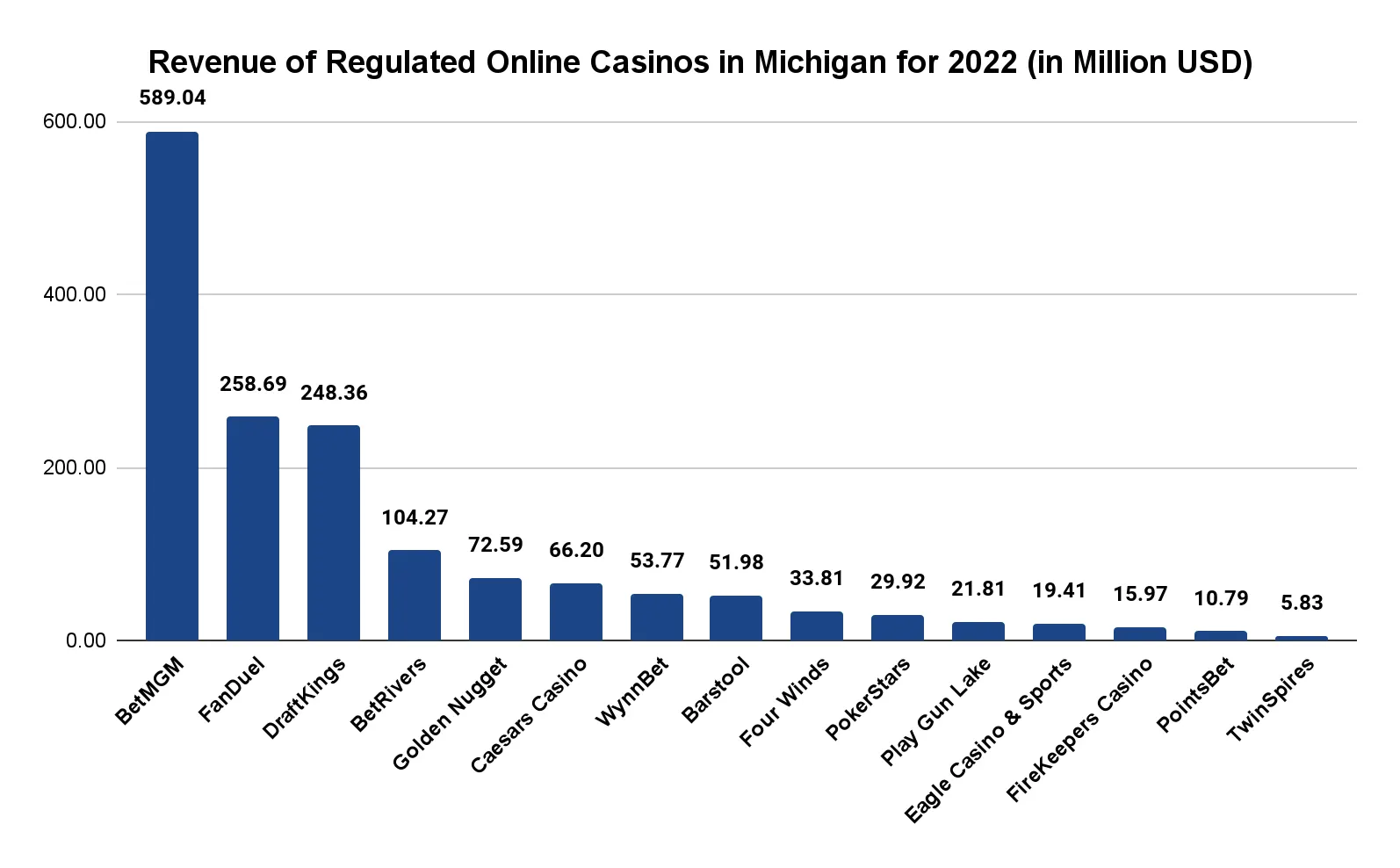

- MGM Grand Detroit and its affiliated online casino BetMGM outperformed all rival iGaming operations in 2022, posting the highest annual revenue of $589.04 million.

- Calls to Michigan’s official problem gambling helpline dropped from 4,463 in 2021 to 4,306 in 2022.

Michigan iGaming Revenue in 2021 and 2022

The first regulated interactive casinos arrived in the Wolverine State on January 22nd, 2021, roughly one year after Governor Gretchen Whitmer signed House Bill 4311 into law. The local gaming industry quickly took off as nine licensed remote casinos combined to deliver $29.35 million in total revenue during their first ten days of operation alone.

Official data by the Michigan Gaming Control Board shows monthly revenue from the segment continued to increase at a steady pace for the remainder of the year. Increases were observed nearly every single month except April, June, and November, with monthly profits peaking in December when the segment brought in a record $121.76 million in total revenue for a 13.2% month-on-month increase.

At the close of fiscal 2021, the number of licensees had grown to 14 who reported combined gross profits of $1.13 billion for this twelve-month period. The five new arrivals that debuted on the market after January were Barstool, Firekeepers, Play Gun Lake, PointsBet, and Four Winds. Out of the 14 licensees, MGM Grand Detroit and its online brand BetMGM posted the highest revenue in 2021, accounting for approximately 37.4% of the total market in Michigan.

| Michigan Monthly iGaming Revenue in 2021 | ||

|---|---|---|

| Month | Total Revenue for the Month | Monthly Percentage Change |

| January | $29,354,295.00 | – |

| February | $79,729,343.00 | ↑171.6% MoM |

| March | $95,081,592.00 | ↑19.3% MoM |

| April | $94,851,766.00 | ↓0.3% MoM |

| May | $94,851,552.00 | Statistically non-significant |

| June | $89,214,138.00 | ↓5.9% MoM |

| July | $92,311,368.00 | ↑3.5% MoM |

| August | $97,197,617.00 | ↑5.3% MoM |

| September | $102,380,222.00 | ↑5.3% MoM |

| October | $109,673,896.00 | ↑7.1% MoM |

| November | $107,593,002.00 | ↓1.9% MoM |

| December | $121,760,593.00 | ↑13.2% MoM |

| Annual Total: $1,113,999,384 (314.8% growth from January to December) | ||

Source: Michigan Gaming Control Board

The year was off to a slow start, however. January ushered in a minuscule decline (0.4%) from December 2021 as profits from the segment dropped by roughly half a million. The industry quickly rebounded and reported month-on-month increases for three consecutive months, in February, March, and April. May halted this positive growth as revenue fell by 3.8% month-on-month to 127.39 million.

