Released in 2013, Cash App is a mobile payment service that caters to users in the United States and the United Kingdom. As of 2023, the app has been embraced by more than 44 million monthly active users.

Cash App is highly praised for its multifunctionality, as it enables customers to do more with their funds. In addition to sending money, paying online merchants, and banking, users can also buy stocks or Bitcoin. The latter is a particularly important feature for online casino players who want to transact with digital currencies.

| Cash App Summary | |

|---|---|

| Available in | The United States and the United Kingdom |

| Website | cash.app |

| Connecting bank card/account to Cash App | Bank accounts: free Credit card transfers: 3% fee |

| Withdrawal balance from Cash App to your bank card/account | Standard transfers: free Instant transfers: a fee of 0.5%-1.75% |

| Pay to online merchants | Free |

| Available for deposit | Yes |

| Available for withdrawal | Yes |

| Usual deposit time in online casino | Instant |

| Usual withdrawal time from online casino | Varies across casinos |

| Live chat | Yes |

| Telephone support | 1-800-969-1940 (Monday through Friday, 9:00 AM to 7:00 PM EST) |

| E-mail support | Verified Cash App emails come from an @cash.app, @square.com, or @squareup.com address. |

To get started, users should download the app from Google Play or the Apple App Store. Ordering a free Cash App Visa Debit Card is one of the various perks available to customers.

The current publication concentrates on the best casino operators supporting Cash App deposits and withdrawals. We will also examine some of the most popular casino games available to Cash App depositors. Furthermore, we will go into detail regarding the payment method’s fees, processing times, and security, among other important features.

Cash App Registration Process

Ever since its release in 2013, Cash App has been geared toward users in the United States and the United Kingdom. However, most of the platform’s users are based in the US. According to official information, Cash App has more than 44 million verified monthly users.

The mobile app’s ease of use, convenience, and security are among the main factors contributing to its popularity. Cash App enables customers to send, spend, save, and invest. Furthermore, the payment platform’s crypto functionality has been embraced by thousands of gamblers, given the ever-increasing popularity of digital currencies in iGaming.

The process of Cash App account setup is exceptionally straightforward. Users can create their accounts for free in minutes. Let us now look at the registration procedure in a few simple steps.

How Cash App Works

Using Cash App for Gambling Transactions

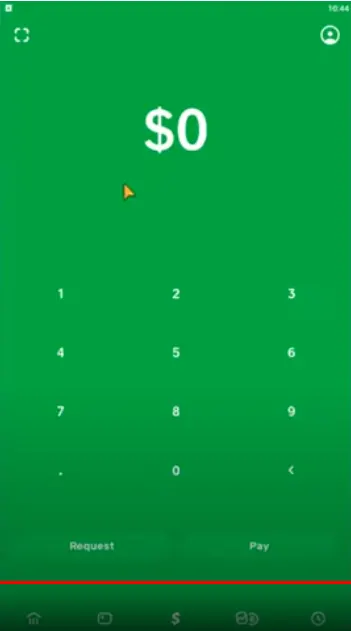

Cash App is a mobile payment platform that facilitates money transfers, banking, and investments. As already mentioned, it is available to customers based in the US and the UK. To use Cash App for gambling transactions, casino players should follow several simple steps.

First, they should download the app from Google Play or Apple’s App Store, depending on their device. Setting up a Cash App account is free of charge and can be completed in minutes.

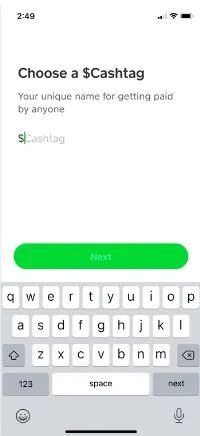

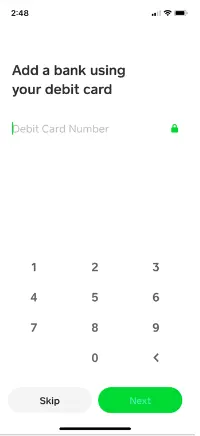

After users download and open the app, they will be prompted to enter their phone number or email address, followed by a confirmation code. Entering one’s ZIP code is next. Afterward, users should choose a $Cashtag, which serves as a unique identifier for receiving payments. Next, they can link a funding source such as a debit card, credit card, or bank account.