This trend continued in June but things improved for the operators a month later. A streak of monthly increases commenced in July and continued well until the year’s end. September was the only month in the second half of the year to suffer a small month-on-month decline. December was the strongest month in 2022, with $152.77 million in total revenue for a 25.5% year-on-year surge.

| Michigan Monthly iGaming Revenue in 2022 | ||

|---|---|---|

| Month | Total Revenue for the Month | Monthly Percentage Change |

| January | $121,243,501.00 | ↓0.4% MoM from December 2021 |

| February | $122,775,924.00 | ↑1.3% MoM |

| March | $131,673,653.00 | ↑7.2% MoM |

| April | $132,438,012.00 | ↑0.6% MoM |

| May | $127,385,503.00 | ↓3.8% MoM |

| June | $121,507,586.00 | ↓4.6% MoM |

| July | $126,614,517.00 | ↑4.2% MoM |

| August | $130,924,194.00 | ↑3.4% MoM |

| September | $128,734,447.00 | ↓1.7% MoM |

| October | $140,956,282.00 | ↑9.5% MoM |

| November | $145,428,114.00 | ↑3.2% MoM |

| December | $152,772,723.00 | ↑5.1% MoM |

| Annual Total: $1,582,454,456 (26% growth from January to December) | ||

Source: Michigan Gaming Control Board

Delving deeper into the online casinos’ fiscal results, we shall next examine another metric known as ‘adjusted gross receipts’ or ‘adjusted gross revenue’. The term reflects the amount left after the monetary value of bonuses and free play is deducted from the gross revenue of the operators. According to the Michigan Gaming Control Board, licensees are taxed based on their reported adjusted gross receipts.

A portion of the AGR also goes toward covering their operational expenses, including the benefits and salaries of employees. As you can see below, adjusted gross revenue increased consistently during every single month of the previous fiscal year. The highest growth was understandably achieved in January 2022 when adjusted gross receipts surged by 296.5% compared to the same month a year earlier.

| Month | Monthly AGR for 2021 | Percentage Change | Monthly AGR for 2022 | Percentage Change |

|---|---|---|---|---|

| January | $27,538,672.00 | – | $109,177,044.00 | ↑296.5% YoY |

| February | $75,188,016.00 | ↑173% MoM | $110,557,392.00 | ↑47.0% YoY |

| March | $88,711,907.00 | ↑18% MoM | $118,578,598.00 | ↑33.7% YoY |

| April | $88,869,106.00 | ↑0.2% MoM | $119,310,269.00 | ↑34.3% YoY |

| May | $89,064,106.00 | ↑0.2% MoM | $114,695,648.00 | ↑28.8% YoY |

| June | $66,193,027.00 | ↓25.7% MoM | $109,416,359.00 | ↑65.3% YoY |

| July | $83,107,169.00 | ↑25.6% MoM | $117,189,605.00 | ↑41.0% YoY |

| August | $87,579,462.00 | ↑5.4% MoM | $117,496,719.00 | ↑34.2% YoY |

| September | $92,267,565.00 | ↑5.4% MoM | $115,798,376.00 | ↑25.5% YoY |

| October | $98,940,060.00 | ↑7.2% MoM | $126,668,719.00 | ↑28.0% YoY |

| November | $96,300,456.00 | ↓2.7% MoM | $130,912,039.00 | ↑35.9% YoY |

| December | $109,694,214.00 | ↑13.9% MoM | $137,473,697.00 | ↑25.3% YoY |

| Total | $1,003,453,761 | ↑298.3% from January to December 2021 | $1,427,274,465 | ↑42.2% Annually |

Source: Michigan Gaming Control Board

Regulated online casinos in Michigan run an impressive variety of promotional incentives, ranging from welcome offers and cashbacks to friend referral bonuses. It is important to point out that promotional credits are taxed as regular revenue in the Wolverine State. Official data released by the MGCB reveals that free-play incentives accounted for $115.18 million of the total gross revenue posted by Michigan online casinos in 2022, a 40.4% increase from $110.55 million a year earlier.

| iGaming Revenue Resulting from Free-Play | ||||

|---|---|---|---|---|

| Month | Free-Play in 2021 | Percentage Change | Free-Play in 2022 | Percentage Change |

| January | $1,815,623.00 | – | $12,066,457.00 | ↑564.6% YoY |

| February | $4,541,327.00 | ↑150.1% MoM | $12,218,532.00 | ↑169.1% YoY |

| March | $6,369,685.00 | ↑40.3% MoM | $13,095,055.00 | ↑105.6% YoY |

| April | $5,982,660.00 | ↓6.1% MoM | $13,127,743.00 | ↑119.4% YoY |

| May | $5,787,446.00 | ↓3.3% MoM | $12,689,856.00 | ↑119.3% YoY |

| June | $23,021,111.00 | ↑297.8% MoM | $12,091,228.00 | ↓47.5% YoY |

| July | $9,204,199.00 | ↓60.0% MoM | $9,424,912.00 | ↑2.4% YoY |

| August | $9,618,155.00 | ↑4.5% MoM | $13,427,475.00 | ↑39.6% YoY |

| September | $10,112,657.00 | ↑5.1% MoM | $12,936,071.00 | ↑27.9% YoY |

| October | $10,733,836.00 | ↑6.1% MoM | $14,287,563.00 | ↑33.1% YoY |

| November | $11,292,545.00 | ↑5.2% MoM | $14,516,075.00 | ↑28.5% YoY |

| December | $12,066,379.00 | ↑6.9% MoM | $15,299,026.00 | ↑26.8% YoY |

| Total Promos for 2021 | $110,545,623 | ↑564.6% from January to December 2021 | $155,179,993 | ↑40.4% Annually |

- iGaming Revenue Under $4 Million: 20% of the adjusted gross receipts

- iGaming Revenue Exceeding $12 Million: 28% of the adjusted gross receipts

- Municipal Service Tax for Commercial Casinos: 1.25% of the adjusted gross receipts or $4 million, depending on which amount is higher

- Tax Rates on Players’ Winnings: 4.25% for winnings exceeding $5,000

Licensed iGaming operators honored their tax obligations in 2022 as they collectively contributed $399.9 million in taxes during the last fiscal year. State taxes represent the bulk of this total as they amounted to $289.2 million, soaring 43.4% above the previous year. Monthly increases were observed during ten out of the twelve months of their first year of operation, with June and November of 2021 being the sole exceptions.

Revenue continued to pour into the state coffers at a steady pace throughout 2022, peaking at $28.5 million in December for a 26.4% year-on-year change from the same month in 2021. The most substantial growth from a percentage perspective occurred in January 2022 when state tax revenue increased by a remarkable 346.4%, jumping from $4.3 million to $19.1 million YoY.

| State Tax Contributions from Online Casinos in Michigan | ||||

|---|---|---|---|---|

| Month | Paid State Taxes in 2021 | Percentage Change | Paid State Taxes in 2022 | Percentage Change |

| January | $4,285,723.00 | – | $19,130,198.00 | ↑346.4% YoY |

| February | $14,031,629.00 | ↑227.4% MoM | $21,607,543.00 | ↑54.0% YoY |

| March | $17,273,498.00 | ↑23.1% MoM | $23,882,899.00 | ↑38.3% YoY |

| April | $17,813,430.00 | ↑3.1% MoM | $24,310,193.00 | ↑36.5% YoY |

| May | $18,102,213.00 | ↑1.6% MoM | $23,518,238.00 | ↑29.9% YoY |

| June | $13,697,860.00 | ↓24.3% MoM | $22,491,921 | ↑64.2% YoY |

| July | $17,050,649.00 | ↑24.5% MoM | $24,137,470.00 | ↑41.6% YoY |

| August | $17,880,575.00 | ↑4.9% MoM | $24,253,179.00 | ↑35.6% YoY |

| September | $18,869,078.00 | ↑5.5% MoM | $23,988,686.00 | ↑27.1% YoY |

| October | $20,295,218.00 | ↑7.6% MoM | $26,270,769.00 | ↑29.4% YoY |

| November | $19,777,832.00 | ↓2.5% MoM | $27,108,703 | ↑37.1% YoY |

| December | $22,589,330.00 | ↑14.2% MoM | $28,544,042.00 | ↑26.4% YoY |

| Total | $201,667,034 | ↑427.1% from January to December 2021 | $289,243,841 | ↑43.4% from 2021 to 2022 |

Source: Michigan Gaming Control Board

Looking at the annual figures for 2022, we see city wagering taxes and municipality fees from the three commercial casinos have increased by 40.8% compared to the previous year. To put this into context, the iGaming operations affiliated with Detroit casinos paid $77.8 million in city wagering taxes and municipality fees last year as opposed to $55.3 million in 2021. A similar trend was observed with tribal iGaming operators that contributed $32.8 million in funding to their local communities, showcasing a 46.6% surge from the previous year.

As much as 2% of the overall tax money the state collects from the tribes is allocated to the local tribal governments collectively known as “local revenue sharing boards”. The remaining amount goes toward the Michigan Economic Development Corporation (MDEC).

| iGaming Tax Contributions to Detroit City and Tribal Governments in 2022 | ||||

|---|---|---|---|---|

| Month | Detroit Commercial Casinos | YoY Percentage Change | Tribal Casinos | YoY Percentage Change |

| January | $5,255,488.00 | ↑299.6% | $2,152,560.00 | ↑402.2% |

| February | $6,020,832.00 | ↑39.9% | $2,349,134.00 | ↑75.8% |

| March | $6,522,461.00 | ↑33.4% | $2,661,987.00 | ↑44.6% |

| April | $6,619,044.00 | ↑27.8% | $2,716,583.00 | ↑48.8% |

| May | $6,351,347.00 | ↑22.5% | $2,654,523.00 | ↑40.3% |

| June | $6,081,201.00 | ↑96.2% | $2,535,116.00 | ↑37.0% |

| July | $6,472,155.00 | ↑46.5% | $2,747,988.00 | ↑36.1% |

| August | $6,301,403.00 | ↑28.4% | $2,863,619.00 | ↑44.7% |

| September | $6,276,158.00 | ↑20.6% | $2,810,314.00 | ↑35.5% |

| October | $6,941,396.00 | ↑20.6% | $3,043,046.00 | ↑33.9% |

| November | $7,385,869.00 | ↑25.8% | $3,026,838.00 | ↑35.7% |

| December | $7,607,530.00 | ↑38.2% | $3,273,120.00 | ↑23.8% |

| Total | $77,834,884.00 | ↑40.8% from 2021 | $32,834,828.00 | 46.6% from 2021 |

Source: Michigan Gaming Control Board

Michigan’s iGaming Market Is Showing Solid Growth in 2023

Turning our attention to the latest figures released by the MGCB, we see the online gaming industry in the country’s tenth most populous state continues to exhibit healthy growth in the new fiscal year. Total revenue from online casinos has risen by 22.3% during the first eight months of 2023 as licensed operators reported gross earnings of $1.24 billion, improving their results from the same period a year earlier by $225.89 million. Promotions accounted for approximately $123 million of the total figure.

It turns out March was the most profitable month for regulated remote gambling businesses in the Mitten as they collectively grossed $171.83 million in revenue for a 30.5% year-on-year increase. The slowest month for the operators was February when they took home earnings of $148.17 million, a figure that is, nonetheless, 20.7% beyond the results for the same period in 2022.

Unsurprisingly, adjusted gross revenue also witnessed a 21.9% surge from January to August as it grew to $1.12 billion, exceeding the figures from a year earlier by around $201 million. Licensees of the Michigan Gaming Control Board have paid a total of $225.5 million in state taxes since the beginning of the year, up 23% from the first eight months of 2021. City wagering taxes, municipality fees, and tribal community distributions showed a 20.7% increase and amounted to a combined $84.9 million for the period ending on August 31st.

| Michigan iGaming Revenue in 2023 (January – August) | |||

|---|---|---|---|

| Month | Total Revenue | Adjusted Gross Receipts | State Taxes |

| January | $153,694,393 (↑26.8% YoY) | $138,324,954 (↑26.7% YoY) | $24,858,288 (↑29.9% YoY) |

| February | $148,168,863 (↑20.7% YoY) | $133,278,536 (↑20.6% YoY) | $26,259,308 (↑21.5% YoY) |

| March | $171,830,721 (↑30.5% YoY) | $154,647,649 (↑30.4% YoY) | $31,255,270 (↑30.9% YoY) |

| April | $159,360,429 (↑20.3% YoY) | $143,421,386 (↑20.2% YoY) | $29,430,274 (↑21.1% YoY) |

| May | $150,559,370 (↑18.2% YoY) | $135,503,433 (↑18.1% YoY) | $28,001,045 (↑19.1% YoY) |

| June | $151,006,936 (↑24.3% YoY) | $136,855,933 (↑25.1% YoY) | $28,369,272 (↑26.1% YoY) |

| July | $153,585,511 (↑21.3% YoY) | $138,225,395 (↑18% YoY) | $28,714,020 (↑19% YoY) |

| August | $152,244,046 (↑16.3% YoY) | $137,200,776 (↑16.8% YoY) | $28,611,285 (↑18% YoY) |

| Total | $1,240,450,269 (↑22.3% YoY) | $1,117,458,062 (↑21.9% YoY) | $225,498,762 (↑23% YoY) |

iGaming Operators Ranked by Annual Revenue

Detroit’s largest landbased casino offers statewide desktop and mobile gaming in partnership with BetMGM, which came on top with over half a billion in gross revenue. The brand’s earnings surged by 41.2% compared to the previous year when BetMGM’s revenue totaled $417.1 million. The highest-earning online casino brought in just over $104 million in tax contributions to the state, marking a 42.4% increase from 2021.