Regarding transaction limits, holders of unverified accounts can send up to $250 within seven days and receive up to $1,000 within 30 days. To unlock higher limits, they must verify their accounts by providing their full name, date of birth, and Social Security Number. Holders of verified Cash App accounts can send up to $2,500 within seven days and receive unlimited payments.

Using Cash App for Gambling Transactions Additional TipsBesides linking a credit card, debit card, or bank account to their Cash App account, customers may take advantage of the service’s Bitcoin investment functionality. The app functions as a cryptocurrency wallet, allowing users to buy and transfer Bitcoin to online gambling operators.

To buy Bitcoin on Cash App, customers should navigate to the investment tab on their home screen, tap ‘Bitcoin,’ and then ‘Buy.’ Next, they need to enter the amount they wish to invest and their PIN. Of course, users must have already linked a funding source to their Cash App account. Finally, they will see a transaction summary and must confirm it.

Customers who have activated the Cash App Bitcoin wallet will be able to play at crypto-friendly online casinos offering lucrative welcome bonuses. Once they set up their casino accounts, they should navigate to the cashier and select ‘Bitcoin’ among the funding options. Then, they should enter the amount of Bitcoin they wish to deposit. The process works both ways, and Cash App can be used for withdrawals just as easily. When players request a withdrawal, they need to enter the respective amount and then provide their Cash App wallet address.

Overall, Cash App facilitates both deposits and withdrawals at online casinos. While deposits are processed instantly, the pending time for withdrawals varies across gambling operators.

| Cash App Gambling Transactions | |

|---|---|

| Supported transactions | Deposits, withdrawals |

| Deposit pending time | Instant |

| Withdrawal pending time | Varies across gambling operators (up to 72 hours) |

| Additional security | 2-FA Authentication Security Lock |

Advantages and Disadvantages of Cash App

Considering Cash App occupies top positions on both Google Play and Apple’s App Store in terms of downloads, the company is clearly doing something right. To give players an unbiased idea of the app’s strong and weak points, we will quickly go through them.

First and foremost, the platform does not charge customers for many of its services, including account setup, maintenance, and sending or receiving funds. Standard transfers to bank accounts are completed within one to three business days and involve no fee. If users wish to take advantage of instant transfers, they will pay a fee ranging from 0.50% to 1.75% of the transfer amount, with a minimum of $0.25. Sending money via a linked credit card entails a 3% fee, and Cash App Debit Card ATM withdrawals are charged between $2 and $2.50 per transaction.

Secondly, Cash App’s convenience and ease of use are significant. With just a smartphone and an app, users can manage their transactions quickly, simply, and securely. It is no surprise that more and more casino players choose to deposit and withdraw through their phones. For that purpose, Cash App performs excellently and compares favorably with most competitors.

More Advantages and Disadvantages of Cash AppThirdly, the fact that Cash App works for both deposits and withdrawals at online casinos makes it exceptionally convenient for avid gambling fans.

Furthermore, Cash App’s Bitcoin wallet enables customers to play at crypto-friendly gambling venues and take advantage of lucrative welcome offers and reload incentives. At the time of writing, Bitcoin is the only cryptocurrency supported by Cash App. Users should be aware that sending unsupported coins will result in a loss of funds.

Besides the Bitcoin wallet functionality, customers can order a free Cash App Visa Debit Card. It is linked to the user’s Cash App balance and can be used everywhere Visa is accepted.

As far as Cash App’s disadvantages are concerned, the main one is probably its territorial restriction. From the very beginning, the company’s services have been geared toward users based in the United States and the United Kingdom.

Additionally, the method’s weekly limits are set at $250 within seven days, which makes it less attractive to high rollers. However, once they verify their accounts, they can enjoy higher weekly limits of up to $2,500. As for the amount users can receive within a month, it is capped at $1,000 for holders of unverified accounts.

Cash App depositors should double-check the details of their transactions because they cannot cancel them once authorized.

| Cash App Pros | Cash App Cons |

|---|---|

| Cost-effectiveness | Available only in the US and the UK |

| Convenience and ease of use | Low weekly limits |

| Supports deposits and withdrawals | Transactions cannot be canceled once authorized |

| Supports Bitcoin | |

| Free Cash App Debit Card |

Cash App Fees for Gambling Transactions

Cash App is a cost-efficient payment method available to customers in the US and the UK. As such, it is widely preferred by iGaming enthusiasts for managing their deposits and withdrawals at interactive casinos.