MotorCity Casino and its partner FanDuel placed second with $258.69 million in annual revenue, up 40.1%, while the Bay Mills Indian Community and DraftKings secured the third spot with earnings amounting to $248.36 million for a 34.6% year-on-year increase. BetRivers and Golden Nugget placed fourth and fifth, with revenues of $104.27 million and $72.59 million, respectively.

Hannahville’s TwinSpires was the lowest earner last year as its operations brought in only 5.83 million in revenue for a 65.1% decrease from 2021. We attribute these poor results to the fact the Hannahville Indian Community ceased offering online gambling last September, which affected its financial performance.

The Saginaw Chippewa tribe entered the market in April 2022 but did surprisingly well as their Eagle Casino & Sports tallied up a robust $19.41 million in revenue. All data considered, 13 operators enjoyed revenue increases at the close of the fiscal 2022. PokerStars and TwinSpires were the only iGaming businesses to suffer decreases in Michigan, as their gross profits declined by 26.7% and 65.1% from the previous year, respectively.

- Affiliated iGaming Site: BetMGM

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $533,328,056 (up 42.1% from 2021)

- Annual State Tax Contribution: $104,056,299 (up 42.4% from 2021)

- Strongest Month in 2022: December with $54,385,259 in gross revenue (up 18.3% YoY)

- Affiliated iGaming Site: FanDuel

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $232,820,149 (up 40.1% from 2021)

- Annual State Tax Contribution: $45,156,749 (up 40.7% YoY)

- Strongest Month in 2022: December with $28,954,997 in gross revenue (up 66.9% YoY)

- Affiliated iGaming Site: DraftKings

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $223,527,803 (up 34.1% from 2021)

- Annual State Tax Contribution: $49,526,228 (up 34.6% YoY)

- Strongest Month in 2022: December with $26,153,669 in gross revenue (up 30.1% YoY)

- Affiliated iGaming Site: BetRivers

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $93,469,683 (up 39.3% YoY)

- Annual State Tax Contribution: $20,393,209 (up 40.8% YoY)

- Strongest Month in 2022: March with $9,669,864 in gross revenue (up 43.6% YoY)

- Affiliated iGaming Site: Golden Nugget

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $65,334,984 (up 43.6% (YoY)

- Annual State Tax Contribution: $14,091,037 (up 46% YoY)

- Strongest Month in 2022: August with $7,196,304 in gross revenue (up 35.5% YoY)

- Affiliated iGaming Site: Caesars Casino

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $59,576,366 (up 429.4%)

- Annual State Tax Contribution: $12,801,106 (up 543.9%)

- Strongest Month in 2022: December with $7,239,301 in gross revenue (up 81.4% YoY)

- Affiliated iGaming Site: WynnBet

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $48,392,935 (up 13.2%)

- Annual State Tax Contribution: $10,296,017 (up 14%)

- Strongest Month in 2022: November with $5,551,946 in gross revenue (up 33.6% YoY)

- Affiliated iGaming Site: Barstool

- Launch Date: February 1st, 2021

- Adjusted Gross Receipts: $46,772,859 (up 24.4% YoY)

- Annual State Tax Contribution: $8,691,480 (up 26.1% YoY)

- Strongest Month in 2022: March with $5,221,751 in gross revenue (up 35.3 YoY)

- Affiliated iGaming Site: Four Winds Casino

- Launch Date: February 15th, 2021

- Adjusted Gross Receipts: $30,281,832 (up 55% YoY)

- Annual State Tax Contribution: $6,239,130 (up 62.9% YoY)

- Strongest Month in 2022: October with $3,100,038 in gross revenue (up 46.2% YoY)

- Affiliated iGaming Site: PokerStars

- Launch Date: January 29th, 2021

- Adjusted Gross Receipts: $26,926,879 (down 26.8% YoY)

- Annual State Tax Contribution: $5,487,621 (down 28.7% YoY)

- Strongest Month in 2022: January with $3,109,849 in gross revenue (up 57.5% YoY)

- Affiliated iGaming Site: Play Gun Lake

- Launch Date: April 23rd, 2021

- Adjusted Gross Receipts: $19,632,918 (up 131.7% (YoY)

- Annual State Tax Contribution: $3,853,774 (up 168.6% YoY)

- Strongest Month in 2022: January with $2,430,439 in monthly revenue

- Affiliated iGaming Site: Eagle Casino & Sports

- Launch Date: April 14th, 2022

- Adjusted Gross Receipts: $17,506,576

- Annual State Tax Contribution: $3,377,473

- Strongest Month in 2022: October with $3,011,881 in gross monthly revenue

- Affiliated iGaming Site: FireKeepers Casino

- Launch Date: July 12th, 2021

- Adjusted Gross Receipts: $14,373,020 (up 136.4% YoY)

- Annual State Tax Contribution: $2,675,557 (up 166% YoY)

- Strongest Month in 2022: August with $1,756,493 in monthly revenue (up 65.9% YoY)

- Affiliated iGaming Site: PointsBet

- Launch Date: May 4th, 2021

- Adjusted Gross Receipts: $9,750,717 (up 96.3% YoY)

- Annual State Tax Contribution: $1,680, 138 (up 107.4% YoY)

- Strongest Month in 2022: November with $1,619,915 in monthly revenue (up 102.2% YoY)

- Affiliated iGaming Site: TwinSpires

- Launch Date: January 22nd, 2021

- Adjusted Gross Receipts: $5,579,686 (down 62.9% YoY)

- Annual State Tax Contribution: $918,025 (down 67.5% YoY)

- Strongest Month in 2022: January with $1,314,135 in monthly revenue (up 2067% YoY)

Michigan’s iGaming Industry Contrasted with Other Segments

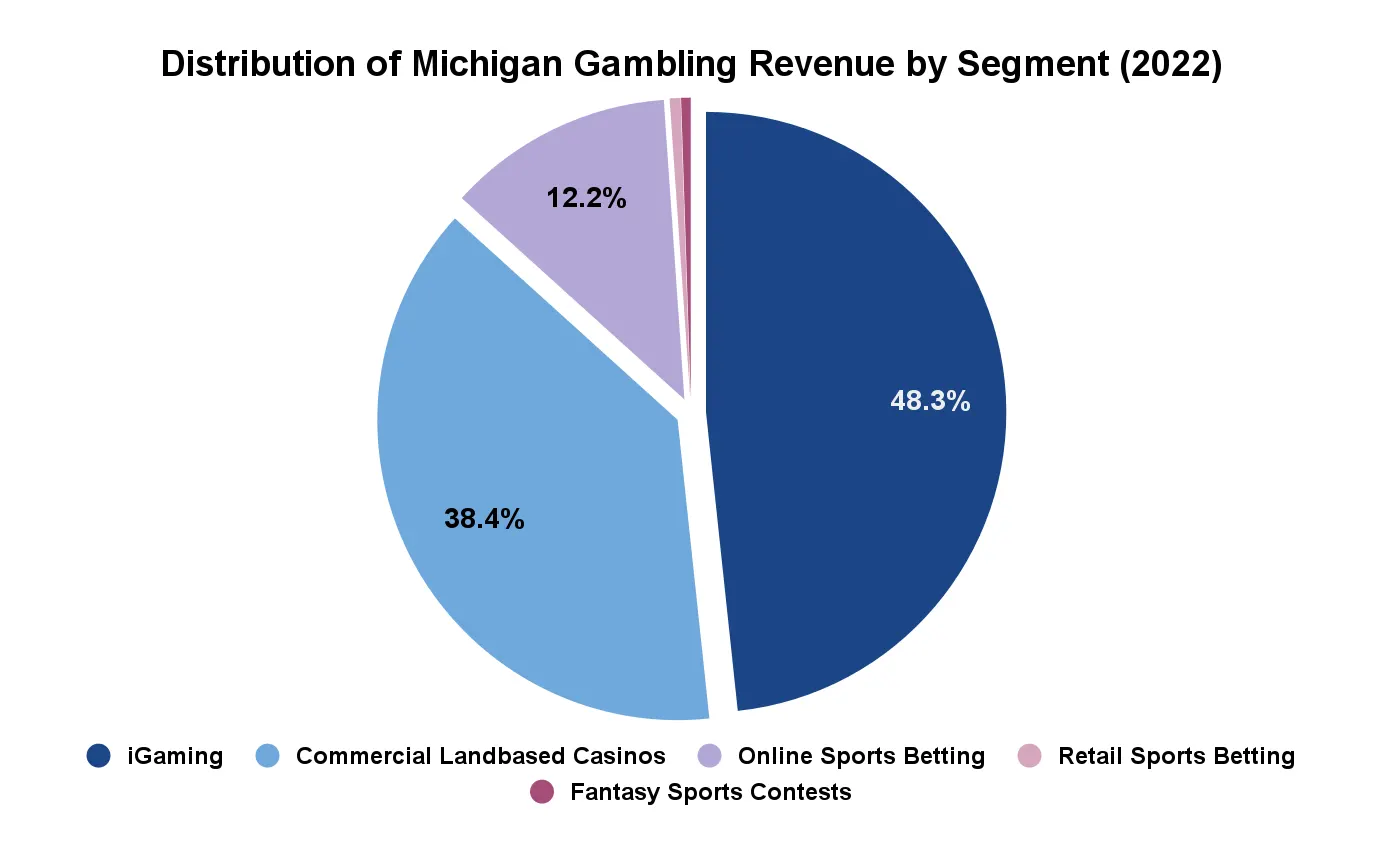

The iGaming segment held the largest share of Michigan’s commercial gambling market (48.3%) in 2022, accounting for $1.58 billion of the $3.26 billion annual total. Landbased casinos ranked second in terms of market share with earnings of $1.26 billion (38.4%).

Online sports betting placed third with a 12.2% market share, followed by retail sports betting (0.6%) and fantasy sports contests which contributed a meager $16.84 million (0.5%) in annual revenue. Commercial casinos and retail sportsbooks both suffered decreases in 2022 as you shall see briefly.

Source: Michigan Gaming Control Board

- Online Sports Betting Handle: $4,550,355,781 in 2022 (up 24.5% YoY)

- Gross Revenue: $399,576,873 (up 36.8% YoY)

- Adjusted Gross Receipts: $219,581,123 (up 98.6% YoY)

- State Taxes: $13,741,008 (up 89% YoY)