Setting up a Cash App account is free. There are no maintenance or inactivity fees. Transferring funds to people and paying online merchants is also free, including deposits to and withdrawals from online casinos.

Sending money using one’s Cash Balance or debit card incurs no charges either. There is no fee to transfer funds from one’s Cash App account to a linked bank account with the standard option, which is usually completed within one to three business days. However, instant deposits entail a fee ranging from 0.5% to 1.75% (minimum $0.25). Sending money from a linked credit card involves a 3% fee.

Holders of Cash App Visa Debit Cards should note there is a $2.00-$2.50 ATM withdrawal fee. Those interested in buying Bitcoin through Cash App can expect fees of 2%-3%, which are clearly displayed before users confirm their transactions.

| Cash App Fees | |

|---|---|

| Gambling deposit fee | Free |

| Gambling withdrawal fee | Free |

| Bank account deposit fee | Standard deposits: free Instant deposits: 0.5%-1.75% fee |

| Bank account withdrawal fee | Standard bank transfers: free |

| Credit/debit card deposit fee | 3% fee on transfers from a credit card |

| Credit/debit card withdrawal fee | Instant transfers to linked cards: 0.5%-1.75% |

| Maintenance fee | None |

Processing Times with Cash App

Cash App is a premier brand, widely preferred over competitors not only because of its cost-effectiveness but also because of its swift processing times. Cash App deposits at online casinos are typically instant, allowing players to start gaming right away.

Withdrawal timeframes vary across gambling operators and should be checked in advance. Additionally, account verification procedures can further prolong the withdrawal process.

Transferring funds to one’s Cash App balance via a linked bank account may take three to five business days. Conversely, transferring from one’s Cash App balance to a bank account typically requires one to three business days. If a transfer must be completed urgently, instant transactions are handled within 30 minutes.

| Cash App Processing Time | |

|---|---|

| Gambling deposit time | Instant |

| Gambling withdrawal time | Varies across casinos |

| Bank account deposit time | 3-5 business days |

| Bank account withdrawal time | 1-3 business days Instant transfers: 30 minutes |

| Credit/debit card deposit time | Instant for holders of Cash App debit cards |

| Credit/debit card withdrawal time | Instant for holders of Cash App debit cards |

Mobile Payments with Cash App

Cash App can be downloaded from both Google Play and the Apple App Store. With 50 million downloads from Google Play at the time of writing and 2.43 million reviews giving the app an average score of 4.6 out of 5 stars, the company clearly works hard to cater to its customers and improve its services. On Apple’s App Store, Cash App ranks first among free financial apps and has a rating of 4.8 out of 5 stars.

Cash App is supported in two languages: English and French. While scanning reviews on both app stores, we were impressed that the company’s employees appreciate customer feedback and continually work to enhance the user experience.

Customers can add their Cash App card to Google Pay. From the Cash App, they should tap the Cash Card tab on their home screen, select ‘Add to Google Pay,’ and follow the prompts. Similarly, users can follow the same steps to add their Cash App card to Apple Pay.

| Cash App Mobile Payments | |

|---|---|

| Apple pay | Yes |

| Google pay | Yes |

Security at Cash App Online Casinos

Securing sensitive customer information is of paramount importance for any digital payment method. Fortunately, Cash App utilizes the latest encryption and fraud-detection measures to ensure that personal and financial data remain protected. Any information transmitted between customers and the company is encrypted and sent to its servers securely.

The Payment Card Industry Data Security Standard (PCI-DSS) provides businesses with a comprehensive suite of measures to protect customers’ credit card details. Cash App conforms to PCI-DSS Level 1 standards.

When signing in, Cash App provides users with a one-time code. To further enhance security, customers can enable two-factor authentication. They can also activate the Security Lock feature, which requires a passcode, Touch ID, or Face ID for every payment.

Cash App may prompt users to verify their identity by providing their Social Security Number within the app. As for the Cash App Debit Card, users can turn it off temporarily to block fraudulent purchases.

| Cash App Security | |

|---|---|

| Passcode | Yes |

| Fingerprint | Yes |

| FaceID | Yes |

| Two-factor authentication | Yes |

| Trusted devices | Yes |

| IP Restrictions | n/a |

Cash App Casinos FAQs

Below, we have addressed some of the most common questions related to Cash App casinos. The payment method is ideal for players new to crypto gambling. Thanks to its user-friendly interface, the app makes the transition to crypto gambling easy. Should you have further questions, you can contact support via the convenient Live Chat function.