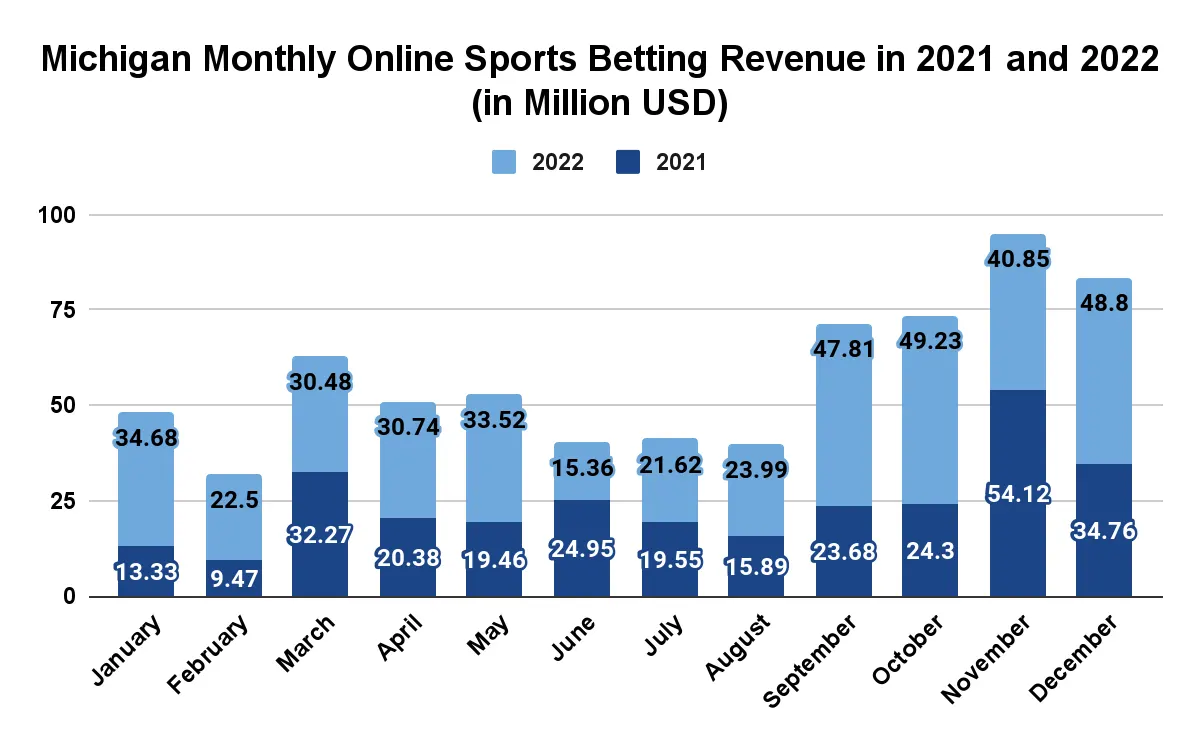

Regulated online sports betting became available to punters in the Mitten on January 22nd, 2021, launching in parallel with the first remote casinos. The first year of operation saw legal sportsbooks in the Wolverine State collectively accumulating $292.17 million in profits and paying $110.59 million in state taxes.

Online sports betting operators beat this record in 2022 as gross revenues soared 36.8% above the previous year to reach $399.58 million. Comparing this amount to the figures for iGaming, we see that online bookies earned $1.18 billion less than online casinos in 2022. The interactive sports betting segment will perhaps manage to improve on these results as it generated $236.33 million during the first eight months of 2023, an 11% jump from the same period a year earlier.

Source: Michigan Gaming Control Board

- Number of Fantasy Contest Operators: 10 operators in 2022

- Adjusted Revenue: $16,844,153 in 2022 (up 4% from 2021)

- Total Taxes Paid: $1,414,909 in 2022 (up 4% from 2021)

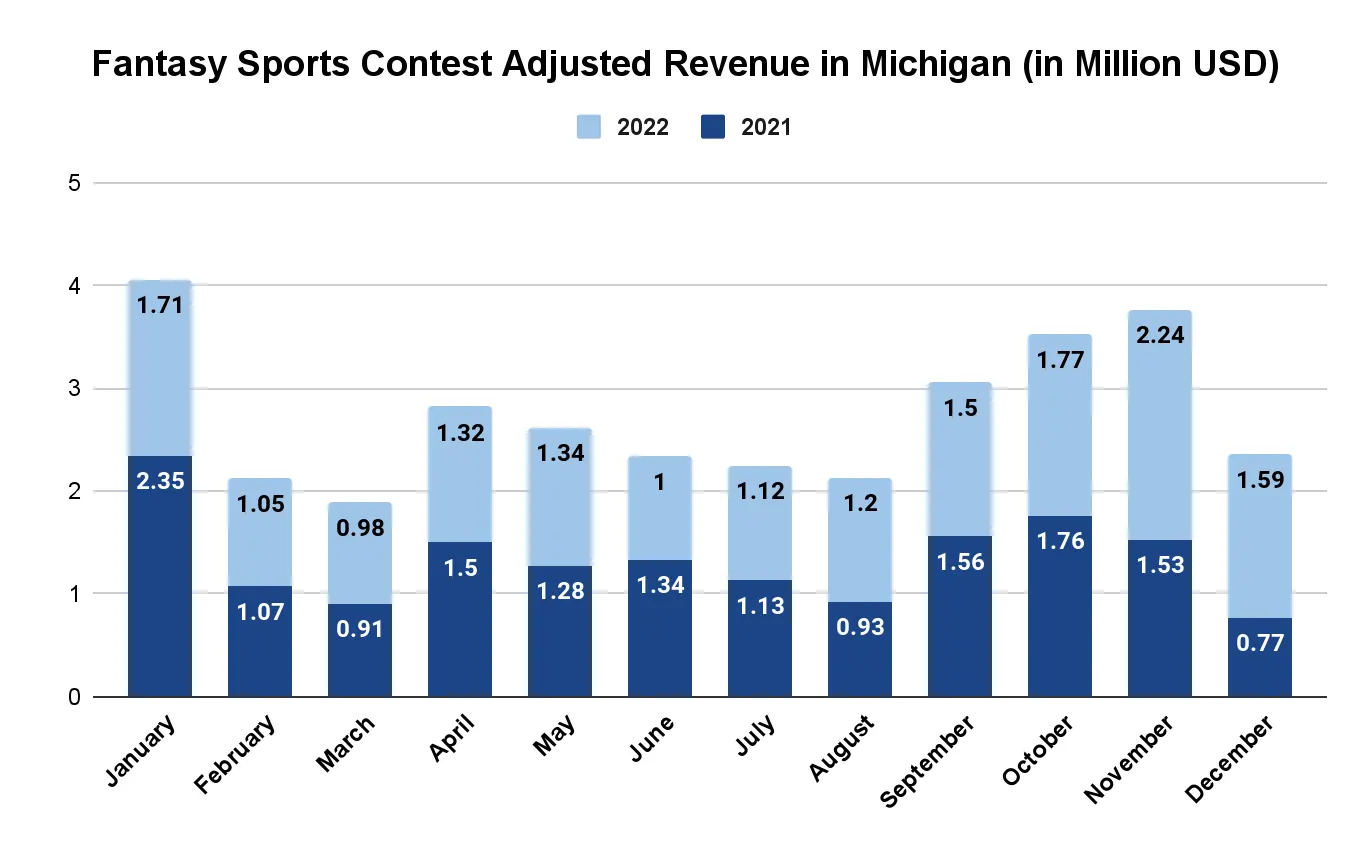

Fantasy sports appear to be the least popular segment of Michigan’s online gambling industry, having yielded an adjusted revenue of $16.84 million only in 2022. This figure represents a 4% increase from the previous year, but it is still nearly 85 times less than what online casinos brought in and 13 times less compared to the adjusted revenue from online sports betting.

The state taxes collected from this segment in 2022 also grew by 4% from the previous year, increasing from $1.36 million to $1.41 million. The local fantasy sports market was largely propped up by the solid financial performance of DraftKings which reported $7.90 million in adjusted revenue for 2022. Rivals FanDuel and PrizePicks placed second and third, with adjusted earnings of approximately $4.37 million and $4 million, respectively.

Fantasy sports providers stand a decent chance of improving these disappointing results in 2023 as they have collected a combined $13.35 million in the first seven months of the year. January was their strongest month for 2023 thus far, as adjusted revenue climbed by 69.9% year-on-year to $2.91 million. Nevertheless, fantasy sports have a long way to go before they can catch up to online casinos, which posted over a billion in revenue for the first eight months of 2023.

Source: Michigan Gaming Control Board

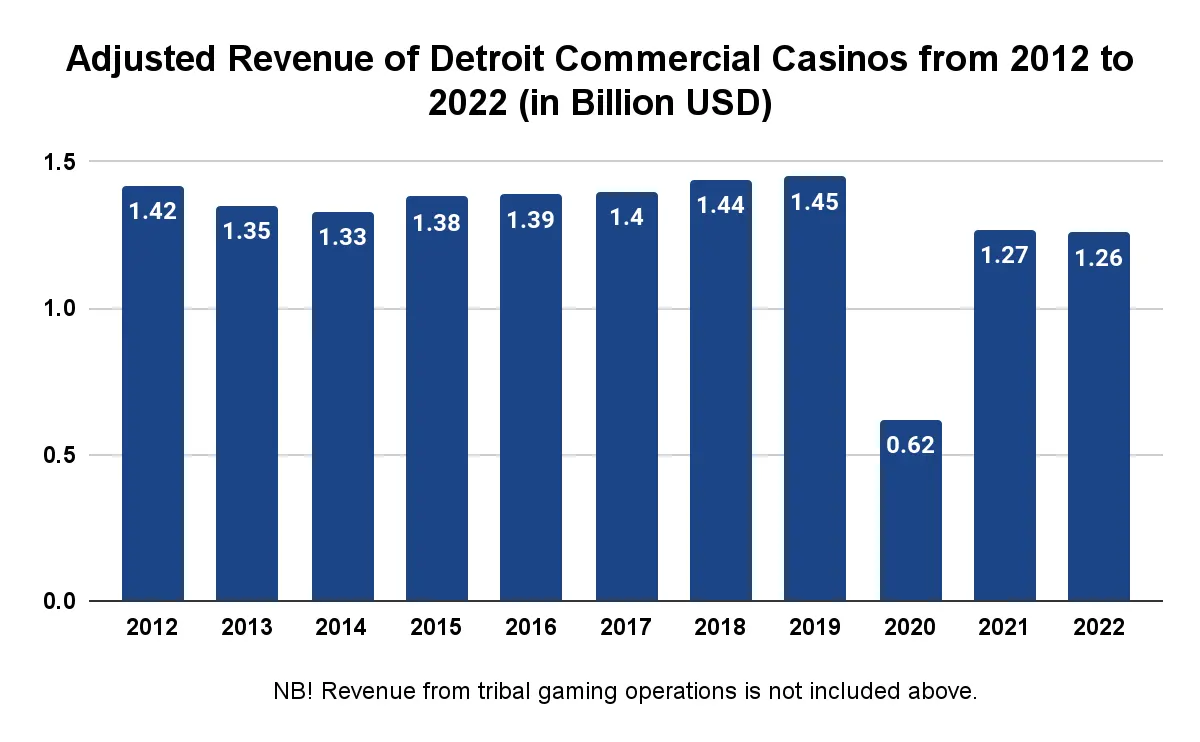

- Adjusted Gross Revenue: $1,256,974,742 in 2022 (down 0.8% YoY)

- State Taxes: $101,814,954 (down 0.8% YoY)

- Taxes Paid to Detroit City: $155,628,432 (down 3.2% YoY)

Official data reveals online casinos and poker sites outpaced commercial gaming in the Mitten last year, earning approximately $325 million more. The three landbased gambling venues in Detroit reported adjusted gross revenue of $1.26 billion in 2022, which is around 0.8% less than what they earned a year earlier. While commercial gaming revenue is still to climb back to pre-pandemic levels, this figure represents an improvement compared to the previous two years.

In 2020, the coronavirus-related closures caused a severe dent in the proceeds of Michigan’s three commercial gaming businesses. Things took a turn for the better in 2021 when revenue surged by $646.38 million to reach $1.27 billion at the end of the year. This is despite the fact the venues were forced to operate at a reduced capacity from January through June.

Official data shows the three Detroit casinos experienced their worst year in 2020 when their adjusted revenue fell under the one-billion mark for the first time since 2000. The landbased venues collected a paltry $620.39 million in 2020 for a 57.3% decrease YoY. This unimpressive amount is due to the coronavirus restrictions imposed on the casinos. They were forced to shut down in mid-March and finally resumed their operations in early August at a 15% capacity.

Incumbent MGM Grand Detroit was responsible for 47.7% of the 2022 total with adjusted gross receipts of nearly $600 million, while MotorCity Casino and Hollywood Casino in Greektown placed second and third with $396.52 million and $260.46 million, respectively. March was the most profitable month for the three commercial casinos as they grossed a combined $120.93 million for a 9.1% year-on-year increase.

Source: Michigan Gaming Control Board

Apart from the three commercial casinos located in Detroit, the Wolverine State is home to 23 Indian casinos run by 12 federally recognized native tribes. It is worth clarifying that landbased tribal gambling businesses are outside the regulatory scope of the Michigan Gaming Control Board.

Hence, they are not required to report their fiscal results to the state watchdog. Their operations are overseen by the National Indian Gaming Commission (NIGC) and the local governments of the tribal communities. The NIGC publishes annual reports on the financial performance of tribal gambling operators grouped by region.

Tribal casinos in the ‘Saint Paul’ region, which encompasses Michigan, Iowa, Wisconsin, Minnesota, and Indiana, enjoyed a 3.4% increase last year as their combined revenue grew from $4.79 billion in 2021 to $4.95 billion in 2022. The NIGC has not published individual fiscal results for Michigan’s tribal gaming operators, so this total is representative of all 96 Indian casinos included in the above-mentioned region.

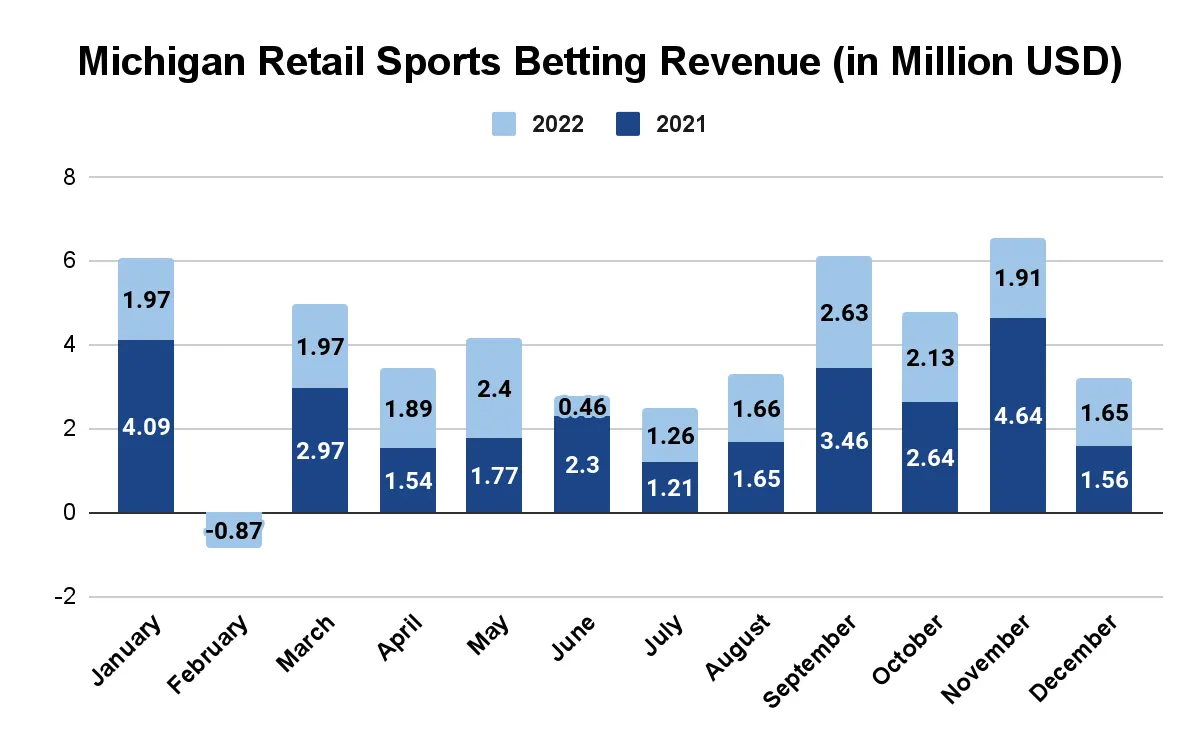

- Retail Sports Betting Handle: $263,733,190 in 2022 (down 15.1% from 2021)

- Gross Revenue: $19,070,264 (down 30.3% YoY)

- Adjusted Gross Revenue: $18,811,836 (down 30.2% YoY)

- State Taxes: $711,087 (down 31.1% YoY)

Retail sports in the Wolverine State also experienced a decline in 2022, with total gross revenue sliding by 30.3% to $19.07 million. Everyone would agree the ten-figure earnings from the iGaming segment dwarf this amount, exceeding it by a whopping $1.56 billion.

As you can see on the chart below, the sharpest monthly dips occurred in January, March, June, and November as all four months saw the revenue plummeting by seven-digit amounts. However, February was perhaps the worst month of the year since data by the MGCB suggests retail sportsbooks were awash in red ink during those 28 days.

Other than that, June was the least profitable month with $462,215 in revenue, reflecting a 79.9% decline from the same month a year earlier. Increases were recorded in April, May, July, August, and December but they were not large enough to allow for any tangible improvement.

Judging by the latest figures released by the MGCB, the segment is unlikely to rebound this year as it reported gross revenue of a little under $3.4 million for the first eight months of 2023. To give you some context, this figure represents a 76% decrease from the same period a year earlier.

Source: Michigan Gaming Control Board

Problem Gambling in Michigan

Michigan has emerged as the second largest gambling market in the United States right behind New Jersey but the rapid expansion the industry has been experiencing in recent years has both its negatives and positives. The Michigan Association on Problem Gambling estimates that approximately 150,000 residents struggle with problem gambling and addiction.

The state has adopted various measures in an attempt to mitigate gambling-related harm, including running self-exclusion databases for landbased and online casinos. Michiganders also have access to a dedicated toll-free problem gambling helpline (1-800-270-7117) where they can seek counseling and support at no cost.

Source: Michigan Department of Health and Human Services

Official data by Michigan’s Department of Health and Human Services reveals that as many as 4,306 individuals called to seek assistance for gambling problems in 2022. Out of those, 773 persons subsequently joined support groups or sought treatment for gambling. As many as 508 Michiganders participated in publicly funded programs for treatment of gambling addiction.

Michigan Ranks Second in Online Gambling Revenue

On a national scale, Michigan is outstripped only by New Jersey where total revenue from online casino gaming is concerned. The Garden State reported $1.66 billion in gross profits from iGaming, outpacing Michigan by a small margin of around $80 million.

Pennsylvania places third with $1.36 billion in online casino revenue, followed by Connecticut, West Virginia, and Delaware, all three of which reported earning less than half a billion from this segment. More importantly, all six states saw increases from 2021, with Connecticut boasting the most significant surge of 489.7%.

| Revenue Breakdown for States That Have Legalized Online Casino Gaming | |||

|---|---|---|---|

| State | iGaming Revenue in Billion USD (2022) | Commercial Gaming Revenue in Billion USD (2022) | Total Gambling Revenue in Billion USD (2022) |

| New Jersey | 1.66 (↑21.6% YoY) | 2.79 (↑9% YoY) | 5.21 (↑10% YoY) |

| Pennsylvania | 1.36 (↑22.6% YoY) | 3.38 (↑.3% YoY) | 5.34 (↑10.6% YoY) |

| Michigan | 1.58 (↑42.1% YoY) | 1.26 (↓0.8% YoY) | 3.26 (↑20.7% YoY) |

| Connecticut | 0.28 (↑489.7% YoY) | No commercial casinos* | 0.42 (↑430% YoY)** |

| West Virginia | 0.11 (↑84.9% YoY) | 0.59 (↑5.9% YoY for slot machines, ↑4.3% YoY for table games) | 0.76 (↑13.2% YoY) |

| Delaware | 0.014 (↑29% YoY) | 0.46 (↑1.8% YoY for slot machines, ↑8.1% YoY for table games) | 0.49 (↑1.8% YoY) |

Source: State Regulatory Reports

*Connecticut has only tribal landbased casinos.

**Revenue from retail sports betting in Connecticut is included.